Market Brief

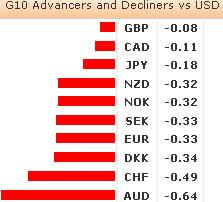

The risk appetite rebounded as the attention moved away from the European debt crisis to news out of Japan. BoJ’s Governor Shirakawa decided to step down earlier than scheduled. In reaction, Yen weakened against all of its major counterparts, except AUD, over the last 24 hours even though the BoJ policy board stated that the focus should be on “channel” in which the monetary policy can indirectly affect FX, as the 2% inflation target cannot be reached only by weakening Yen.

USDJPY tested 94.06 early in the session, yet retreated due to stops above 94.00. EURJPY hit 127.71, its highest level since April 2010, GBPJPY rallied to 147.255. NZDJPY came to its lowest since July 2008, while AUDJPY was bearish amid weak December retail sales out of Australia.

EURUSD traded in 1.3560 / 96 range in Asia, thanks to bullish pressure on EURJPY and EURAUD. EURCHF had support at 1.2260, and recovered above 1.2360 ahead of German manufacturing orders release this morning.

On the back of Shirakawa’s decision, Japanese stocks saw massive rally overnight. The Nikkei 225 surged 3.8%, Hang Seng and Shanghai’s Composite advanced by 0.6% and 0.02%, Taiex added 0.25%. Australia’s ASX200 gained 0.78%. The Korean Kospi index was the only one to retreat 0.10%, amid the concerns on weaker Yen hurting country’s exports.

Overseas, the US stock markets advanced yesterday, despite the worse-than-expected ISM non-manufacturing figures. The S&P500 increased by 1.04%, Dow Jones and Nasdaq’s Composite followed by 0.7% and 1.29%.

Today, the economic calendar is light. We will watch German Dec Factory Orders m/m and y/y and the US MBA Mortgage Applications.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.