USD/NOK

The dollar traded mixed against its G10 counterparts during the European morning Friday. It was higher against JPY, EUR and CHF, in that order, while it was lower against NZD, AUD and SEK. The greenback was stable vs CAD, NOK and GBP.

The euro depreciated against the dollar after the German retail sales in September disappointed the market and dropped more-than-expected. The various data coming from the country seem to be weak and raise concerns that the German economy is losing steam. On the other hand, Eurozone’s CPI estimate rose +0.4% yoy in October from +0.3% yoy previously, while the unemployment rate for September remained unchanged. The data were in line with the forecasts thus they had limited impact on the single currency. Despite the acceleration in Eurozone’s consumer prices, the weak German data seem to have entrenched the negative sentiment towards the euro. We still expect EUR/USD to challenge once again the key line of 1.2500 in the near future.

The Norwegian krone was resilient even though data showed that the official unemployment rate remained at 2.7% in October. The figure was slightly above the forecast of a decline to 2.6%. The weak labor data, are in line with the rise in the AKU unemployment rate released earlier this week and the drop in retail sales for September. The worse-than-expected data together with the recent fall in oil prices could weigh on the Norwegian economy and weaken the NOK.

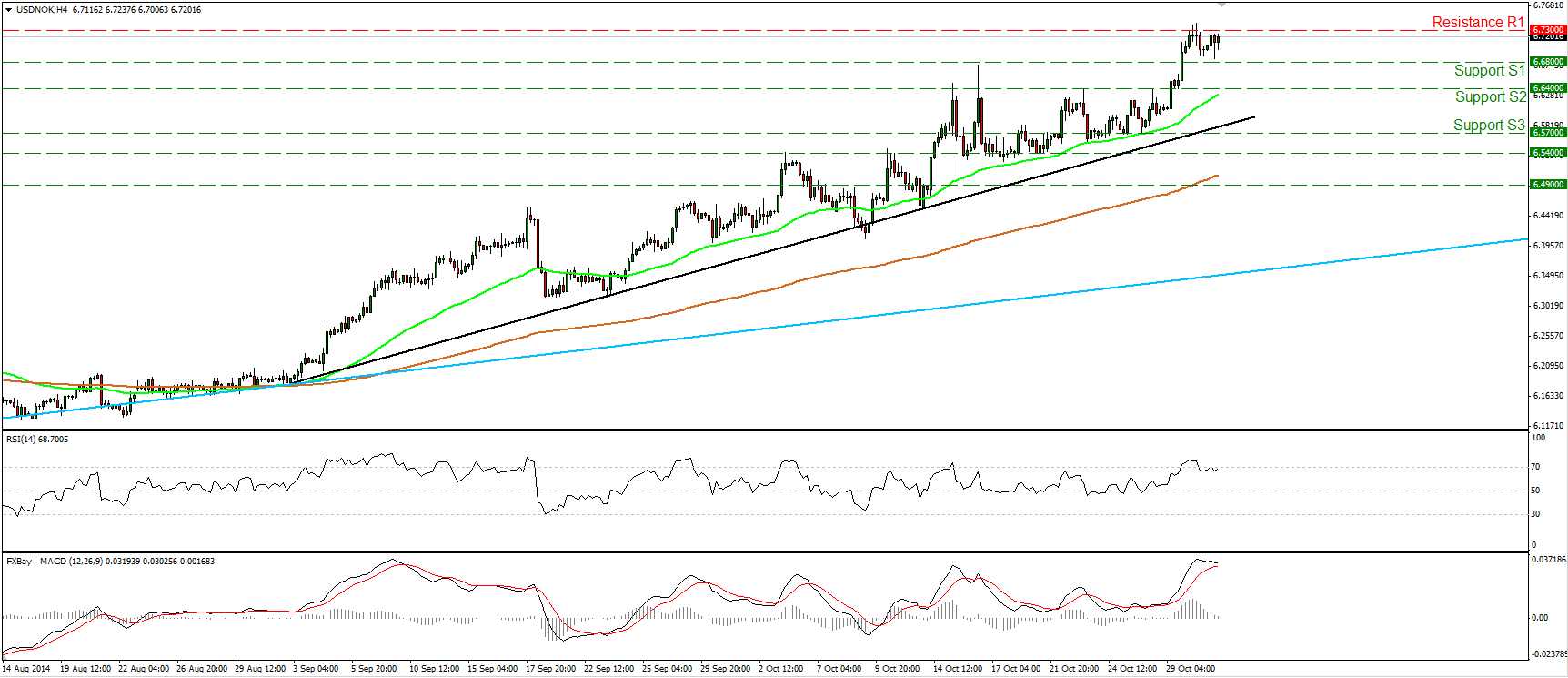

On Wednesday, USD/NOK reached and violated our resistance (turned into support) barrier of 6.6800 (S1), the high of the 16th of October, and on Thursday it found resistance near the high of the 8th of June 2010 at 6.7300 (R1), as expected. Today, the rate moved in a consolidative manner below that barrier, but as long as the price remains above the black uptrend line and above both the 50- and the 200-period moving averages, I would see a positive near-term picture. A clear move above the resistance area of 6.7300 (R1) could set the stage for another up leg, probably towards the 6.8100 (R2) zone, determined by the high of the 28th of April 2009. However, bearing in mind our momentum signs, I would be cautious of a possible pullback before buyers take the reins again. The RSI exited its overbought territory, while the MACD has topped and looks willing to move below its signal line. As for the broader trend, the rate is printing higher highs and higher lows above the light blue longer-term uptrend line (taken from back at the low of the 8th of May). Thus, I would consider the overall path to remain to the upside.

Support: 6.6800 (S1), 6.6400 (S2), 6.5700 (S3)

Resistance: 6.7300 (R1), 6.8100 (R2), 7.000 (R3)

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.