Technical Analysis

EUR/USD supported by monthly PP

“It looks like people are pretty keen to go short on the U.S. dollar again, and that’s having positive ramifications across a number of currencies today.”

- IG (based on Bloomberg)

Pair’s Outlook

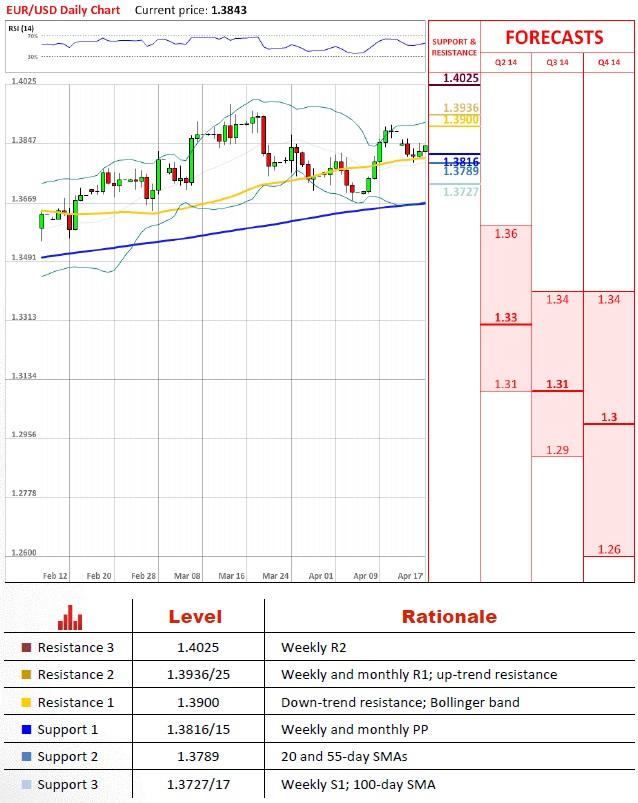

The latest downward momentum did not prove to be strong enough to push the price beneath the monthly PP. Instead EUR/USD seems to be recovering from 1.3816/15, which could mean a test of the down-trend resistance line at 1.39 in the nearest future. Nevertheless, the longer-term perspective is bearish, despite the ‘buy’ signals given by the technical indicators. In place of the 2011 highs at 1.42 the pair is expected to pursue an encounter with 1.37.

Traders’ Sentiment

Most of the traders continue to view EUR/USD as more likely to fall than to rise, being that 65% of open positions are short. At the same time, most of the orders (60%) placed 100 pips from the spot are to sell the Euro against the buck.

GBP/USD attempts to surpass Feb high

“Markets are now aggressively pricing in an early BoE rate hike. We are now looking at January or February 2015 for a hike. This data is likely to continue lending support and a push towards $1.70 is now on the cards.”

- UKForex (based on Reuters)

Pair’s Outlook

After an eventless beginning of the week GBP/USD soared 100 pips and it is already testing a cluster of resistances around the recent Feb high. Should the bulls gain an upper hand, the rally will be expected to extend up to the 2009 highs at 1.70, as suggested by the daily and monthly technical studies. Alternatively, the currency pair could bounce off this supply zone and re-test a rising trend-line and 200-day SMA at 1.66.

Traders’ Sentiment

A precipitous increase in the Sterling’s value yesterday resulted in a growth in the share of bearish market participants (from 58% to 60%) and a significant drop in the percentage of buy orders—from 70% down to 36%.

USD/JPY fights supply at 102.33/19

“There is little hope of a prolonged cyclical rally in the U.S. dollar until we get off of zero interest rates.”

- BNY Mellon (based on MarketWatch)

Pair’s Outlook

Despite a fairly strong bullish impetus USD/JPY demonstrated yesterday, the resistance at 102.33/19 remains intact. And, since the short-term indicators are bearish, we may soon see a pullback from the falling trend-line back to the 200-day SMA, which appears one of the few supports actually capable of influencing direction of the pair. Still, in the long run the U.S. Dollar should prove to be able to appreciate relative to the Yen.

Traders’ Sentiment

On average SWFX traders remain strongly convinced that eventually the greenback is going to gain ground. This is evidenced by a notable skew in the distribution between the long (71%) and short (29%) positions in favour of the former.

USD/CHF to step back from monthly PP

“With U.S. data surprise measures bouncing now, the Fed nearly half way through its tapering process, and U.S. yields still near the bottom of their broad ranges, we see upside risks for the USD from current levels.”

- BNP Paribas (based on CNBC)

Pair’s Outlook

As the resistance at 0.8813/12 continues to stand its ground, the current bias towards the greenback is to the downside. Even if for some reason USD/CHF spikes up, there will also be 20 and 55-day SMAs at 0.8837/33 guarding the upper trend-line of the falling wedge. Accordingly, the exchange rate is likely to fall through the support at 0.8742/28 and reach the lower boundary of the pattern before the 2011 lows at 0.86.

Traders’ Sentiment

Both the gap between the bulls and bears and the gap between the buy and sell orders widened. And while the first case implies improving sentiment towards USD/CHF, the second case suggest this tendency is unlikely to persist for long.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.