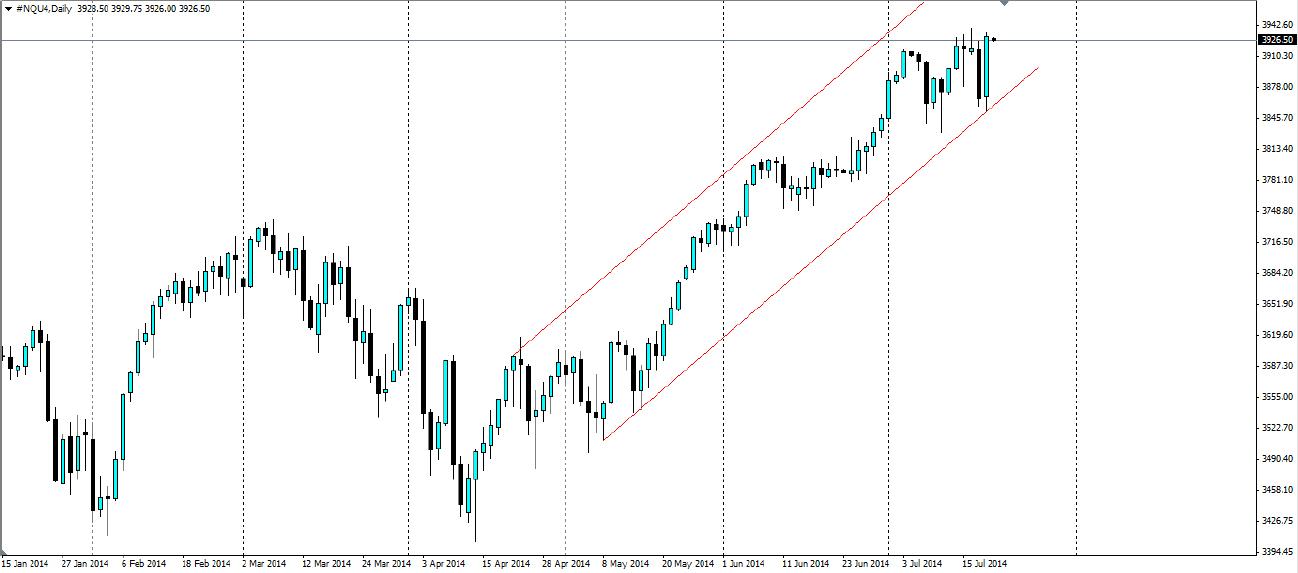

The NASDAQ Index took a big bounce off the bullish trend line as the end of last week. It has met some resistance at the current highs, however, if this breaks we will see a movement much higher and a continuation of the channel.

The NASDAQ has generally been more volatile than the leading US stock indices such as the Dow Jones and S&P 500, however, it is closely correlated with the two, therefore is affected by the broader economic sentiment in the same way. For these reasons it would pay to keep an eye on the US economic data that is due out this week. CPI figures will add to volatility and this should have the biggest impact of the NASDAQ as it is the riskier of the US Indices.

Unemployment Claims will have an effect on consumer products and the NASDAQ as this reflects how many people have disposable income. The US economy as a whole is looking more solid. The Job market is certainly showing positive signs and US Federal Reserve Chairwoman Janet Yellen shows confidence and believes interest rates could rise sooner rather than later. She has said an accommodating Monetary Policy is still necessary, hence the bullish trend in equities, and her confidence in the labour market has helped.

The end of last week saw a big day of selling off following the shooting down of Malaysian Airlines flight MH17. The threat of an escalation in tensions between the West and Russia led many traders to seek the safety of the assets such as gold. The invasion of Gaza by Israel also added to the Nasdaq’s worst day in three months. But the next day saw a big bullish engulfing candle on the chart as many trades poured back in and the index bounced off the trend line. The index was boosted by earnings announcements from many companies on Wall Street.

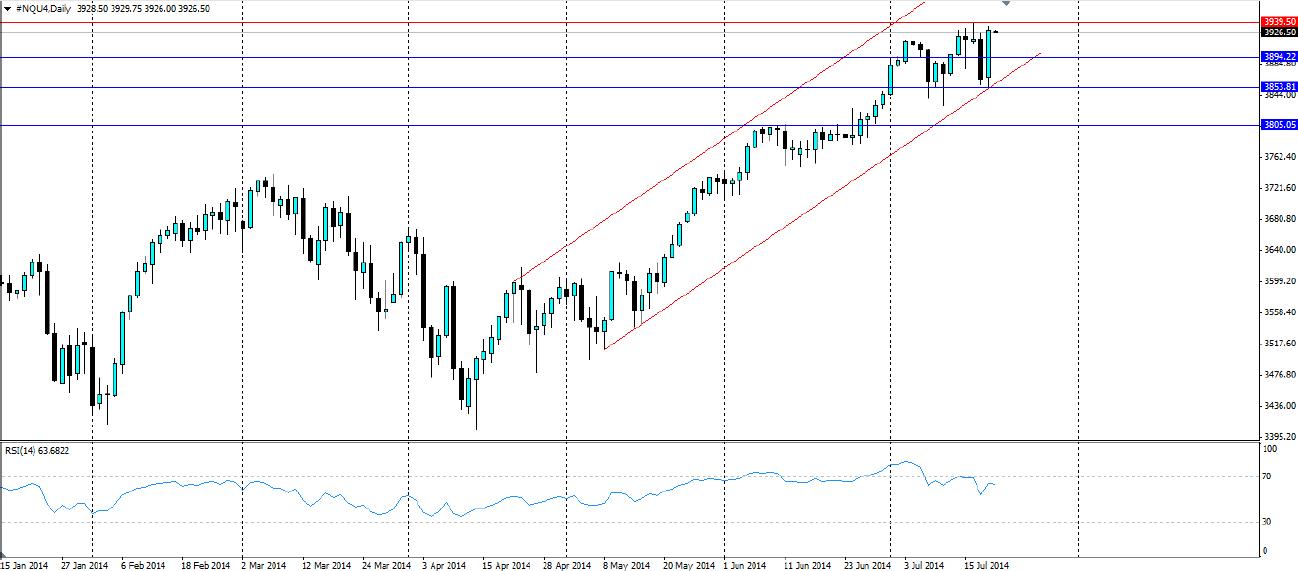

The RSI is showing some interesting divergence. The highs in the price have been higher throughout the month, however the RSI has been posting lower highs. This could signal a reversal in the trend, however, if the resistance at 3939.50 breaks, we should see a strong movement higher and the RSI will no doubt follow.

If the price does move lower, support can be found at 3894.22, 3853.81 and 3805.05, however the trend line is likely to act as dynamic support and could be a pivot point for a reversal and a move higher. Traders looking to follow the trend up should either look for a touch of the trend line, or for the resistance to break at 3939.50 before entering.

The NASDAQ Index recovered from a geopolitical shock at the end of last week and the bullish channel looks quite solid as a result. It will now need to test the resistance at the previous high before the trend can take the index any higher.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.