A lot has happened since that fateful October bottom in stocks, which was driven by a multitude of factors namely, market worries over end of Fed QE and escalating casualties from the Ebola virus. But those were only worries and not factual manifestations of data weakness. Today, the extended weakness in the world's biggest buyer of commodities, combined with the erosion of the “Gulf Nations' Put” as well as the decline in EM FX reserves is a de facto tightening from in and capital markets.

Click To Enlarge

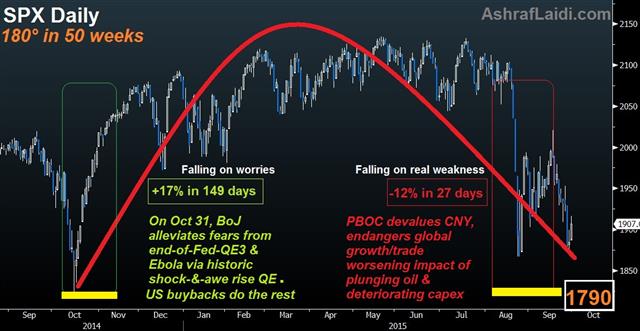

These are only some of the factors, which prompted a 180° downturn since the mid-October lows, dragging the S&P500 down 12% in a mere 27 days, following +17% in as many as 149 days from the October lows to the May highs.

As the market gradually makes its ways back to the October lows, it is important to contrast the situation between now and then.

Greater USD FalloutThe USD may have stabilised against the euro and yen, but in trade-weighted terms, it has gained an additional 14% against most major currencies since October, exacerbating the currency translation effect for US multinationals and increasing the price for US exports in the global market place. The situation is especially ominous when considering surging costs of USD-denominated loans in emerging markets, especially in Asia where the USD has risen 8% against a basket of Asian currencies since October. In China alone, more than $900 bln in USD-denominated debt remain unpaid. Not to mention the IMF warning about surging EM debt.

Nearing DisinflationMost market and survey-based measures of US inflation are lower than in October 2014. Unlike survey-based inflation measures, which are provided monthly, break-even rates priced off US inflation-protected bonds are available daily, with the 2-year BE tumbling near 8-month lows at 0.23% and 5-year BE rates at 1.1%, nearing its 6-year lows. These inflation measures have been criticized for being too sensitive to oil prices. But the Fed now risks being behind the curve in pre-empting deflation as real yields surge.

No Magic from BoJ, ECBTwo weeks after global yields and share prices plummeted in midOctober, the Bank of Japan surprised the world with a rare split 5-4 decision in its policy board to accelerate the monthly purchases of Japanese government bonds so that its holdings increase at an annual pace of 80 trillion yen. Two weeks later, the European Central Bank signalled to markets that quantitative easing and negative interest rates would finally be pursued.

Markets' reaction to these events was a 2-month rally in global shares, which eventually stalled in January 2015 as the New Year gave its first hint of impending deflation.

China Devaluation = Antithesis of ECB, BoJ QEsChina today is far weaker than it has ever been over the last 15 years. Most services and manufacturing surveys indicate a contraction, while exports have declined for the 5th month over the last seven months, driving down currency reserves to two-year lows. Tying the yuan to the rising USD has worsened the situation since October.

Last month's CNY devaluation may have been a slight stimulus for China, but its impact on the rest of the world is the antithesis of QEs from the BoC and ECB. And once again, do not forget the disappearance of the MidEast out after reports that Saudi Arabia's Monetary Authority has withdrawn as much as $70 bn over the past six months. If you thought injections from MidEast and FarEast SWFs were instrumental in stabilizing global markets in 2007-9, then contemplate the reverse effect of these flows as Saudi Arabia and Qatar consider selling (known as restructuring their portfolios) to withstand budget imbalances resulting from falling energy prices.

We expect the October low to be revisited, before it is taken out for the next leg in what will become a bear market.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.