Technical Analysis

EUR/USD undergoes bullish correction

“The overall bias remains lower in the euro...the only question within that is how far and how fast.”

- Standard Chartered Bank (based on CNBC)

Pair’s Outlook

Despite a plethora of ‘sell’ signals on the daily and weekly charts, the Euro is currently recovering, as the support at 1.3150, represented by the monthly S2, proved to be quite strong. Given the absence of any significant resistances nearby, the currency is now likely to move towards 1.33, where it is going to meet the monthly S1 and 2013 Q4 low. The supply there will be expected to limit the gains and initiate a sell-off to 1.31.

Traders’ Sentiment

The bullish market participants are slowly but surely increasing their advantage in numbers over the bears—the gap amounts to 24 percentage points. But there are almost no buy orders left—their share is now merely 24% (37% yesterday).

GBP/USD returns to 1.66

“There isn't a strong case for a sterling short-covering rally. So no news may make for a range-bound market but any bounce in sterling/dollar is likely to be small on data-less days.”

- Societe Generale (based on Reuters)

Pair’s Outlook

The Cable refuses to leave the vicinity of the weekly PP, which has already been confirmed as a resistance level. And if the bulls continue to push the Pound away from 1.6550, they will encounter the monthly S2 at 1.6650 and May low at 1.67. If this is not enough to halt the advancement, there are also monthly S1 and 200-day SMA standing near 1.6750 that are highly unlikely to let the currency to appreciate any further.

Traders’ Sentiment

There are no significant changes in the sentiment of the SWFX market towards GBP/USD—most (66%) of the traders are presently holding long positions. Speaking of orders, there is no difference between the buy (46%) and sell (54%) commands right now.

USD/JPY to look for support at 103.50

“Dollar-yen is a pretty screaming buy.”

- UBS (based on Bloomberg)

Pair’s Outlook

For the time being this week is bearish for the U.S. Dollar, as it has already given up 50 pips. However, the outlook remains bullish, being that none of the main supports have been breached yet. The first concentration of demand is considered to be at 103.50, where the monthly R1 merges with the monthly PP. There is also an important level at 103 (July high), but as long as 102 is intact, the bias will be to the upside.

Traders’ Sentiment

While the SWFX market sentiment remains neutral with respect to USD/JPY (54% of open positions are long), there has been a sharp decline in the relative amount of buy orders since the previous report—from 64% to 41%.

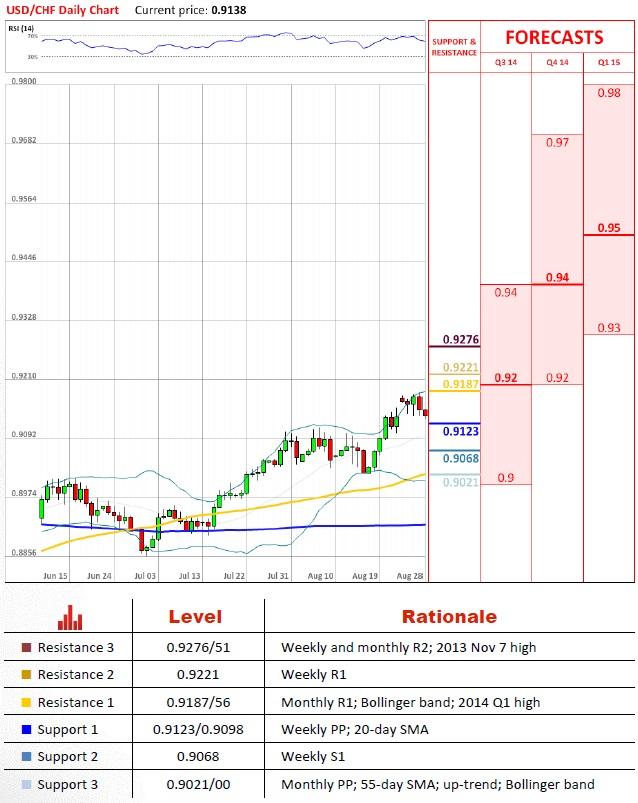

USD/CHF to stay above 0.91

“After a couple of sessions of solid gains for the dollar, it's not unlikely to see a little profit-taking, a little consolidation.”

- Commonwealth Foreign Exchange (based on CNBC)

Pair’s Outlook

Although most of the near-term indicators poaint North and the price has recently closed above the 2013 Q1 high, USD/CHF is currently retreating. But this bearish activity should only be temporary, and the latest losses are likely to be negated after the pair comes down to 0.91, where the bullish momentum is likely to be restored. If not, then we will be looking at 0.90 as a potential reversal point.

Traders’ Sentiment

While the portion of buy orders placed 50 pips from the spot went up, namely from 68 to 75%, at the same time their share in a wider price interval (100 pips from the spot) fell from 69 to 59%, most likely because of a cluster of sell stop orders below 0.91.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.