Market Brief

The weakness in yen continued in Tokyo, the Japanese EconMin Amari refused to comment whether the current FX levels are appropriate or not. USD/JPY extended gains to a fresh high of 107.39, the bullish momentum further strengthen. Japanese exporter offers and light profit taking are presumed at 107.50/108.00. The option bids are solid above 105.00. EUR/JPY broke the 100-dma (138.39) on the upside and stabilized above its daily Ichimoku cloud cover (137.15/91). Trend and momentum indicators are marginally positive; the critical resistance is eyed at 139.86/140.00 (200-dma / optionality). The pair is subject to EUR risk.

EUR/USD traded in the tight range of 1.2915/29 in Asia. Released yesterday, the German and French inflation remained soft in August, in line with market expectations. The Spanish and Italian figures are due today. The Euro-zone August CPI will be released on September 17th; the expectations remain subdued. EUR/USD gains on short-covering in the absence of important data/event. Traders remain sellers on rallies as the Ukraine/Russia tensions and the contamination fears of the Scottish situation are risks that the majority doesn’t want to carry too long. The EU officials announced that additional sanctions will enter into force today. Offers remain solid pre-1.3000.

GBP/USD advanced to 1.6270 (week high) yesterday, yet remained offered below last week low 1.6283. EUR/GBP remained capped by offers pre-21-dma (0.79718). Technicals are perfectly flat as the pair closed are at the MACD pivot yesterday. A week close below 0.79500 should keep the bias on the sell side. However, the GBP-complex is very sensitive to news/polls on Scots independence vote thus the sharp moves are unpredictable. According to the latest YouGov poll, the “yes” vote has retreated from 51% to 48%. Given the uncertainties, we chose to remain on the sidelines.

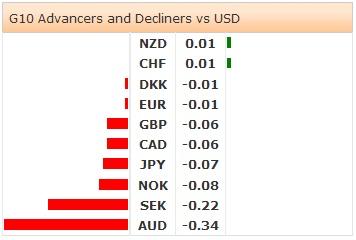

The high-beta, commodity currencies remain under decent selling pressures due to softening commodity prices. AUD/USD declined to 0.9053, NZD/USD extended weakness to 0.8157. The bias remains on the downside. In Canada, USD/CAD rallied to 1.1060 as the crude oil contracts traded at year lows yesterday. The pair stabilized above 1.1028 (Fib 38.2% from March-July drop). Large option bids are placed at 1.1000/35/50 for today expiry. Next week’s FOMC meeting (September 16-17th) will be closely monitored and should redefine the short-term direction for carry strategies and high-beta currencies. The Fed has good chance to keep its tone balanced, thus traders should stand ready for short-term reversals in capital flows.

Today, traders focus on German August Wholesale Price Index m/m & y/y, Spanish August (Final) CPI m/m & y/y, Italian August CPI y/y, Italian July Industrial Production m/m & y/y and General Government Debt, UK July Construction Output m/m & y/y, Euro-Zone July Industrial Production m/m & y/y, Euro-Zone 2Q Employment q/q & y/y, US August Retail Sales m/m and Import Price Index m/m & y/y, Canadian August Teranet/National Bank HPI m/m & y/y, University of Michigan’s September (Prelim) Confidence Index and US July Business Inventories.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.