Market Brief

Greece will walk into the negotiation room today (6pm CEST in Brussels), knowing that it is its last chance to reach an agreement with its European creditors. Greece has a new finance minister in the person of Euclid Tsakalotos after Yanis Varoufakis was asked to resign by Alexis Tsipras with the purpose of showing goodwill regarding today’s key negotiations. However, Tsakalotos is not seen as pro-austerity and it may be as difficult for EU finance ministers to negotiate with him as it was with Varoufakis. By declaring that “Greek people want a sustainable solution”, Greece’s new finance minister announced its line of negotiation and it seems that it is not much different from its predecessor. EUR/USD moved sideways in the Asian session as market participants patiently wait the outcome of the last-chance talks. Greek 10-year government bond yields rose to a 2.5-year high at 18.09% while Italian and Spanish yields increased substantially at the short-end of the curve, with 2-year bond yields reaching 0.43% and 0.44% respectively.

In the Asian session, equity markets are mixed this morning with the Nikkei up 1.31%, the Kospi down -0.66%, the BGK up 0.35% and the Sensex up 0.23%. In China, the equity sell-off continues as the Shanghai Composite falls -1.08% while its tech-heavy counterpart drops -5.35%, despite the PBoC’s move to try to restore investor confidence in the stock market. USD/JPY is treading water around 1.2260 and will find support around 121.45 and resistance around 124.45.

As expect the Reserve Bank of Australia (RBA) maintained its cash target rate unchanged at record-low 2% and reiterated its call for an accommodative monetary policy. AUD/USD swung widely on the news but stabilised around its pre-announcement level of 0.7480. The Aussie lost more than 3% since July 1st and we anticipate the Aussie to fall further against the US dollar.

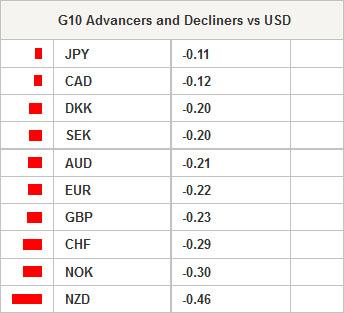

The US dollar is up against all G10 currencies this morning amid risk-off moods. Its recent strength has more to do with global mounting uncertainties than the soundness if the US economy. The yen edges lower by -0.11%, the loonie retreats -0.12% while the biggest looser is the kiwi, which dropped -0.46% and the NOK down -0.30%. However, the release of the FOMC minutes from June 16-17 meeting due tomorrow will likely awake some sleepy traders. The dollar index is gaining upside momentum and is currently testing the 96.56 resistance (Fib 50% on April May debasement). We expect currency market to stay focus on the Greek negotiations today and to move sideways while waiting fresh news.

Today traders will be watching Norway’s May industrial production and Halifax house prices; UK’s May industrial and manufacturing production; Brazil’s inflation report; US trade balance and JOLTS job opening.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.