Asian Session Morning:

You may have noticed a slight re-naming of our morning blog this week. We are still letting the Vantage FX News Centre evolve naturally and the name and format is just a natural progression of the idea.

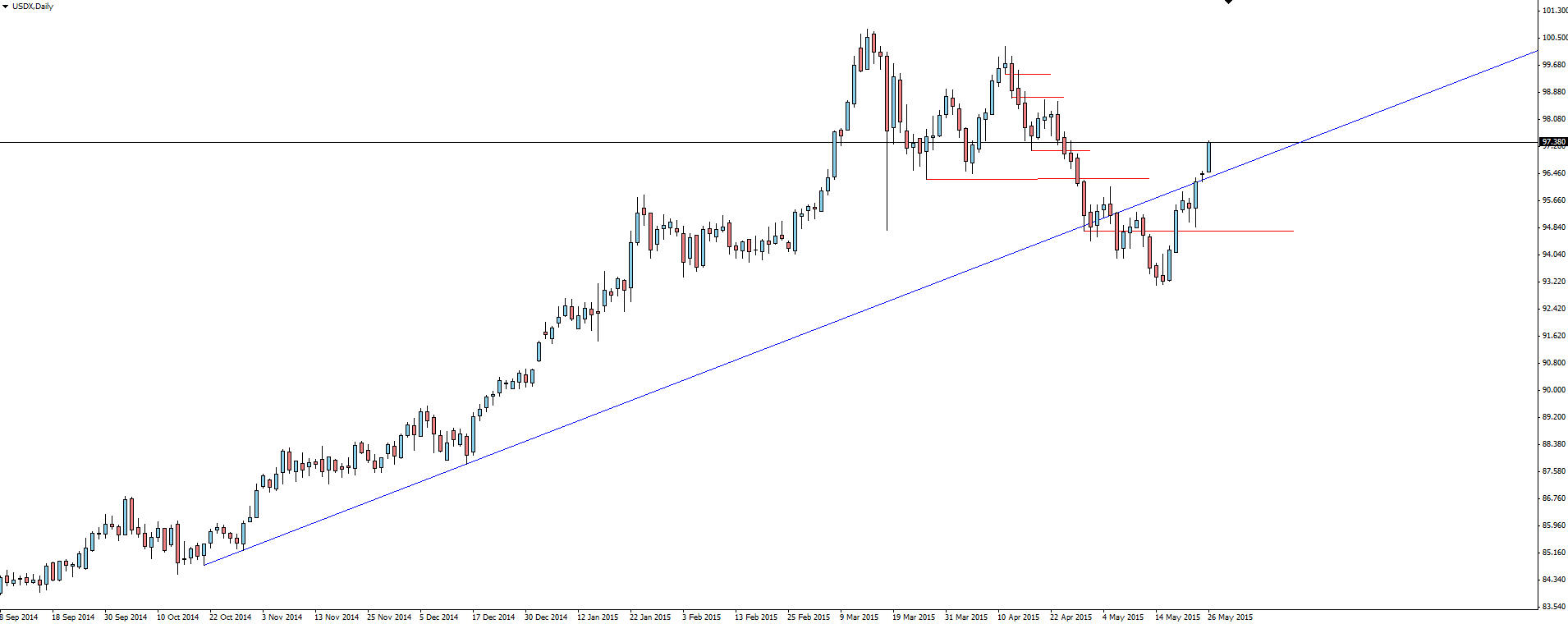

US Durable Goods Orders beat expectations to the upside overnight, pushing the USDX back inside it’s previously broken trend line and on target for new highs again. The Durable Goods print came in with a 1.0% jump on expectations, helping to confirm that the Fed was justified in not putting as much weigh on any Q1 economic slowdown.

USDX Daily:

The data dependent line has been repeated over and over throughout the Q1 slowdown and the market loves these sorts of prints actually backing up the talk and confirming that the Fed actually does have the foundation that it needs to begin raising rates.

With things starting to quickly unravel in Greece, there is now no hope that the government will be able to reach it’s upcoming repayment requirements. This heaps more pressure on an already unstable coalition government with yet another parliament re-shuffle likely. This would allow new reforms to pass parliament, taking yet more money from an already strangled nation but avoiding the uncertainty of elections or an exit from the Eurozone.

On the Calendar Today:

Each of the notes on the Asian Session portion of the calendar are 2nd tier data but worth keeping an eye on none the less.

Greece will surely be top of the agenda at the G7 Meetings today in Germany while the major Central Bank risk comes out of Canada with their Rate Statement to finish the evening.

Wednesday:

JPY Monetary Policy Meeting Minutes

USD FOMC Member Lacker Speaks

AUD RBA Deputy Gov Lowe Speaks

AUD Construction Work Done

USD G7 Meetings

CAD BOC Rate Statement

CAD Overnight Rate

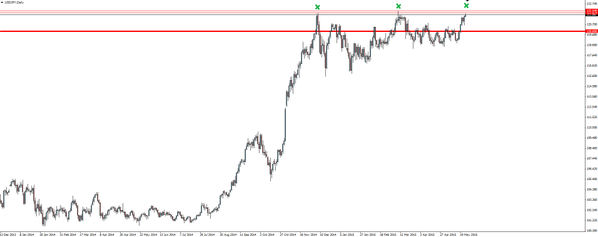

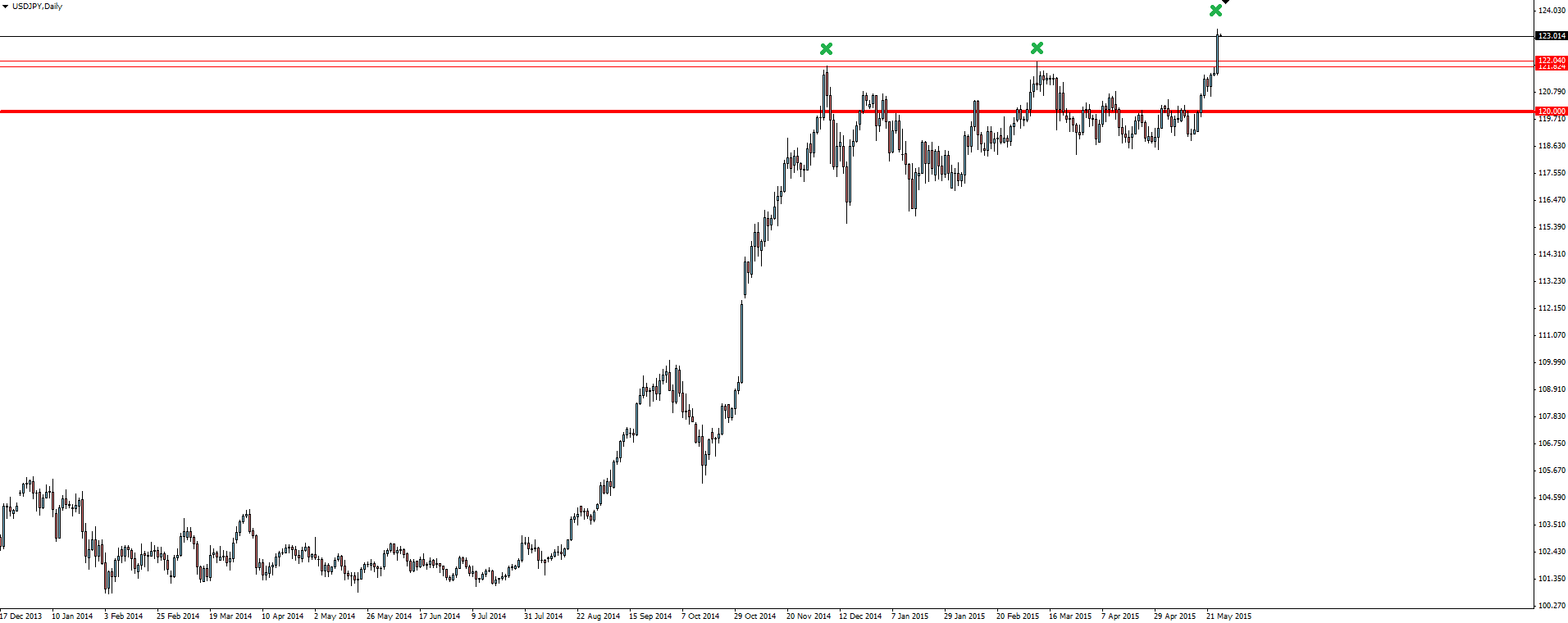

Chart of the Day:

The idea was that two touches of resistance wasn’t able to reject price off the level and the third was likely to be the strew that broke the camels back and breakout.

USD/JPY Daily:

Price really didn’t mess around when it got there either, hitting stops and momentum carrying the breakout through. A Core Durable Goods beat a bit later in the night kept the rally pushing through and the daily candle basically closed on it’s highs.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.