Polish Zloty (EUR/PLN) – How high it can go?

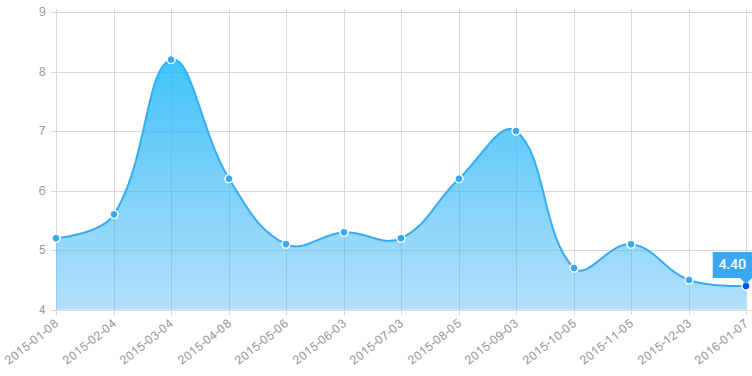

China. That one word is on the main topic among global traders. Dramatic declines of Chinese equities (due to fears the economy will slow down) caused major global indices to fall and increased volatility on all asset classes. EM currencies were hit pretty hard and none of them sustained the increase of risk aversion. In Poland we have additional factors that are depreciating the Zloty. Foreign investors take into account increased political risk in Poland. The new government is introducing controversial acts (about the constitutional tribunal and media) and is expected to increase spending to fulfill part of the promises they made during the campaign. Also, the upcoming introduction of the bank tax and tax on supermarkets (hello Victor Orban!) is expected to increase the cost of credit and prices of consumption goods. These in turn could slow down savings and investments. So far though, the economy is not in bad shape. The Industrial PMI in December stood at 52.10 points, in line with expectations. Also, the government sold the full batch of 5-year bonds for 4,6 bln PLN (around 1,37 bln EUR) while demand was for 7,2 bln PLN. Average yield of those securities was set at 2,382%. Still, external factors play a more crucial role in what is happening on the Zloty market. Sure, confidence of foreign capital towards the Polish economy has declined in the last couple months, but the currency’s recent depreciation has to be attributed to China.

As we see on the daily chart, the EUR/PLN started the week at 4.26 but right away began its way north in a strong fashion. It broke through the 4.28 resistance and continued its upward move reaching levels above 4.35. Currently, the PLN is being traded at around 4.34 but the way to December’s highs of 4.37 is open. If that high is broken, the market should target 4.39. The stochastic oscillator suggests the market is overbought and if so, the corrective movement could take the EUR/PLN down to 4.32. In order for this to happen, the situation on global markets needs to calm down. Otherwise, next week the EUR/PLN will be attacking higher levels.

Hungarian Forint (EUR/HUF) – stuck in the middle

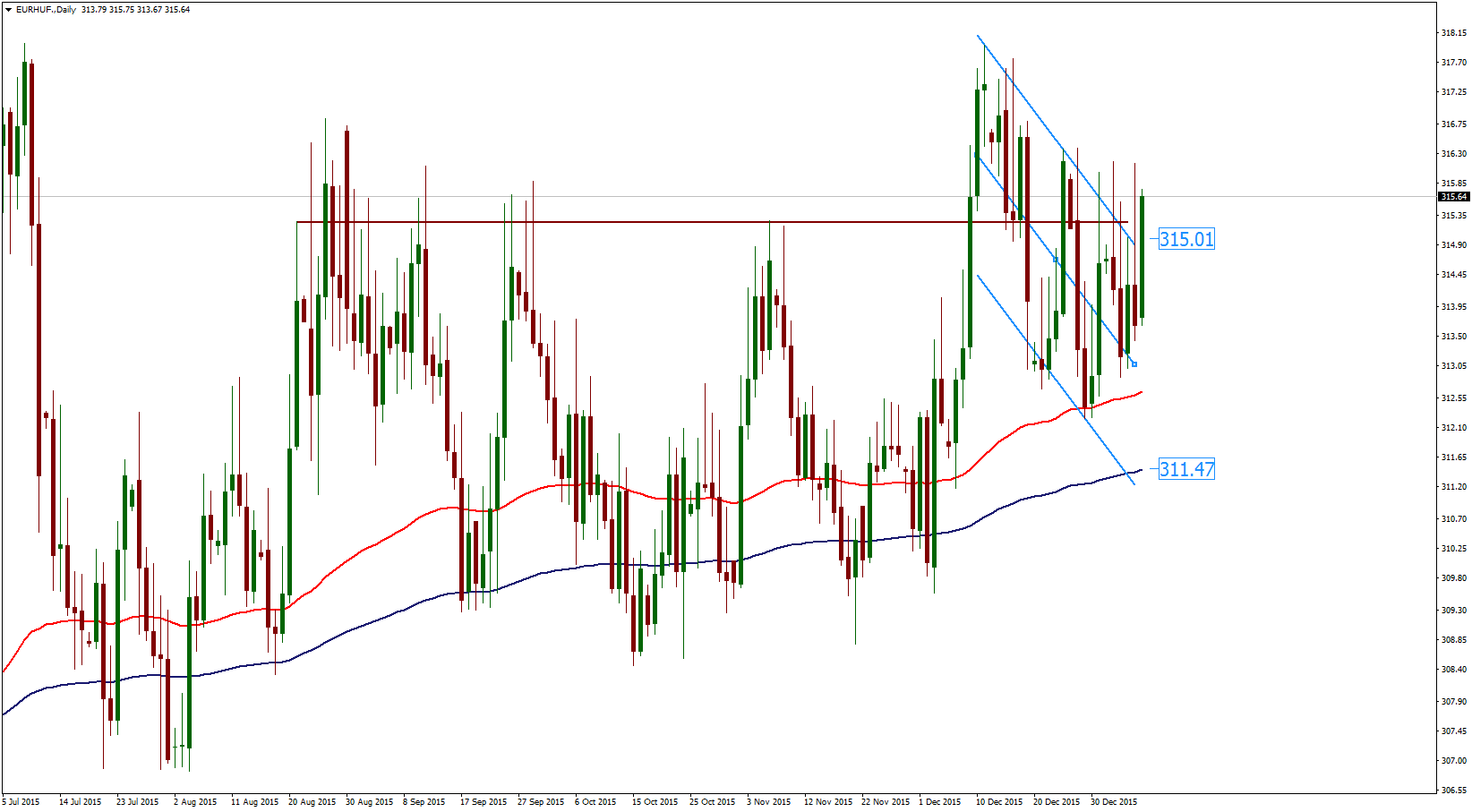

The Forint has eased since the morning and went north up to 316 against the euro. Then tensions on the markets started to abate, which gave a boost to the Forint and its regional peers. The local currency was trading at 314.45 against the euro late Thursday on the interbank forex market, slightly up from final quotes of 314.70 on Wednesday. Main Budapest arteries were closed for David Cameron’s visit this week. UK’s Prime Minister praised Hungary’s “very successful economy” and low unemployment numbers, and maintained that the economic ties of the two countries are excellent. The prime ministers, Hungarian (Viktor Orban) and UK’s, both said at the press conference that they want a strong and competitive Europe. Furthermore, Cameron also highlighted that the EU has to make sure that member states that are not in the Eurozone – including Hungary and the U.K. need to work together. We also found out that Black Friday was not a big deal in Hungary. The volume of retail sales grew by 4.4% in November (yearly basis) of 2015 but this was the slowest growth rate in the past 15 months. Volume of sales rose by 2.5% in food, drinks and tobacco stores, by 6.9% in non-food retail trade and by 4.7% in automotive fuel retailing.

As we expected, the EUR/HUF seems to be stuck within the 312 - 315 trading range as depicted on the daily chart. Forint bulls should hold below the price at least under the 315 resistance levels to ensure further strength. A clear push above the 316.00 levels would be a breakout and encourage a bullish setup.

Romanian Leu (EUR/RON) –Above the former ceiling

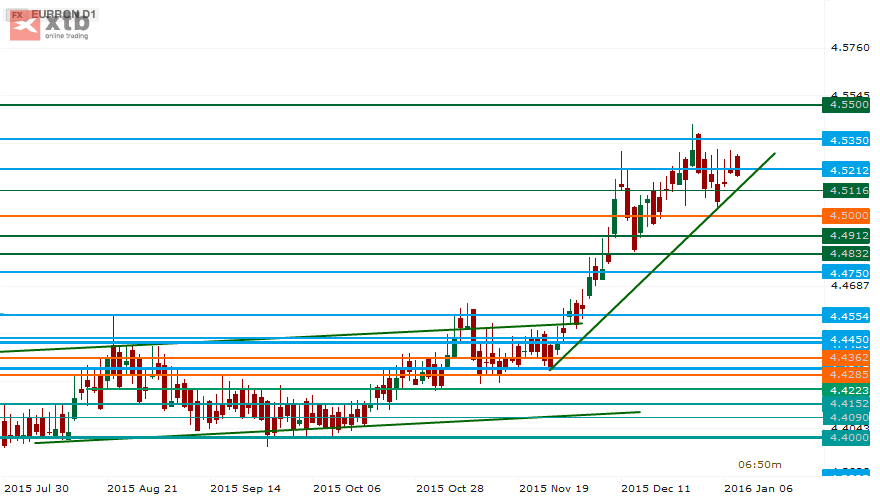

EURRON has proved that what has happened on the final notes of last year is not just a 2015 thing: the breach of 4.52, previously a far-away, aspirational ceiling is, it appears now, not a one-off thing. In the new status-quo the Leu seems quite nervous, ready to give ground again to the EUR, even though it has managed to navigate rather well the interest rate decision on the 7th. The NBR decided to keep the interest rate at 1.75% while reducing the minimum reserve requirement for foreign currency deposits by 2 points to 12%. Since rates on the interbank market are actually at record lows, and the economy is on track to grow by 3.9% this year, or even higher by government estimates, with inflation below target, there should be no need for further stimulus. In fact markets see the reserve requirements being cut further to get aligned to the European standards. Macro data showed improved retail numbers, with a strong 2.5% increase while building permits fell by about the same amount. With a shaky global environment, the 3M rates below 1% barely seem to compensate for risk, so we see the RON under pressure not only next weeks but further down the road.

The technical picture shows a trend is still alive, and even if a re-draw is possible, the more we reach into the future the more likely a push towards 4.5350 becomes. Actually even 4.55 does seem possible, although not very likely in the next week. Support is provided by the trendline, at the intersection with an older support at 4.5116, followed by 4.5000.

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.