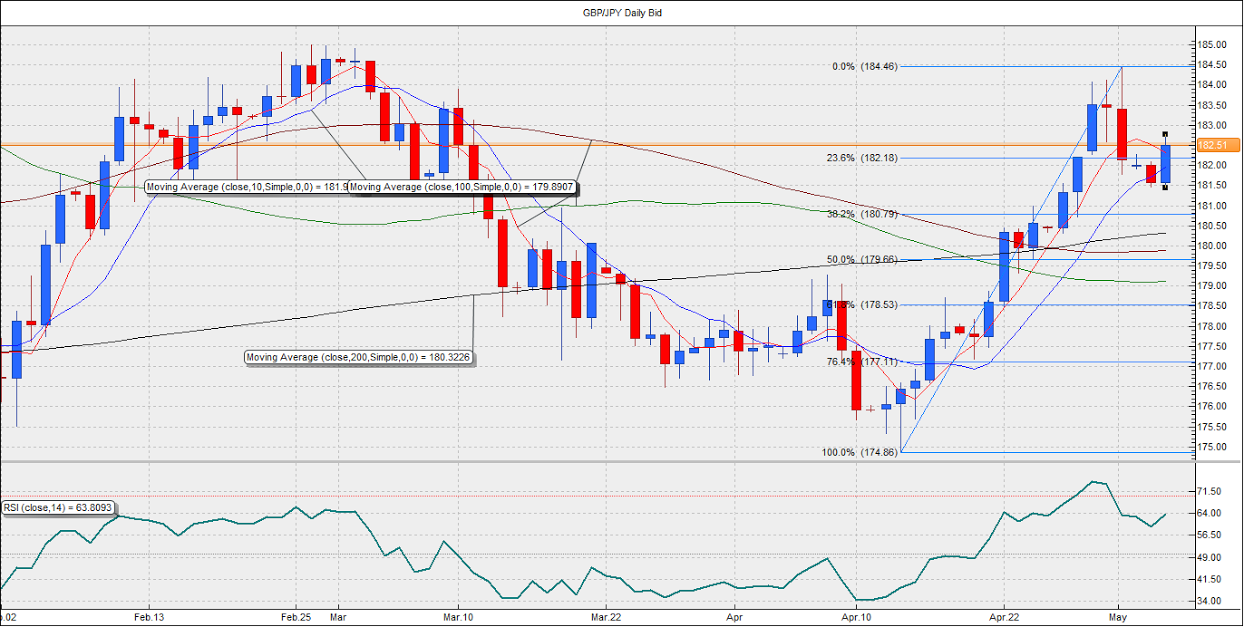

GBP/JPY: 950‐pip rally in two‐weeks

The pair rallied more than 950 pips (174.86‐184.45) in two weeks (mid‐April to May 1st) as the markets ignored the election uncertainty in the UK. The rally was largely a result of a broad based sell‐off in the USD index on account of a slowdown in the first quarter economic growth. However, the USD managed to remain resilient against the Japanese Yen since the 10‐year Treasury yield continued to move higher to clock a seven‐week high today. Consequently, the GBP/JPY pair rose from 174.86 to 184.45.

Focus on UK elections, slowdown in the UK economic activity

Markets now focus on the election uncertainty, which is evident from the weakness in the British Pound. The GBP/JPY pair has weakened to 182.00 levels ahead of the May. 7 elections. The 2015 election is one of the most unpredictable since the main parties – Conservatives and Labor – are running neck to neck in opinion polls.

Back in 2010, the GBP/USD pair had dipped 300‐pips in the week ahead of elections, followed by a 400‐ pip drop on election day, and a further 500‐pip drop in the next two weeks. The pair is down almost 30‐ pips from the high of 1.5490 ahead of elections. Given, the highly unpredictable nature of the elections, we could very well see British Pound emulate its movement back in 2010. Hence, the Pound could continue to extend losses further as we move towards elections.

Meanwhile, we also have UK services PMI data due for release 24 hours ahead of elections. The latest PMI reports – Manufacturing, Construction – both missed the consensus estimate to show a sharp slowdown in the activity. The election uncertainty and a strong GBP/EUR exchange rate were two main reasons cited by the private sector for a slowdown in the activity. The services PMI too is likely to highlight slowdown driven by the same factors. Given the 950 point rally, coupled with election uncertainty, the British Pound looks more vulnerable that ever to an actual services PMI print for April that is weaker than the consensus estimate of 58.5.

On the other hand, the Japanese Yen is likely to remain relatively resilient in case of a broad based rally in the USD index. The Greece bond yields are rising sharply once again; ahead of the May 11 Eurogroup meeting. Markets do no expect any breakthrough deal. However, if the Greek yields continue to rise, then we are likely to see a fall in German yields leading to a drop in the US treasury yields. Thus, the Japanese yen is likely to remain relatively resilient, which reduces the possibility of a sharp rally in GBP/JPY due to broad based Yen sell‐off

GBP/JPY could drop to 180.32. Currently trading at 182.58

The pair could drop to its 200‐DMA located at 180.32 in a week’s time. The daily close below 182.18 (23.6% Fib retracement of 174.86‐186.45) for two consecutive session indicates 184.46 is likely to be a near‐term top in the pair.

After having declined to 181.50 earlier today, the pair has strengthened to 182.77. In case we see a daily close above 182.18 today, another attempt at 183.50 could be seen. However, the pair is likely to be offered on the rise.

A failure to close above 182.18 today could trigger sharp sell‐off on Wednesday and Thursday, shifting risk in favor of the pair falling to the anticipated level of 180.32 before weekend.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.