UP NEXT:

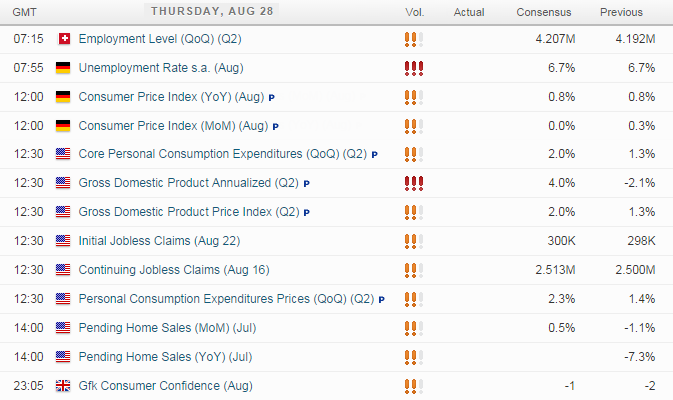

EUR: With ECB now not expected to act next week with extra stimulus, EURUSD may continue to rebound from the lows. Considering this we could assume that even mediocre news from Europe could help EURUSD rebound from the lows with less effort.

US: Core PCE is widely regarded as the 'real' inflation gauge used bythe FED so could end up being the headline figure if it comes in or above 2%. GDP has high expectation at 4% so any shortfall here could also help USD retrace further across the majors board. Employment and Housing is unlikely to be the main driver tonight, but if if we see it back up inflation and growth data we should be presented with cleaner trends.

TECHNICAL ANALYSIS:

AUDUSD: Hangs near 3-week highs

I suspect that US data will deliver tonight and to bring downwards pressure upon AUDUSD. However with Europe and London due to open we do run the risk of further highs, as they absorb good CAPEX data and buy before the US data dump tonight.

0.937 is the 3-week high with a break above here targeting 0.9380 and 0.9340. Positive data from US should see AUDUSD back below 0.937.

GBPUSD: Approaches potential sell-zone

Gold remains within a clearly bearish channel and there are obvious zones of resistance to sell into, should we be presented with signs of weakness around these levels.

Cable is currently enjoying a retracement from the lows, but whilst we remain within the bearish channel then bearish setups at resistance is preferred.

A break out of the bullish channel may provide near-term long positions, but there are plenty of levels of resistance which could be used as target, so try not to outstay your welcome trading against the trend.

GOLD: $1292 is the line in the sand

$1292 is a pivotal S/R level which was also the high from the Shooting Star Reversal. Yesterday was an Inside Day to suggest a hesitation to retest these highs but at time of writing we are close to breaching the high from the Inside Day. What would be nice to see is for yesterday's high to hold - then we can assume the Shooting Star Reversal was a swing high, and to seek a short position down to $1274. A break below here opens up $1259.

The counter-analysis is to seek bullish setups above $1292 to target $1300-$1302.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.