Forex News and Events

Mexico: following in the footsteps of the Fed (by Yann Quelenn)

Following the Fed’s rate decision we were also expecting the Banxico to increase rates by 25 basis points to 3.25% despite no inflation. Indeed, the Mexican Central Bank has been obliged in the past to carefully follow the monetary policy of its neighbour in order to avoid the narrowing of the gap between the two countries’ benchmark rates. Even if the current state of the Mexican economy looks healthier with GDP for the first three quarters of 2015 averaging at 2.35% year-on-year, the USDMXN has broken 17.00, down almost 14% against the greenback this year. We remain bearish on the peso. The pair should head further north as the situation in Mexico should be appraised in the context of the current US situation due to Mexico’s extreme dependency on the US economy.

The major issue is that Mexico keeps struggling to find investors to exploit its huge oil reserves. Over the past twenty years, the country has not had the ability to invest in its own infrastructures. Therefore, the country has been forced to open up its petroleum business to private and foreign investors. Unfortunately the country has been badly hit by the lingering oil commodity prices. WTI crude oil futures are trading around their 6 year-lows, below $36, against a backdrop of global oversupply.

It is true that the peso has been consistently dropping against the dollar for the past four years. The Fed rate hike will adjust up the demand for the dollar. Mexico is not only struggling with its own economy but also with the high expectations that markets have from the US.

Fed Master-Class (by Peter Rosenstreich)

In what turned out to be a central banker master-class in communication the Fed increased policy rates by 25bp, to 25-50bp, for the first time in a nearly a decade. And the market’s reaction was negligible. Fed Chair Yellen was deftly able to balance hawkish “dots” accompanied with a dovish statement. The net result was that risk appetite has remained firm today with most of Asia’s equity markets trading higher. In a unanimous vote the FOMC communicated their belief that the pace of rate hikes would be “gradual”, but at a steady pace, whilst keeping Fed fund rates low for an extended period of time. The statement rationalized the rate hike by highlighting the “considerable improvement in labor market conditions this year” with the position “the stance of monetary policy remains accommodative after this increase, thereby supporting further improvement in labor market conditions and a return to 2% inflation.” The committee indicated that each meeting would be “live” and “assess realized and expected economic conditions” indicating the data dependent nature of further policy action. Currently, the projection for Fed fund rates stands around 1.4% by end-2016, which is 50bp above what the rates futures are showing. The Fed emphasized the importance of exchange rates risks indicating that policy expectations could weigh on USD bullish momentum. We are anticipating that inflation will move quicker towards the Fed’s 2% target then the market is forecasting. Our optimistic view is for the Fed to hike rates 25bp per quarter in 2016, which is more than currently priced in to the futures. Our hawkish view against sluggish market expectations (based on strong USD, low oil and imported deflationary pressure) indicates that USD will remain supportive and vulnerable to upside data surprises.

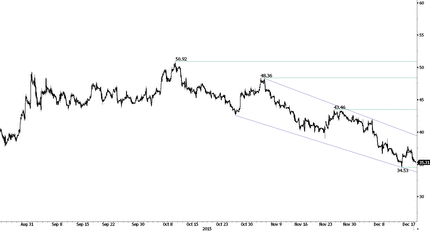

Crude Oil - Falling Again

| Today's Key Issues | Country/GMT |

| 3Q Labour Costs YoY, last 0,40% | EUR/08:00 |

| KOF Institute Winter Economic Forecast (Table) | CHF/08:00 |

| Nov Unemployment Rate, exp 6,60%, last 6,70% | SEK/08:30 |

| Nov Unemployment Rate Trend, last 7,20% | SEK/08:30 |

| Nov Unemployment Rate SA, exp 7,10%, last 7,20% | SEK/08:30 |

| Dec 17 Deposit Rates, exp 0,75%, last 0,75% | NOK/09:00 |

| Dec IFO Business Climate, exp 109, last 109 | EUR/09:00 |

| Dec IFO Current Assessment, exp 113,4, last 113,4 | EUR/09:00 |

| Dec IFO Expectations, exp 105, last 104,7 | EUR/09:00 |

| Oct Trade Balance Total, last 2186m | EUR/09:00 |

| Oct Trade Balance EU, last 760m | EUR/09:00 |

| ECB Publishes Economic Bulletin | EUR/09:00 |

| Nov Retail Sales Ex Auto Fuel MoM, exp 0,50%, last -0,90% | GBP/09:30 |

| Nov Retail Sales Ex Auto Fuel YoY, exp 2,20%, last 3,00% | GBP/09:30 |

| Nov Retail Sales Inc Auto Fuel MoM, exp 0,60%, last -0,60% | GBP/09:30 |

| Nov Retail Sales Inc Auto Fuel YoY, exp 3,00%, last 3,80% | GBP/09:30 |

| Nov PPI YoY, exp 4,50%, last 4,20% | ZAR/09:30 |

| Nov PPI MoM, exp 0,30%, last 0,90% | ZAR/09:30 |

| Oct Construction Output MoM, last -0,40% | EUR/10:00 |

| Oct Construction Output YoY, last 1,80% | EUR/10:00 |

| 3Q Labour Costs YoY, last 1,60% | EUR/10:00 |

| Dec CBI Trends Total Orders, exp -10, last -11 | GBP/11:00 |

| Dec CBI Trends Selling Prices, last -2 | GBP/11:00 |

| Nov Unemployment Rate, exp 8,00%, last 7,90% | BRL/11:00 |

| Dec 11 Gold and Forex Reserve, last 364.4b | RUB/12:00 |

| Nov Real Disposable Income, exp -5,20%, last -5,60% | RUB/13:00 |

| Nov Real Wages YoY, exp -10,20%, last -10,90% | RUB/13:00 |

| Nov Retail Sales Real MoM, exp 0,10%, last 0,70% | RUB/13:00 |

| Nov Retail Sales Real YoY, exp -11,50%, last -11,70% | RUB/13:00 |

| Nov Investment In Productive Capacity YoY, exp -5,20%, last -5,20% | RUB/13:00 |

| Nov Unemployment Rate, exp 5,60%, last 5,50% | RUB/13:00 |

| Dec CNI Industrial Confidence, last 36,4 | BRL/13:00 |

| Bloomberg Dec. Brazil Economic Survey | BRL/13:00 |

| 3Q Current Account Balance, exp -$118.6b, last -$109.7b | USD/13:30 |

| Dec Philadelphia Fed Business Outlook, exp 1, last 1,9 | USD/13:30 |

| Dec 12 Initial Jobless Claims, exp 275k, last 282k | USD/13:30 |

| Dec 5 Continuing Claims, exp 2200k, last 2243k | USD/13:30 |

| Dec 13 Bloomberg Consumer Comfort, last 40,1 | USD/14:45 |

| Dec Bloomberg Economic Expectations, last 42,5 | USD/14:45 |

| Nov Leading Index, exp 0,10%, last 0,60% | USD/15:00 |

| Dec Business Confidence, exp 101, last 102 | EUR/21:00 |

| Dec Manufacturing Confidence, exp 102, last 102 | EUR/21:00 |

| Dec Production Outlook Indicator, last 10 | EUR/21:00 |

| Dec Own-Company Production Outlook, last 4 | EUR/21:00 |

| Nov ANZ Job Advertisements MoM, last 1,20% | NZD/21:00 |

| Nov PPI YoY, last -4,50% | KRW/21:00 |

| Nov Formal Job Creation Total, exp -180000, last -169131 | BRL/23:00 |

| Nov Tax Collections, exp 98950m, last 103530m | BRL/23:00 |

| 3Q BoP Current Account Balance, exp -$7.80b, last -$6.20b | INR/23:00 |

| Oct Economic Activity MoM, exp -0,48%, last -0,50% | BRL/23:00 |

| Oct Economic Activity YoY, exp -6,13%, last -6,18% | BRL/23:00 |

The Risk Today

Yann Quelenn

EUR/USD has weakened towards hourly support at 1.0796 (07/12/2015 low). Stronger support lies at 1.0524 (03/12/2015 low). Expected to target resistance at 1.1096. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD's medium-term downside momentum remains lively. The pair is riding the downtrend channel. Hourly resistance is given at 1.5242 (13/12/2015 high). Stronger resistance can be found at 1.5336 (19/11/2015 high). Hourly support can be found at 1.4985 (02/12/2015 low). Expected to monitor support given at 1.4895. The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY is in a short-term bullish move. Hourly support can be found at 120.07 (28/10/2015 low). Hourly resistance at 122.23 (11/12/2015 high) has been broken. Expected to further consolidate. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF is rising toward hourly resistance at 1.0034 (04/12/2015 high). Yet, the technical structure shows a downside momentum. Expected to show further consolidation and decline. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.

Resistance and Support:

| EURUSD | GBPUSD | USDCHF | USDJPY |

| 1.1561 | 1.5659 | 1.1138 | 147.66 |

| 1.1387 | 1.5529 | 1.0676 | 135.15 |

| 1.1095 | 1.5336 | 1.0328 | 125.86 |

| 1.0857 | 1.4964 | 0.9956 | 122.43 |

| 1.0504 | 1.4857 | 0.9476 | 120.07 |

| 1.0458 | 1.4566 | 0.9259 | 118.07 |

| 1.0000 | 1.4231 | 0.8501 | 116.18 |

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.