Polish Zloty (EUR/PLN) – unable to break from the range

Markets have been nervous this past week but the Polish Zloty remained stable. Traders are worried about the equities sellout (possible market crash?) in China and its possible impact on global financial markets. So far no fire sales are made but stock indices in Europe are down. Also, emerging markets currencies are under pressure, including the Zloty. The local currency experienced some depreciative movements this past week but the negative news from China were balanced form rather decent macro news form the U.S (GDP and Unemployment Claims). Also, the Fed in its statement mentioned the economy is doing pretty well, with the real estate market picking up speed. It was a rather hawkish statement and the USD began to appreciate. Such movement of the dollar can hurt the Zloty in the short term but it will not affect it drastically. So in general, it was a calm week on the Zloty market. The EUR/PLN has been trading in a range and only a breakthrough could trigger a larger move.As we see on the daily chart, the EUR/PLN has been trading in a 4.10 – 4.14 range during the last two weeks although this past one it tried to break the resistance reaching a weekly high of 4.1550. The stochastic oscillator is not providing us with any signals at this moment. Toda, the market is trying to break the upper level and if it happens by the end of the trading day, we can further upward movements. So we are still be observing the two crucial levels – 4.10 as the support, which if broken, should trigger a move towards 4.07 (61.8% of the last upward move) and the resistance of 4.14, which if broken, should take the EUR/PLN higher towards 4.17.

_20150731145835.png)

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – The chart is unchanged

Inflation in Hungary is increasing however the Brent oil price assumption of USD 55/bbl through 2016 would lower inflation to 2%. The National Bank of Hungary has ended the rate cutting cycle at 1.35% this month. Governor György Matolcsy announced that the policy rate would stay at its current lows for a “very long time”. From macro news, CPI climbed higher to 0.6% in June from 0.5% in May but below the target (3%). That is why we expect the NBH will not hike any rates in the future. The negative forward-looking real interest rate 1.35% could hurt the Hungarian currency. Again, the bond market performed well this week again. Hungary’s Government Debt Management (ÁKK) has placed a HUF 25 billion lot of its 12–month discount Treasury-bills up for auction. The highest accepted yield was 1%. Hungary’s economic calendar will start in August with the retail sales and July’s inflation reports.Taking a look at the daily chart, we can see that nothing has really changed from last week. We are still moving between the 100 and 200 DEMA at the 308 levels. The Fibo 50% retracement level stopped the Forint bulls and it seems this border could stay unbreakable for a longer time. Above 308 there is no option for new lows so first of all the local currency should break down this support ion order for a larger strengthening move.

_20150731145921.png)

Pic.2 EUR/HUF D1 source: Metatrader

Romanian Leu (EUR/RON) – Times may be

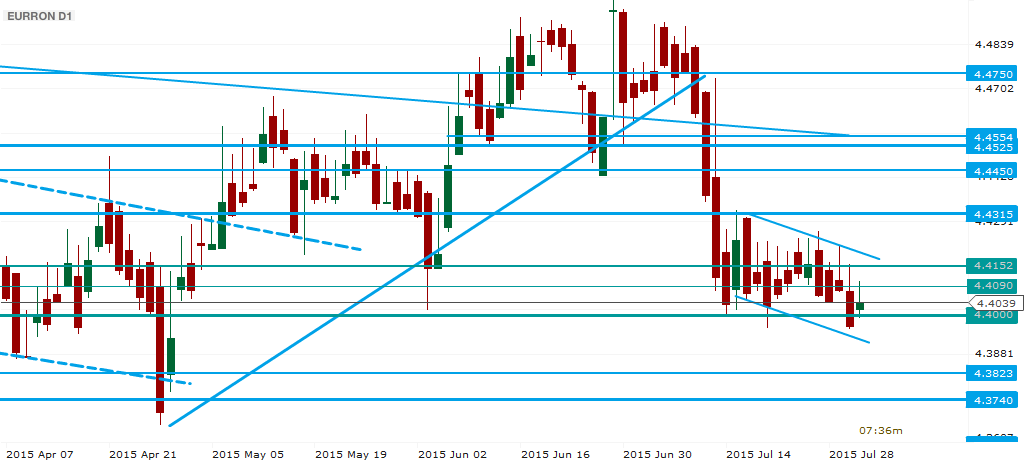

With some markets rebounding, the risk appetite helped EUR/RON test the 4.40 line. There has been until now something like an invisibile hand preventing the slide below (apart from a very very brief touch below) that may have something to do with the National Bank. Wary of the still unsolved mysteries of the Greek third bailout, the NBR also watches carefully the debate surrounding a very large fiscal stimulus, in the form of lower taxes (VAT by 5 points, among others) and higher public sector wages. The macro data points to a strong year, including a return to life in constructions, however there are worries about the agricultural production, which was 4.7% of the GDP last year, due to drought. In the next few sessions we see a bit of pressure to break 4.40, but it may not be just up to the market to decide if that is possible.Technical perspective shows a slow downtrend, with a strong 4.4000 support (one should ignore the ”technical” breaches, some due to less-liquid trading hours). There is plenty of space to move below 4.4200 and above 4.4000, however the next logical step would be to try and break 4.4000 aiming for 4.3823 or even a projection of the current channel towards 4.3740. This is our preferred scenario. A move north of 4.4152 may bring into question the 4.4315 resistance.

Pic.3 EUR/RON D1 source: xStation

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.