FOMC Day:

The day has arrived. While economic factors have pushed back the earliest possible liftoff month to September or December, it’s the tone of tonight’s FOMC statement that will have the most significant impact on Forex markets.

With the odds of a rate hike in September now priced in at 50/50, I am of the opinion that they are more likely to move using a policy of stabilisation rather than being forced into hitting the market hard with multiple hikes clumped together. It’s all about beginning the normalisation process after rates have been at zero for so long and hiking early in September is conducive to this train of thought.

The fact that Yellen has persistently said that the Fed favours moving gradually over a longer period of time is pushing the point that September is in play.

Take a look at our Monday FOMC chart preview in the Technical Analysis section of the Vantage FX News Centre here.

Wheeler Speaks:

Reserve Bank of New Zealand Governor Wheeler this morning delivered a speech titled ‘Monetary policy supporting growth and inflation goal’ at the Tauranga Chamber of Commerce. The full transcript of his speech can be found here, with the few key points taken out below.

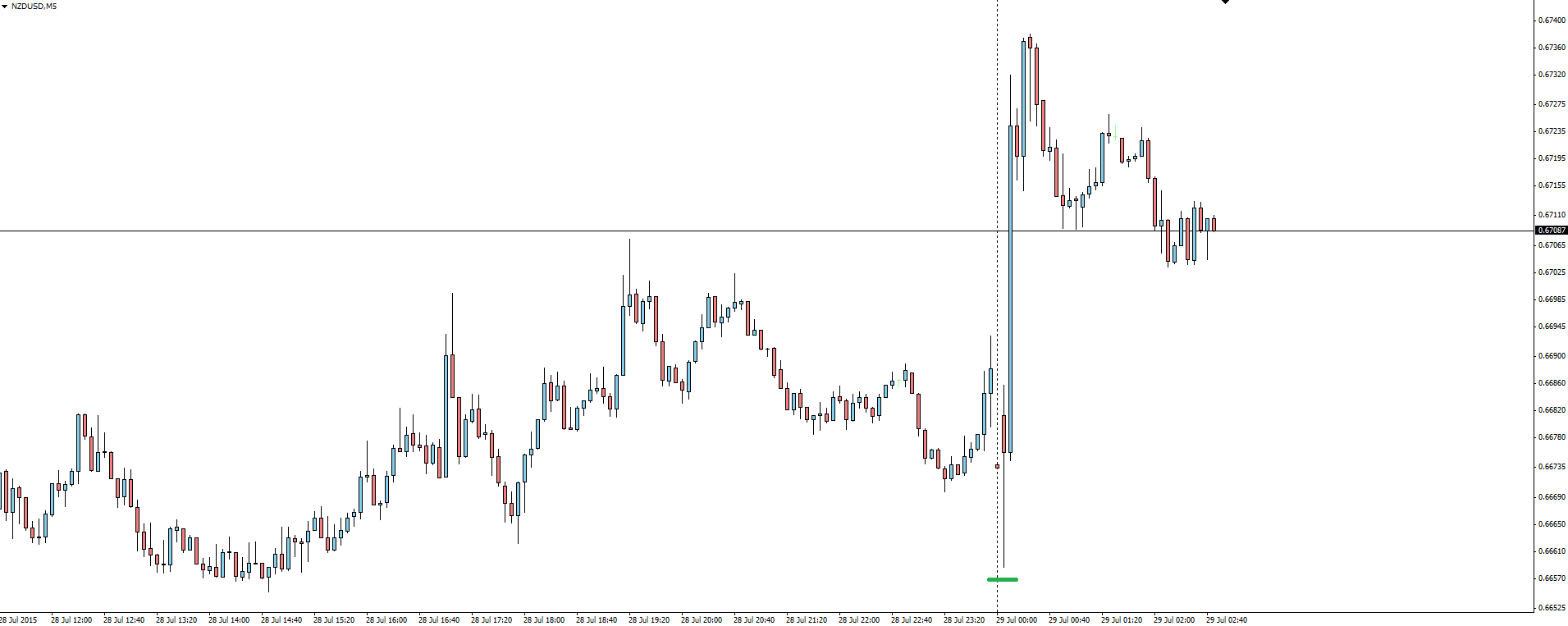

NZD/USD 15 Minute:

“Some further easing seems likely.”

“Further NZD depreciation necessary.”

“Several risks around inflation outlook.”

3 statements that have become fairly standard from the RBNZ. The market instead choosing to rally on the final, positive point.

“Several factors are supporting economic growth.”

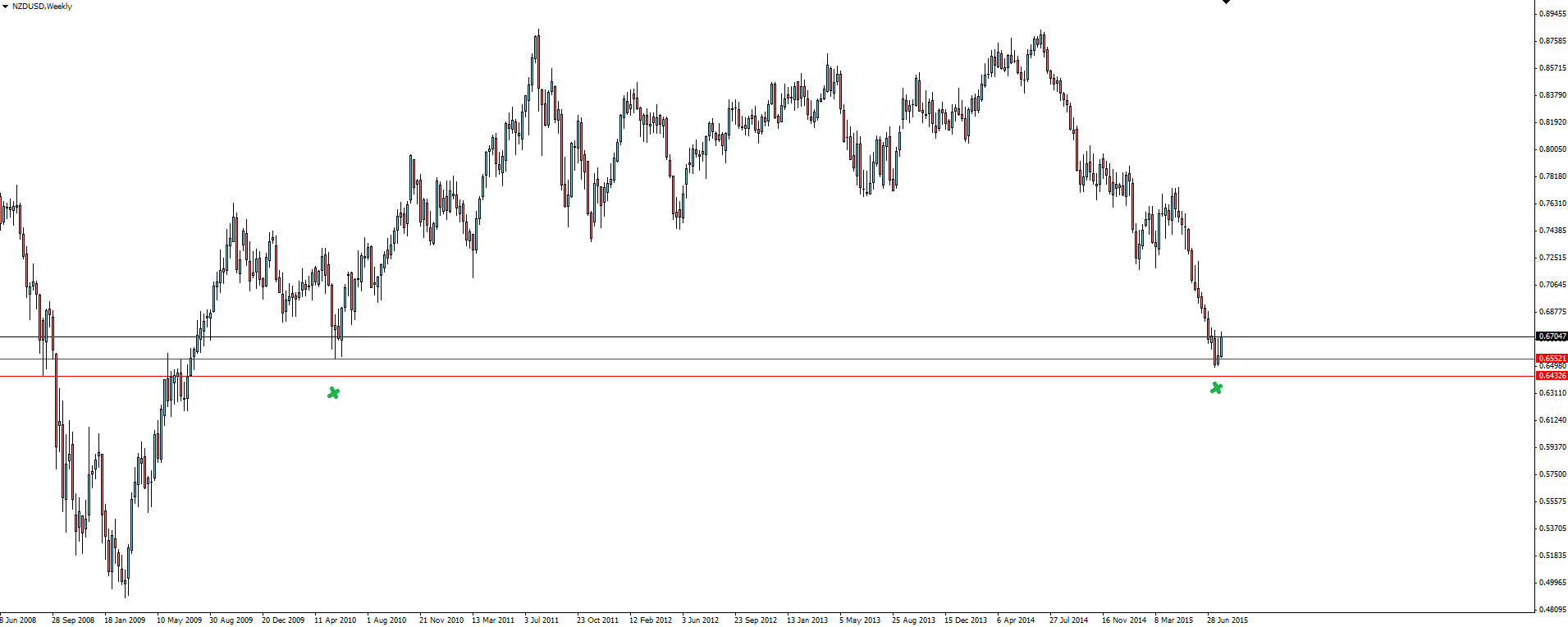

NZD/USD Weekly:

Most interesting to me as a primarily technical trader, is that heading into the speech, the Kiwi bounced off the above weekly support zone. Very clean!

On the Calendar Wednesday:

NZD RBNZ Gov Wheeler Speaks

JPY Retail Sales

USD FOMC Statement

USD Federal Funds Rate

Chart of the Day:

As its FOMC week, we have been looking at the majors heading into tonight’s meeting. This morning we take a look at Cable and how its been behaving.

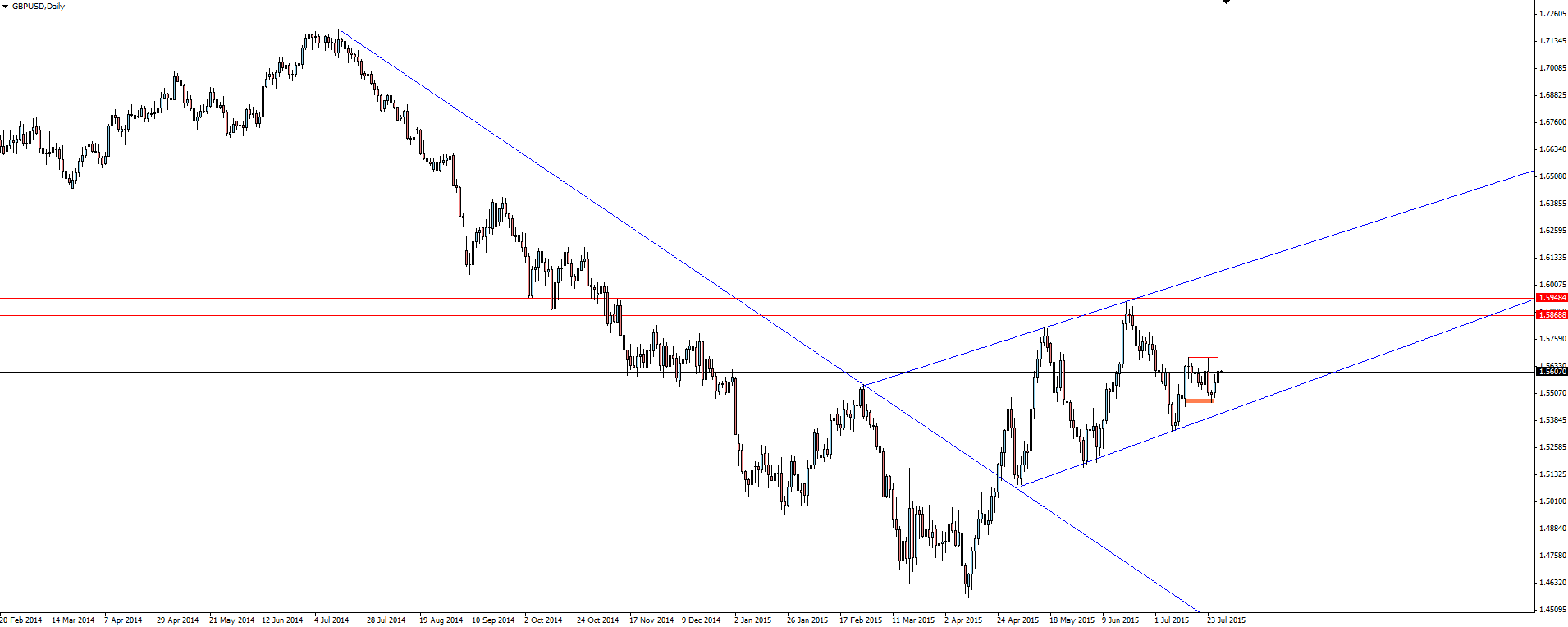

GBP/USD Daily:

The Cable daily chart shows the change in trend once price broke the major bearish trend line, settling into a short term bullish channel that has now taken a front seat.

This chart shows the divergent monetary policies between the Bank of England who are looking to hike and for example the Reserve Bank of Australia or the ECB who are still easing or maintaining an easing bias, with Cable the only major pair that is now in a bullish trend.

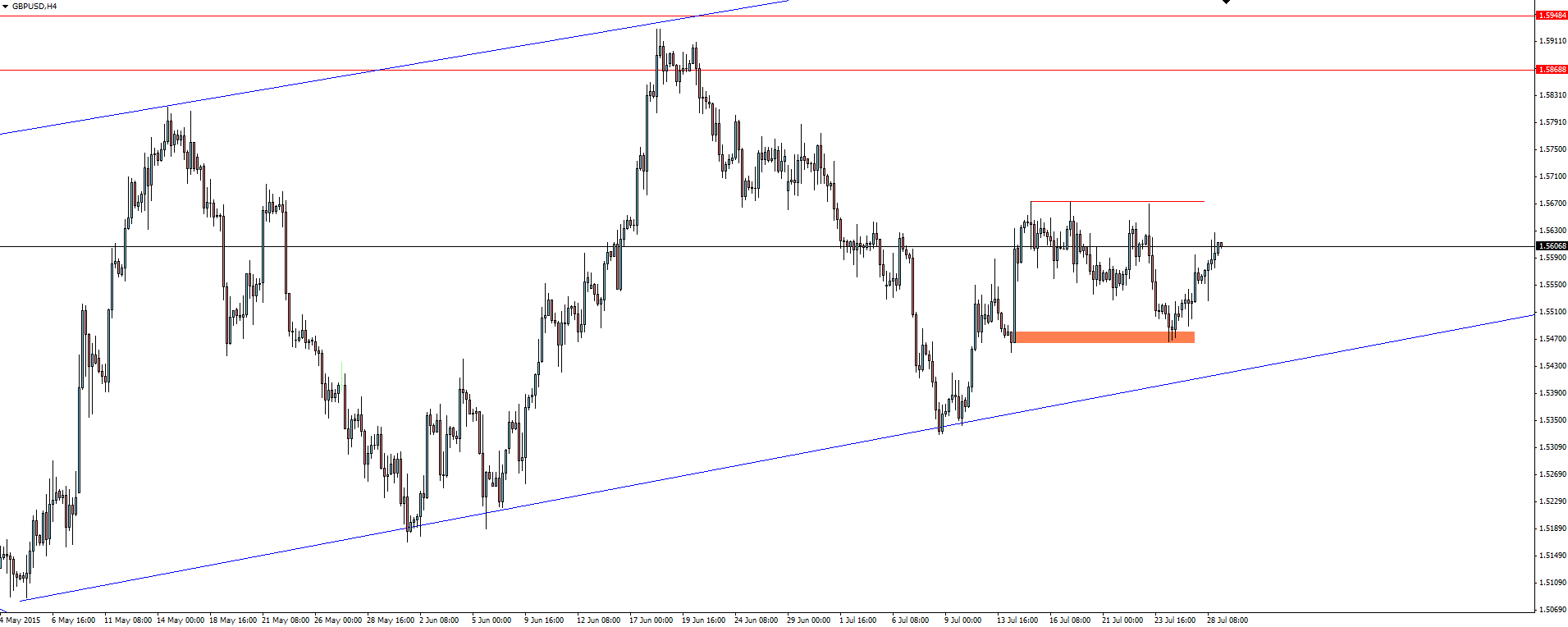

GBP/USD 4 Hourly:

Looking a little closer on the 4 hour chart, going with the trend you can see that price pulled back into a demand zone where price had previously kicked out of, touching it with wicks and moving higher. The fact that it was with the trend and its proximity to channel support provided traders who want a wider stop a bit more breathing room.

From here, stops above the short term resistance at 1.56700 are in play. It will be interesting to see if they act as a magnet heading into FOMC.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.