![]()

Some people have been looking for the Fed to hike interest rates to help reignite the dollar rally. Bad news, some fairly basic analysis suggests that the dollar is not that closely related to the Fed’s rate hiking cycles.

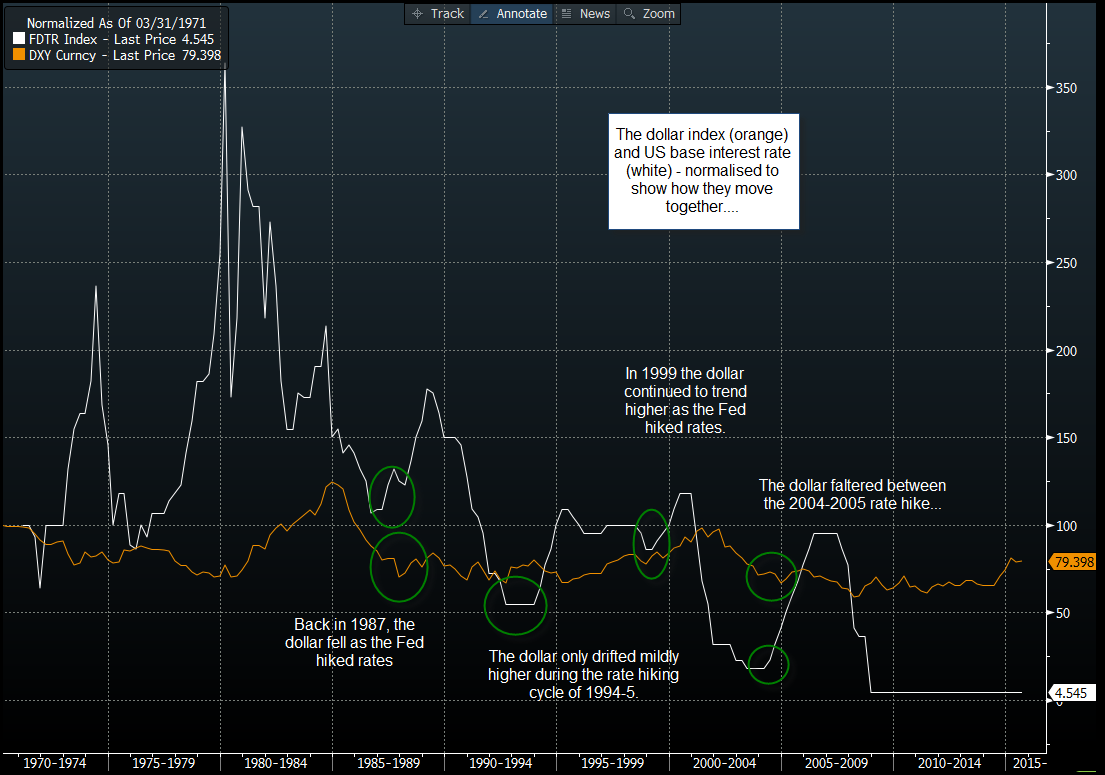

We looked at previous hiking cycles in 1987, 1994, 1999, and 2004, here are the results:

1987: dollar fell in the first few months of hikes.

1994: Dollar drifted sideways, before embarking on a mild upward trend.

1999: the dollar continued with its mild uptrend, which had started before the Fed began raising interest rates.

2004: The dollar fell as the Fed embarked on a rate hiking cycle.

You can see a visual representation of this in the chart below, which shows the dollar index and the US Base rate, this chart has been normalised to show how the two move together.

So what does this mean for traders?

· Do not rely on the Fed to determine the direction of the dollar in the coming months.

· The dollar tends to follow its predominant trend when the Fed starts to hike rates.

· There is no direct link between the Fed hiking rates and the dollar falling, when a weak dollar has coincided with a Fed hiking cycle it has been falling for some time already.

· Due to this, we may see a muted reaction to a potential Fed rate hike next month.

Where could the dollar go this time?

If the Fed does hike rates next month (the jury is still out with only a 50% chance of a hike priced in by the Fed Funds futures market), history tells us not to expect too much of a reaction in the buck. However, because the dollar has rallied into this rate hike, it has been in an uptrend since mid-2014, there is a chance that the buck could rally alongside a Fed rate hiking cycle, although our analysis tells us that this may have little to do with the Fed actually hiking rates.

Figure 1:

Source: Gain Capital, Data: Bloomberg

Recommended Content

Editors’ Picks

EUR/USD turns negative near 1.0760

The sudden bout of strength in the Greenback sponsored the resurgence of the selling pressure in the risk complex, dragging EUR/USD to the area of daily lows near 1.0760.

GBP/USD comes under pressure and challenges 1.2500

GBP/USD now rapidly loses momentum and gives away initial gains, returning to the 1.2500 region on the back of the strong comeback of the US Dollar.

Gold retreats from highs on stronger Dollar, yields

XAU/USD trims part of its initial advance in response to the jump in the Dollar's buying interest and the re-emergence of the upside pressure in US yields.

XRP tests support at $0.50 as Ripple joins alliance to work on blockchain recovery

XRP trades around $0.5174 early on Friday, wiping out gains from earlier in the week, as Ripple announced it has joined an alliance to support digital asset recovery alongside Hedera and the Algorand Foundation.

Week ahead – US inflation numbers to shake Fed rate cut bets

Fed rate-cut speculators rest hopes on US inflation data. After dovish BoE, pound traders turn to UK job numbers. Will a strong labor market convince the RBA to hike? More Chinese data on tap amid signs of slow Q2 start.