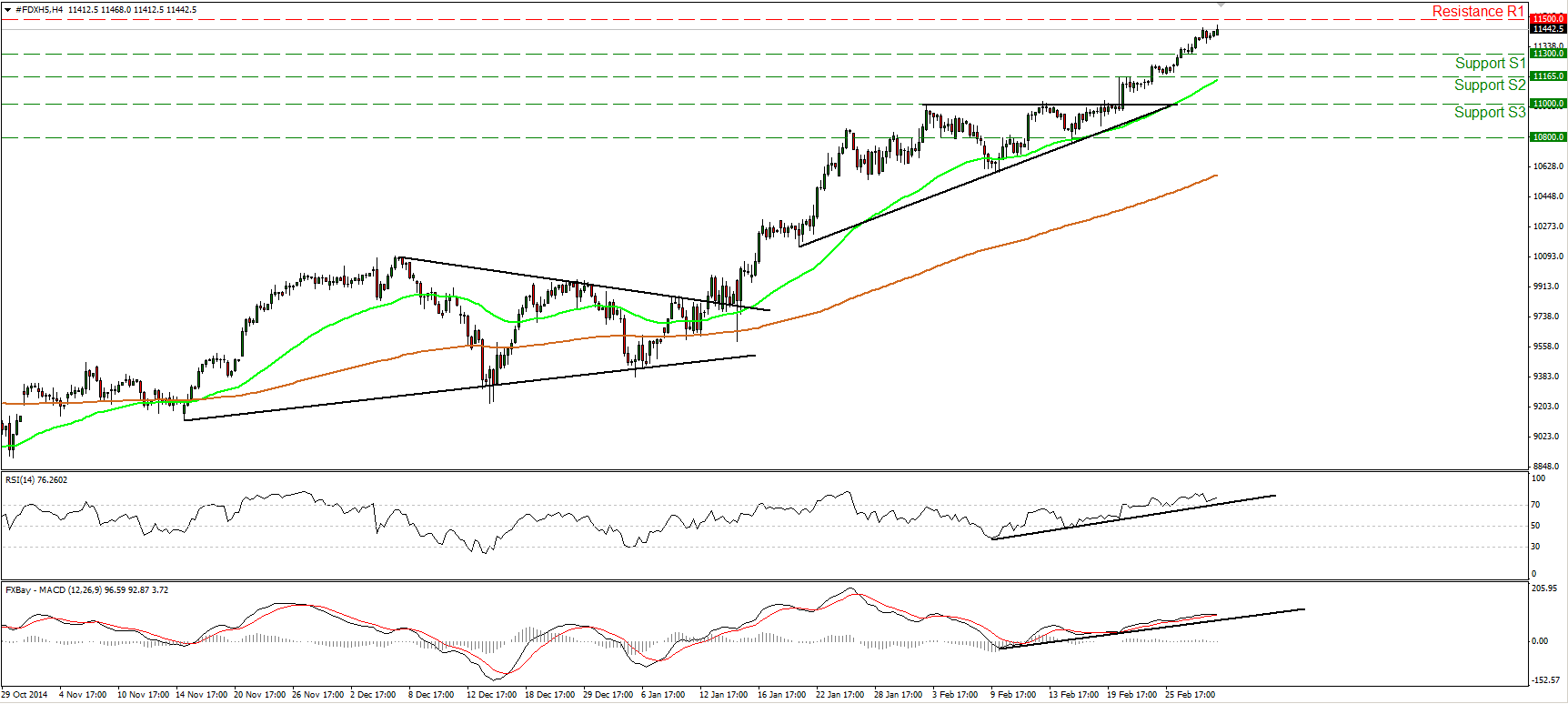

DAX futures

The dollar traded higher against most of its G10 peers during the European morning Tuesday. It was lower against SEK, while it remained unchanged against CAD, JPY and GBP.

The UK construction PMI rose to 60.1 in February, up from 59.1 in January, beating market expectations of a moderate decline to 59.0. As with manufacturing PMI released on Monday, the construction PMI seems to have started 2015 on solid ground and suggests that the UK economy is picking up momentum. If the service-sector PMI, to be released on Wednesday, confirms the improving momentum in Q1, this could strengthen GBP somewhat (particularly against EUR) in the anticipation of strong Q1 GDP growth. I still believe that if EUR/GBP breaks below 0.7230, this will pull the trigger for the 0.7100 zone.

German retail sales rose 2.9% mom in January, an acceleration from +0.6% mom in December, beating forecasts of a deceleration. This was one more piece of encouraging data showing a strong start to the year for German retailers. Low oil prices, the weak euro and low interest rates are among the factors that are likely to support this strength, while risks from Greece and the situation in Ukraine are the potential spoilers of Germany’s recovery. Even though the impact on EUR was limited, the strong German data lifted DAX to a new record level. The recent signs of recovery in the German economy also highlight the good timing of the ECB to announce the QE in January, as it would have faced more resistance inside and outside the Bank otherwise.

DAX futures continued to race higher during the European morning Tuesday to print a new record high at 11468, slightly below the psychological figure of 11500 (R1). The price structure still suggests an uptrend above both the 50- and 200- period moving averages. Both the moving averages are pointing north, adding to the trend’s health. The strength of the trend is also visible in our near-term momentum studies. The RSI stays above 70, pointing up, while the MACD continues higher in its positive field, above its trigger line. As a result, I would expect the index to keep rising and perhaps even break through the psychological barrier of 11500 (R1). Nevertheless, zooming on the 1-hour chart, I see negative divergence between both the hourly oscillators and the price action. This makes me cautious that a minor pull back may occur before the next shoot up.

Support: 11300 (S1), 11165 (S2), 11000 (S3).

Resistance: 11500 (R1) (psychological barrier above the record high).

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.