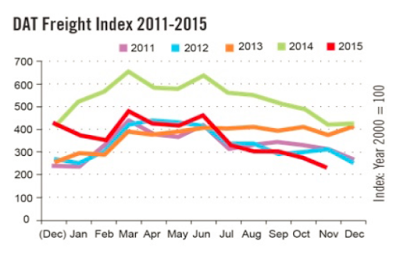

A chart of the DAT freight index posted on CCJ Indicators shows a huge, ongoing collapse in trucking shipments.

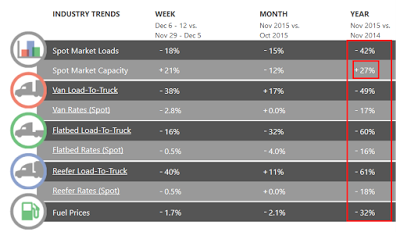

"Spot freight falls 15 percent: The amount of freight available on the spot market fell 15 percent in November from October, DAT reported last week. That dip is in line with seasonal trends, the online loadboard said. Year over year, however, freight volume fell 45 percent from November 2014. Van freight fell 2.9 percent from October, flatbed 39 percent and reefer 9.1 percent, DAT says."

Not to worry!

To that I would add that in August, September, October, and November, shipping volumes were down compared to the same month in 2011, 2012, 2013, and 2014 except for the single instance of September 2015 vs. September 2012.

“We expect conditions to improve as we move through the year as the market further prepares for tight truck capacity when the HOS, ELD, and speed governor rules are implemented over the next two years,” says FTR’s Jonathan Starks. “The main risk right now is the weakness in manufacturing and the high inventory levels. The inventory situation needs to be corrected before we are likely to get a sizable burst of manufacturing activity. Look for that to happen early in 2016.”

Sizable Burst of Unwarranted Optimism

Starks foresees a "sizable burst of manufacturing activity." He provided no reasons for expecting for that burst of activity.

I suppose inventories will magically shrink or consumers will go on a record buying spree despite rising interest rates, a slowing global economy, unaffordable home prices, high and rising rent prices, and rapidly rising medical costs, the latter two rising much faster than paychecks.

DAT Trendlines

In the above chart, courtesy of DAT Trendlines, the only thing up vs. a year ago is capacity to ship. That spells trouble in my book.

To that we can safely add Industrial Production Declines Most in 3.5 Years, Down Eighth Time in Ten Months.

Finally, inventories are a very serious problem, not something that can be wished away.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.