Commodity dollars continue to crumble

No major support in NZDUSD until 0.58

USDJPY could be preparing to break bearish

Key FX developments today:

The USD traded mixed, travelling sideways to weaker against the rest of the G4 currencies but pulling stronger against the very feeble commodity dollars. In this shece, tge kiwi slipped to new lows for the cycle against the US dollar and the AUD was also weak ahead of tonight's European Central Bank meeting.

The NOK and SEK were likewise weak as the market rewarded the most liquid currencies and punished the least liquid among the G10 amid weak risk appetite . Trading ranges for the day, however, were relatively modest t relative to the bigger bouts of volatility seen last week.

It was a quiet day with few developments worth noting on top of the "notes of interest" in the FX Board PDF.

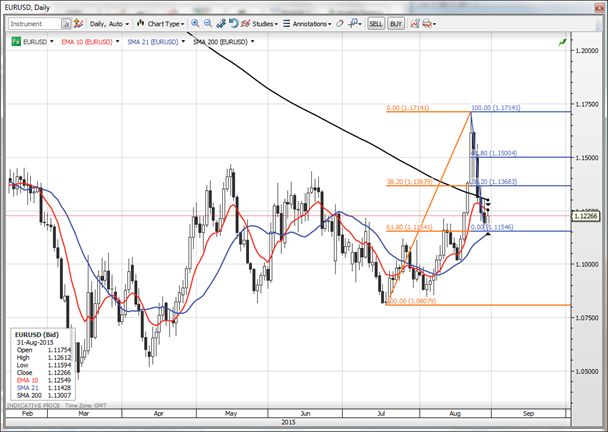

Charts: EURUSD

Note that rather than focusing on the flat line level in EURUSD, the market fixated instead on the 61.8% Fibonacci retracement for support on Friday near 1.1155. The resistance now is perhaps at 1.1300 near the 200-day moving average, though the Fibonacci retracement of the selloff wave is perhaps a more credible resistance level, starting with 1.1370, but particularly the 61.8% at 1.1500.

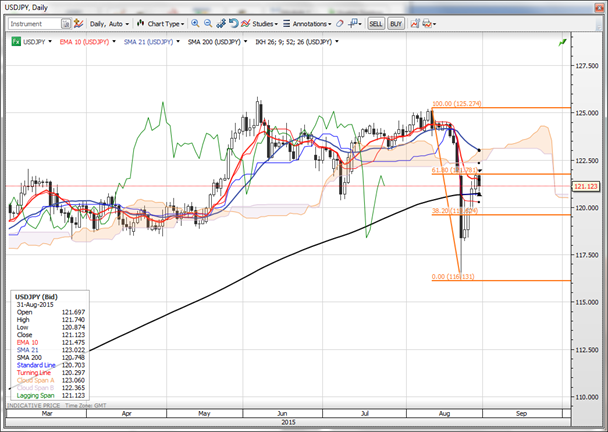

Charts: USDJPY

As with EURUSD, USDJPY seems to be focusing on the classic 61.8% Fibonacci retracement that is common at major trend breaks. So this makes 121.80 the local focus, and then the 122.50-area Ichimoku cloud if risk appetite continues to mount a comeback.

But the level of damage inflicted by the recent selloff may leave us trendless at best and at risk of a second major bear wave (for a three-wave correction) if market confidence fails to return.

Such a move might focus on 112.60 if we have found a local top already on this bounce (and if we use a 100% projection of the first down wave).

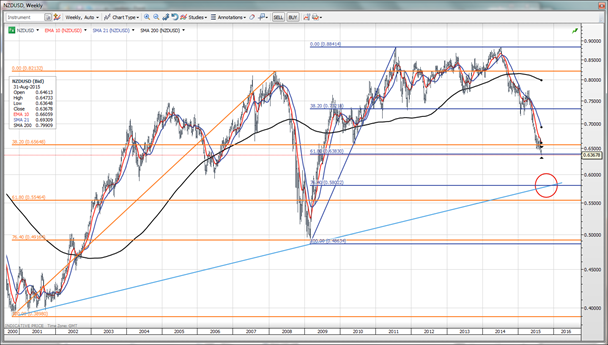

Charts: NZDUSD

NZDUSD has slipped to new lows for the cycle with few points on the open white space below offering notable support, particularly if risk appetite sours further.

The next Fibonacci level of note here is the 76.4% of the huge wave from the global financial crisis lows coming in at around 0.5800. Note that this was the level that found support back in early 2009 and also coincides more or less with the rising trendline in a few months.

- The author(s) and Saxo Capital Markets HK Limited are not responsible for and not liable to any loss arising from any investment based on any recommendation, forecast or any other information contained herein. The contents of this publication should not be construed as an express or implied promise, guarantee or implication by Saxo Capital Markets that clients will profit from the strategies herein or that losses in connection therewith can or will be limited. Trades in accordance with the recommendations in an analysis, especially in leveraged investments such as foreign exchange trading and investment in derivatives, can be very speculative and may result in losses as well as profits, in particular if the conditions mentioned in the analysis do not occur as anticipated. Investors should carefully consider their financial situation and consult their professional advisors as to the suitability of their situation prior to making any investments.

- Risk warning: Leveraged investments in foreign exchange or derivatives carry a high degree of risk and may result in significant gains or losses. You should carefully consider your financial situation and consult your independent financial advisors as to the suitability of your situation prior to making any investments.

Saxo Capital Markets HK Limited holds a Type 1 Regulated Activity (Dealing in securities); Type 2 Regulated Activity (Dealing in Futures Contract) and Type 3 Regulated Activity (Leveraged foreign exchange trading) licenses (CE No. AVD061) issued by the Securities and Futures Commission of Hong Kong.

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

EUR/USD grapples with higher ground as Fed cuts weigh on Greenback

EUR/USD found the high end on Thursday, holding fast to the 1.1150 level, though most of the pair’s bullish momentum comes from a broad-market selloff in the Greenback rather than any particular bullish fix in the Euro.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.