![]()

Brent crude oil closed sharply lower on Friday as it extended its losses for a third straight week. Oil prices were driven lower mainly because the conflicts in Iraq did not have any actual impact on supply, while in Libya the government resumed control of two major oil terminals that were occupied by the rebels for several months. Today however the London-based oil contract is a touch higher, probably supported by fresh concerns over oil supply in the Middle East and North Africa (MEN) regions. In Libya, fresh violence erupted over the weekend where two militant groups fought over Tripoli airport and the eastern oil port of Brega has been closed. In Iraq, the Kurds took control of oil production in the north while in Iran the Deputy Foreign Minister said that if talks to reach agreement with the world powers over Tehran’s nuclear programme collapsed, the country would resume enriching uranium. Meanwhile the Israeli-Palestine conflicts have continued for a seventh day, though the effect of this is likely to be minimal if any on oil prices. Given that the three-week drop has taken the price of Brent oil below the levels it was trading before the situation in Iraq caused it to spike, there’s a possibility that the selling may have been overdone and that some gains could be on the way, perhaps as early as this week.

Meanwhile the focus may turn to demand side of things as we have important data coming up, especially from China where the second quarter GDP estimate and the latest industrial production number could help provide some clues about consumption. On top of this, some of the leading oil watchdogs last week predicted that growth in oil demand would accelerate next year. While the OPEC expects global oil demand would rise by a conservative 1.21 million barrels per day (mb/d) in 2015, the International Energy Agency (IEA) thinks it would actually be 1.4 mb/d. Both groups think non-OECD countries would drive growth in demand. In terms of supply, both see continued growth in non-OPEC production at rates of 1.31 mb/d and 1.2 mb/d, respectively. If the IEA is correct, the growth of non-OPEC supply would be less than demand, meaning the OPEC would have to make up the difference of 200,000 b/d. Given that the supply side risks are high, especially in the MENA regions, Brent oil may have to rise to a new equilibrium price in order to match supply with demand.

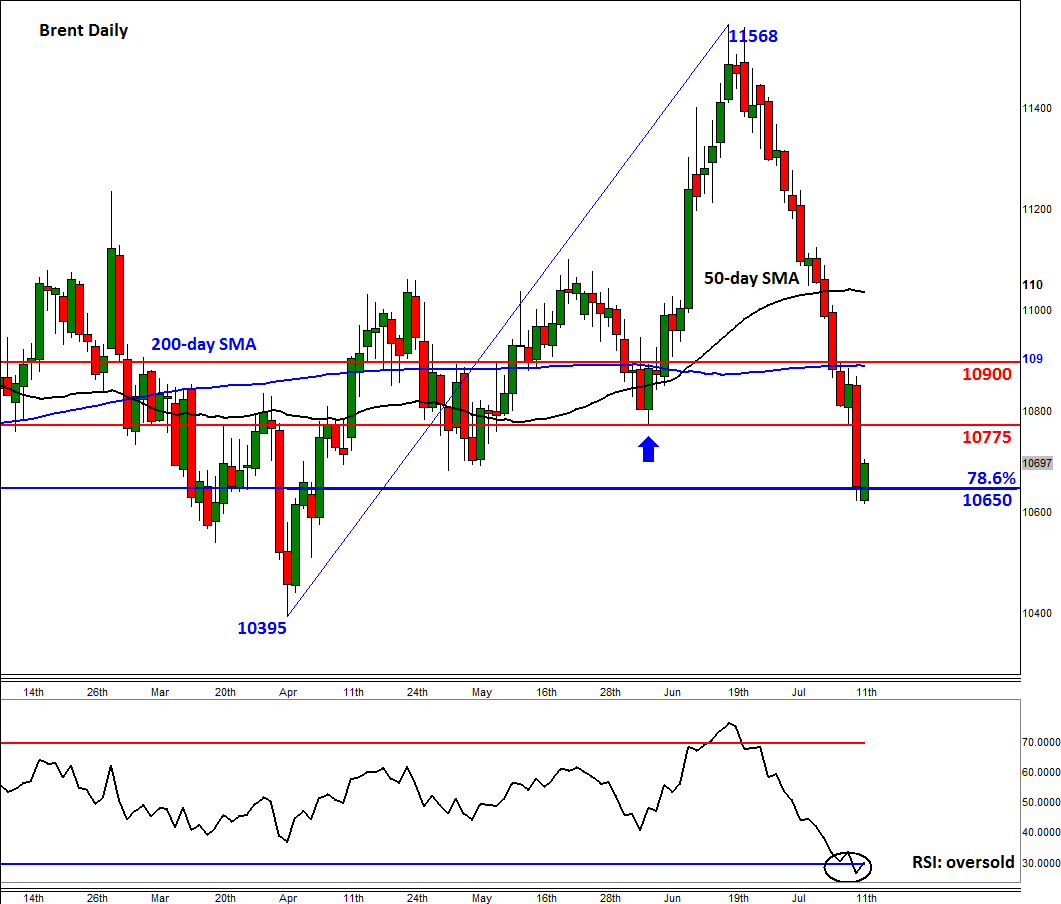

In the short-term, the technicals suggest a possible bounce back in the price of Brent. The RSI for one is at the oversold territory of 30. On top of this, Brent is testing a long-term bullish trend line around $106.50, a level which also ties in with the 78.6% Fibonacci retracement of the upswing from the April low. The short-term resistance level it now needs to break above is around $107.75, which was previously support. The key level is just shy of $109.00 where resistance meets the 200-day moving average. Meanwhile if it were to break further lower from here then a move towards $104.00 and possibly $100.00 could be on the cards over the coming weeks.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.