Introduction

The Nikkei 225 index followed suit after stock indices fell across the board, driven by a decline in European banking equities with heightened talk of the problems in Greece REARING once again. WTI crude oil futures are trading heavily at around the US$30 mark amidst relatively low liquidity and nervous times.

Asian Session

EUR/USD has traded above 1.1200 overnight with the risk-off sentiment driving USD/JPY to a low of 114.21. It also comes as no surprise that gold and CHF were paid up as the scurry for safe-haven assets took place.

In Australia, business confidence data proved largely in line with expectations. Antipodean currencies trade lower against USD with CAD following suit too.

The British Retail Consortium printed a positive retail sales figure overnight. Cable trades right now above the 1.4400 level whilst the US dollar index stands close top lows so far for the year at 96.73.

The day ahead in Europe and NY

A lack of real data and liquidity will inevitably lead to market attitude being the main driving force today. In Switzerland, unemployment data has already been released and proved in line with expectations. Industrial production data and trade balance figures for Germany have recently been published too and pulled EUR lower.

Trade balance info. will print out of London at 09:30 GMT today. EUR/GBP reached a high for the year of .7757 today. Later in the states, a string of data containing only tepid importance will take be released. The weekly crude oil stock data will be a focus when released at 21:30 GMT today.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1182 | -0.10% | 1.1238 | 1.1178 |

| USDJPY | 115.34 | -0.43% | 115.85 | 114.21 |

| GBPUSD | 1.4459 | 0.19% | 1.4462 | 1.4391 |

| AUDUSD | 0.7061 | -0.37% | 0.7088 | 0.7019 |

| NZDUSD | 0.6619 | -0.12% | 0.6629 | 0.6576 |

| EURCHF | 1.102 | 0.25% | 1.1056 | 1.1011 |

| USDCAD | 1.3908 | 0.14% | 1.3961 | 1.3892 |

| USDCNH | 6.5766 | 0.06% | 6.5825 | 6.5699 |

FXO

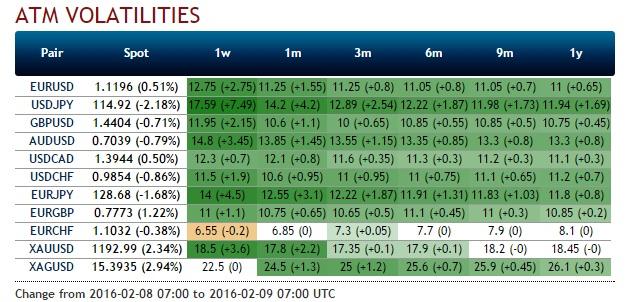

Volatility is higher than may be expected when a look at certain major currencies such as EUR/USD is taken. The one month straddle trades at a volatility of 11.3% which is a high for volatility in this space for the year so far.

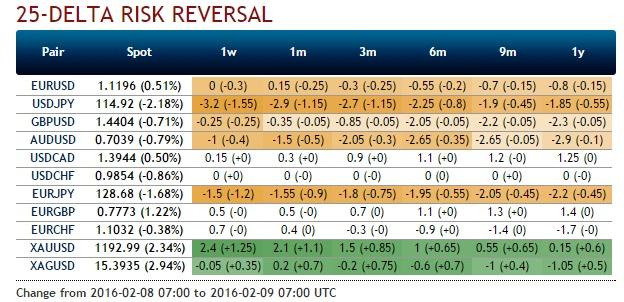

Low liquidity is leading curves to move quite dramatically in the currency options space. The USD/JPY one month 25-delta risk re3versalhas moved from a volatility differential of 1.5% to close to 3.0% today, favouring the downside.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD remains on the defensive near 1.0680 on Dollar strength

The solid performance of the Greenback keeps the price action in the risk-associated universe depressed so far on turnaround Tuesday, sending EUR/USD to multi-day lows in the 1.0680 region.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.