Market Brief

Equity markets are higher in anticipation of Greece presenting its reforms proposals. On Friday in a last minute deal, Greece and its international creditors have agreed to an extension of the current bailout program for up to four months. However, the agreement is conditional on the Greek government providing clear outline of reforms today. The Nikkei rose 0.73%, the Hang Seng was flat and the ASX rose 0.45%. US 10-yr yields held at 2.104%. Shanghai and Taiwan was closed for the holiday keeping trading thin. The optimism has carried over as European shares are heading higher with UK and German indices near their record highs. FX markets were unchanged opting to wait for the Greeks proposal. EURUSD continues to come under selling pressure falling to 1.1347 from 1.1431. USDJPY spent most of the session grinding lower to 118.90 before catching a quick bid to 119.20 at the European open. There is growing discourse in the BoJ as now three members have publicly expressed doubts that that central banks can hit its inflation target due to falling oil prices and slowdown in underlying prices. AUDUSD fell back to 0.8729 as the Lunar New year holiday limited trading. New Zealand’s credit card spending increased 6.2%y/y in January from a solid rise of 4.5% in December. NZDUSD was range bound between 0.7510 and 0.7540 with support at 0.7500 holding traders attention.

The headlines revolving around the Greek deals are coming in hot and heavy as no formal agreement has been finalized. There are rumors that Germany continues to reject the plan as clearly hard negotiations are going on. Greek officials have stated that the reforms to be delivered today will be accepted by the EU and creditors. Interestingly, internationally being praised for showing flexibility, while at home the new Greek government is being attached for selling the “illusions” to voters. According to Bloomberg, it was Spain’s Luis de Guindos took the harshest line with Greek Finance Minister Yanis Varoufakis during negotiations. It was suggested that Luis de Guindos demanded that Greece adhere to the existing bailout plan as a precondition to access official financing. This make sense considering that Spain is also under stick austerity rules and the rise of Syriza in Greece has fueled Spanish opposition Podemos.

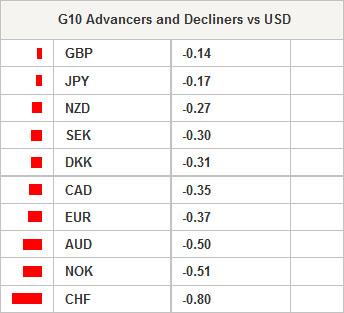

Traders will be watching German Ifo expectations are likely to rise from 102.0 to 103.0, current assessment to advance from 111.7 to 112.5, and business climate improve from 106.7 to 107.7. In the US existing home sales should show a slight decline to 4.96m suggested by the recent fall in pending sales. According to IMM data speculators continue to trim USD long position pushing net longs to its lowest level since December. We anticipate a marginal USD sell-off should Greek reform proposal gets accepted today but in the longer run remain constructive on USD.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.