![]()

Just less than a week ago, the outlook for global stock markets was looking somewhat bleak. Caution ahead of the US earnings season and concerns about the health of Portuguese banks had caused the major stock indices, especially in Europe, to fall sharply. But we have since witnessed a strong recovery, mainly because of the fact that the main US banks have reported surprisingly good quarterly earnings results. As a result, the Dow has rallied to a fresh all-time high while in Europe the FTSE has been among the top performers.

In the UK, sentiment has partly been boosted by M&A talks concerning drug makers Shire and AbbVie, and aerospace manufacturers Meggitt with United Technologies. The share price of Shire has risen strongly in recent days while Meggitt is leading the FTSE with a gain of about 10% today. Meanwhile EasyJet is more than 5% higher after Goldman Sachs said the budget airline’s shares may rise about 60 percent.

The UK index has been lent additional buoyancy by stronger Chinese data overnight. The world’s second largest economy expanded at an annualised pace of 7.5% in the second quarter, up from 7.4% in the first three months of the year. Industrial Production grew by an annualised pace of 9.2% in June, topping expectations of 9% and also May’s reading of 8.8%. As a result, commodity-linked stocks have gained, though with the exception of some precious metal miners due to the weaker gold and silver prices.

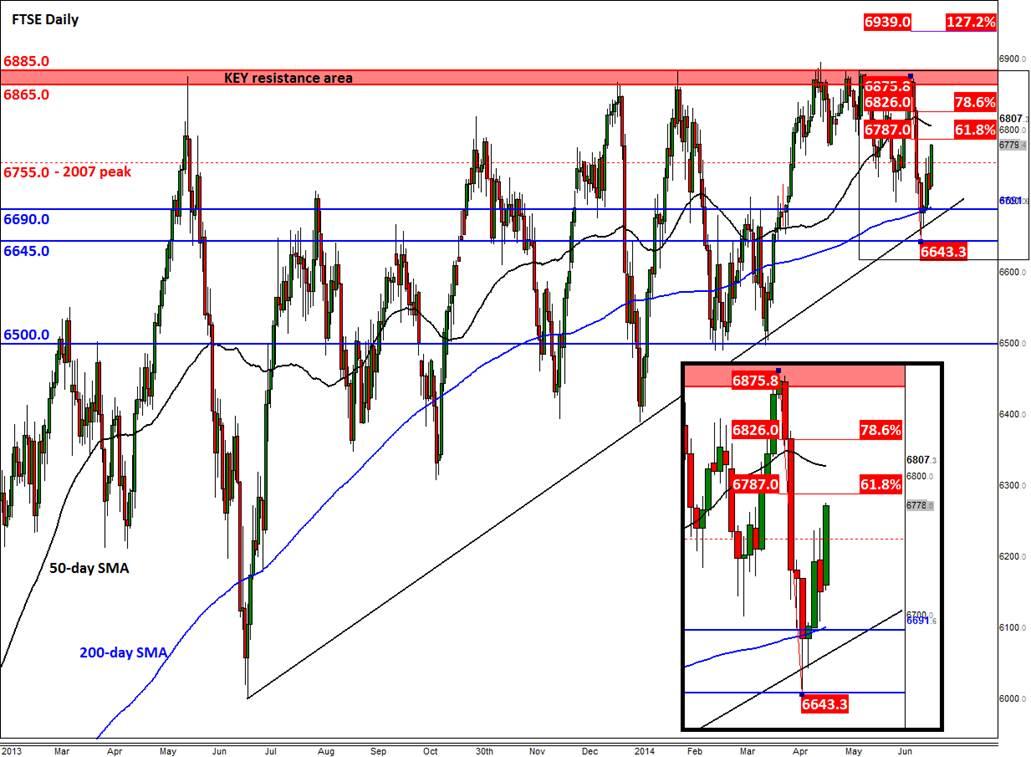

As we reported on Thursday, the FTSE has also taken a technical rebound after it found strong support at 6645 – a level which ties in with a medium-term bullish trendline. As a result, the index has made back more than half of the losses it suffered since the start of the month. At the time of this writing, it was testing the 61.8% Fibonacci retracement level at 6885/90. This comes in around 15 points ahead of the 50-day moving average at 6805/10. Although the index is already more than 1% higher, the index could extend its gains once US traders come into play. As before, the key resistance area remains around 6865/85 where it has struggled for more than a year now. A close above there is needed if we are to finally see gains similar to those witnessed in the US.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.