USD/NOK

The dollar traded unchanged against most of its G10 peers during the European morning Friday, ahead of the US nonfarm payrolls for November. It was higher against NOK, JPY and SEK, in that order, while it was lower only against GBP.

The Swedish krona fell after the country’s industrial production fell short of expectations and disappointed the market. Sweden’s industrial production rose 0.2% mom in October, a turnaround from -1.1% mom in September, but below the forecast of a rise of 0.5% mom. USD/SEK surged approximately 0.30% to find resistance near the 7.560 area. On top of the Riksbank’s recent rate cut to zero and the high possibilities for further stimulus due to the weakening fundamentals, I would expect these to weigh on the currency and increase selling pressure on SEK.

Norway’s industrial production decelerated to +1.4% mom in October, from a downwardly revised +3.6% mom previously, weakening the Norwegian krone. USD/NOK firmed up approximately 1% in the first hour following the release, as it put some pressure on the Norges bank to take action in response to the falling oil prices. Since currently prevailing oil prices could weaken even more, I could see NOK to weaken further.

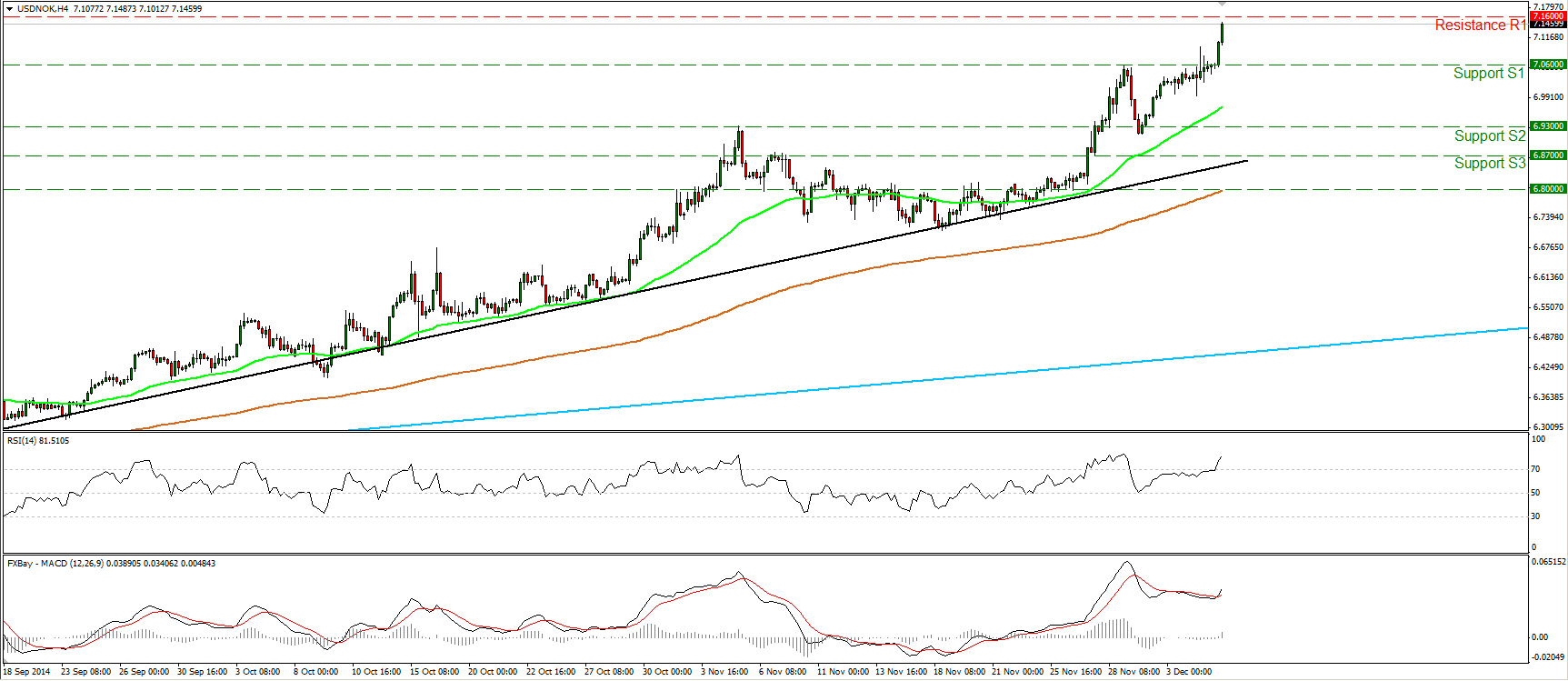

USD/NOK surged on Friday breaking above the resistance (turned into support line) of 7.0600 (S1). At midday in Europe, it is approaching the resistance hurdle of 7.1600 (R1), determined by the highs of the 9th and 10th of March 2009. Taking a look at our short-term momentum studies, I believe that the rate has the necessary momentum to breach that barrier. The RSI moved above its 70 line and is pointing up, while the MACD, already positive, crossed above its trigger line. These signs designate accelerating bullish momentum and enlarge the case for further rise in the close future, in my view. A clear move above the 7.1600 (R1) barrier is likely to pull the trigger for the well-tested zone of 7.3000 (R2). It is worth mentioning that the 7.3000 (R2) area offered strong resistance from October 2008 until March 2009. That area was tested 6 times during the aforementioned period. As long as the rate is trading above the black uptrend line drawn from the low of the 3rd of September, I would consider the near-term picture to remain positive. On the daily chart, USD/NOK stands above the 50- and the 200-day moving averages and well above a longer-term uptrend line taken from back at the low of the 8th of March. This confirms that the overall outlook of the pair is to the upside.

Support: 7.0600 (S1), 6.9300 (S2), 6.8700 (S3) .

Resistance: 7.1600 (R1), 7.3000 (R2), 7.4000 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.