![]()

The positive feelings for Greece that started in early North American trade today continued throughout the second half of trade as the euro gained ground and the USD was the biggest loser. If the insinuation made by an anonymous Greek government official that an agreement between Greece and her debtors is indeed “very close”, EUR positivity may extend in to the weekend and continue to weigh on the USD as well. However, as we all are extremely familiar with by now, negotiations with Greece rarely proceed without at least some sort of intrigue, and those good feelings can turn bad in a hurry.

The unfortunate thing about the kind of Eurogroup meetings that will be going on tomorrow is that most of the news is transmitted via officials who say something to the press. This is one of the rare circumstances where the Second Undersecretary of Seed Development in Kerplakistan (or “anonymous source”) can move the EUR substantially in either direction. Therefore, much like that little catch-all thing at the bottom of your propane grill, you may want to avoid that grease trap; let someone else deal with it.

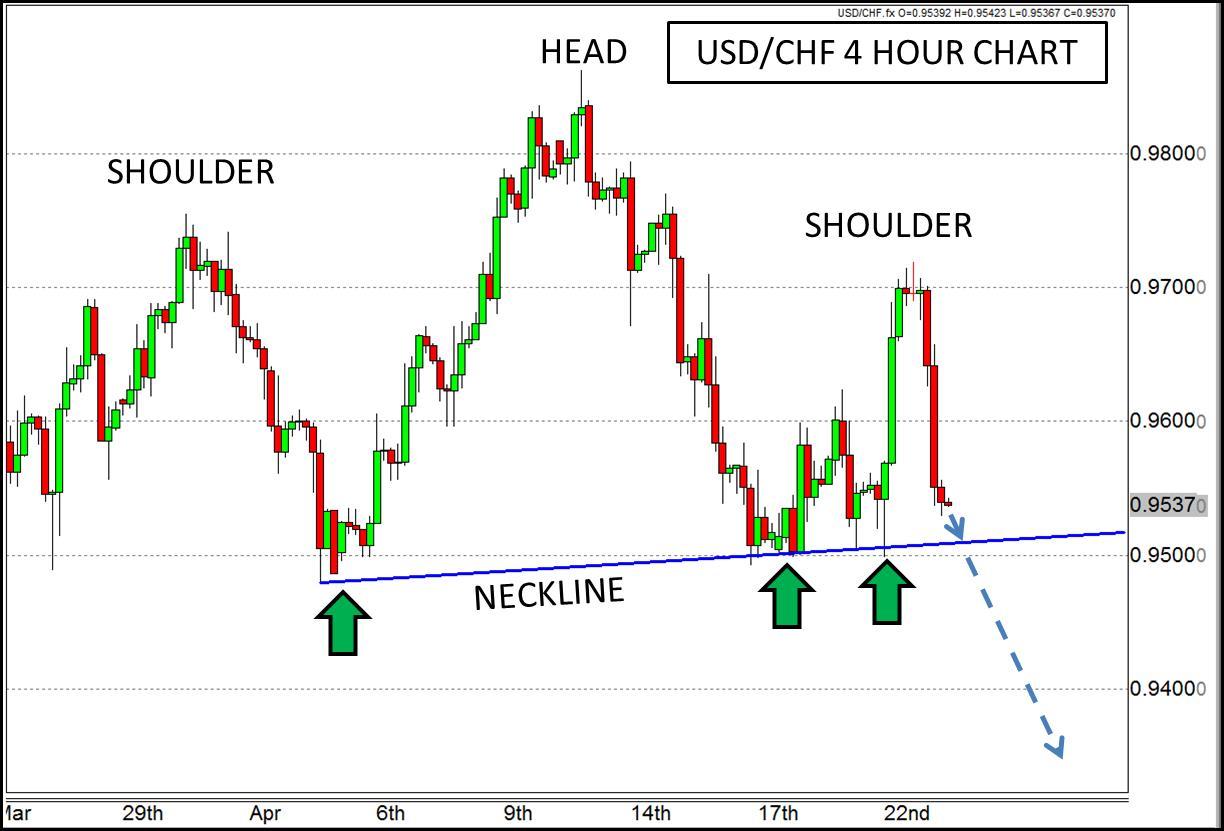

One attempt to avoid it could be in the USD/CHF which is currently carving out a Head and Shoulders pattern. If you were so inclined, you could make an argument that trading the USD/CHF to avoid the EUR is a bit shortsighted since the EUR/USD and the USD/CHF are essentially mirror images of one another, but I would counter that the previously correlated currency pairs aren’t as correlated after the Swiss National Bank dropped the peg in the EUR/CHF. The correlation is still there, to a degree, but it isn’t as pronounced as it used to be and the actions of the Eurogroup tomorrow may supersede that tendency.

A break below the neckline on this pair, near 0.95, could continue the USD weakening action we have seen in many of the major currency pairs over the last week. If the neckline were to give way, substantial support may not be found again until an area of previous support near 0.9350 which also corresponds with the 161.8% Fibonacci extension of the neckline to right shoulder.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.