Talking Points:

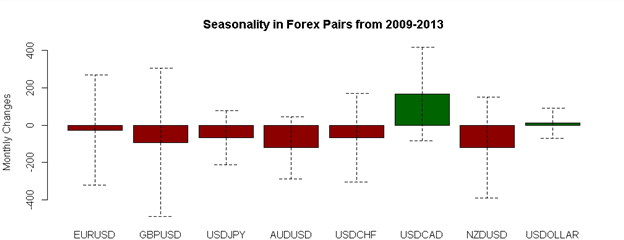

August offers pause in stretch of four out of five months of weakness for US Dollar over the past 5 years.

Commodity currencies look to underperform – August has been weak for AUD, CAD, and NZD.

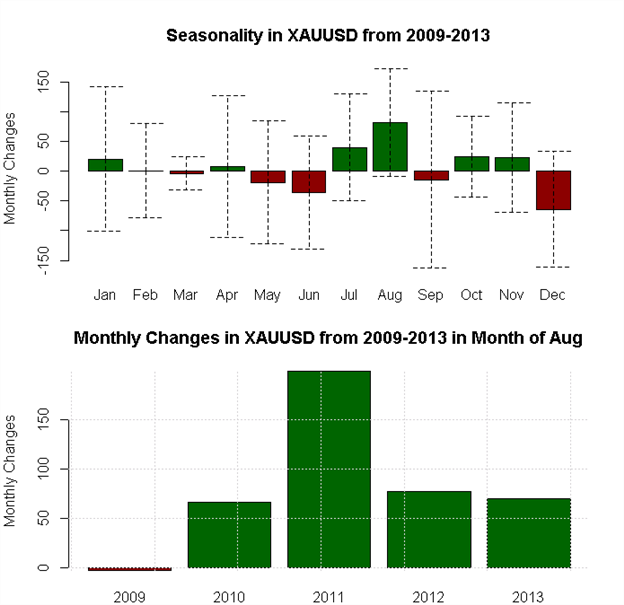

Precious metals best two months of the year are July and August in QE era.

See the full rundown of seasonal patterns broken down by currency pairs below, and to receive reports from this analyst, sign up for Christopher’s distribution list.

The beginning of the month warrants a review of the seasonal patterns that have influenced forex markets over the past several years. In our previous study, we decided to once again focus only on recent performance during the QE era of central bank policies (2009-present), and it revealed the market’s bias for a weaker US Dollar in July across the board.

While the seasonality forecast may have been on track through the first three weeks of July, the historical pattern was blown away after July 24. Not only did the US Dollar surge across the board in direct contradiction to the 5-year study, the commodity currencies, the purported leaders of the buck’s demise midyear, were the worst performers. In this sense, recent history could not have been a worse guide.

Despite the recent miss, we continue to focus on the 5-year horizon in consideration of the studies for April, May, and June versus the 20-year seasonal studies conducted for February and March. We still recognize and accept that the small sample size is not ideal, as well as the notion that there is increased statistical stability with using longer time periods.

However, because of the specific uniqueness of the past 5 years relative to any other time period in market history – the era of quantitative easing – we’ve elected to attempt to increase the stability of the estimates with the shorter time period.

In the QE era (which appears to be winding down now that the Federal Reserve has cut QE3 to $25B/month), August has proven to be a contra-trend month for the US Dollar. For your consideration, August offers pause during a stretch in which the US Dollar has lost ground in four of five months on a seasonal basis.

After the US Dollar’s broad outperformance in July (5-year seasonality called for the second weakest month of the year for the greenback), it is possible that a bullishly augmented technical picture boosts the profile of only a seasonally weak positive month. Viewed in this perspective, the commodity currencies (AUD, NZD, and CAD) look most vulnerable after their disappointing end to last month.

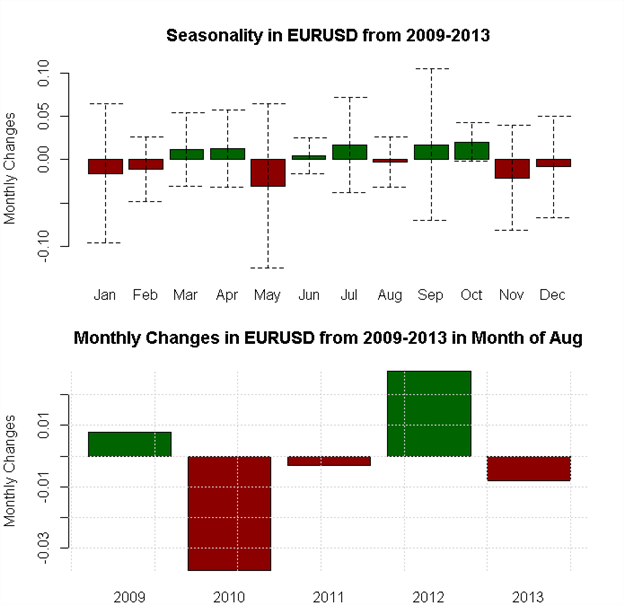

Forex Seasonality in the Euro

Seasonality tends to favor a barely weaker Euro in August. Historically, volatility has shrunk to about half of July’s range. The seasonal outlook is neutral EURUSD.

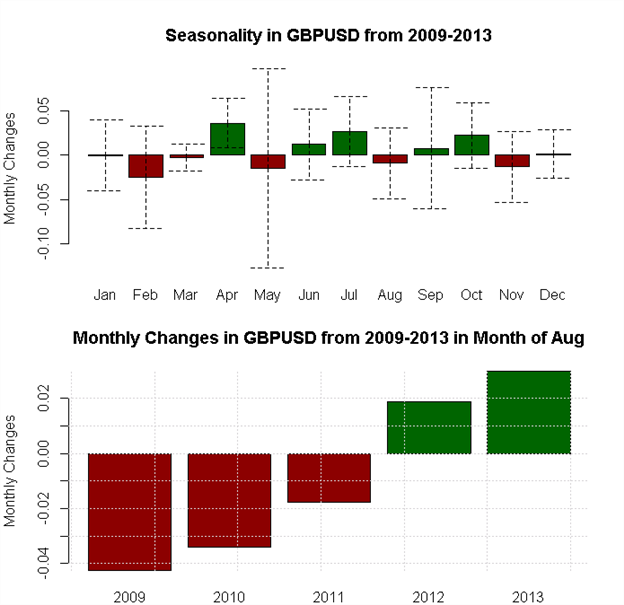

Forex Seasonality in the British Pound

Seasonality tends to favor a barely weaker British Pound. GBPUSD has rallied in August each of the past two years, while the prior three years were each negative. The outlook is neutral, and we would expect volatility to pick up towards month end.

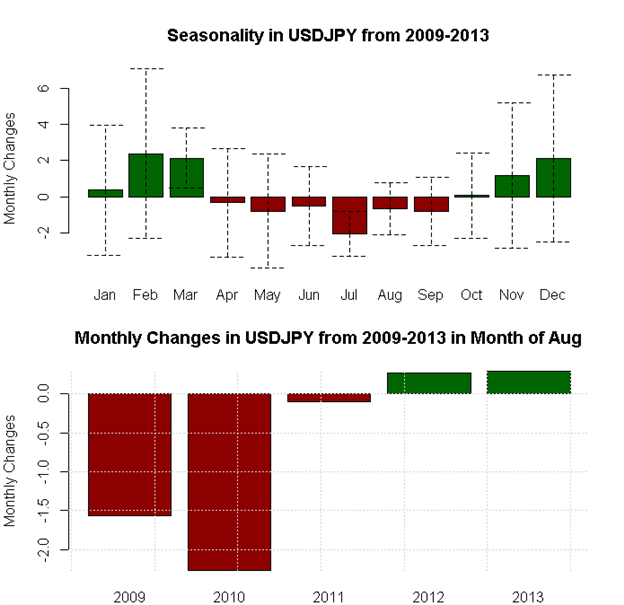

Forex Seasonality in the Japanese Yen

Seasonal outlook leans bullish for Japanese Yen (weaker USDJPY) although the data population is quite volatile. Outsized losses in 2009 and 2010 skew the 5-year average towards a stronger Yen than the 2011-2013 average would indicate. The August seasonality forecast is thus neutral, especially in context of USDJPY rallying in July – the supposed worst month of the year for USDJPY.

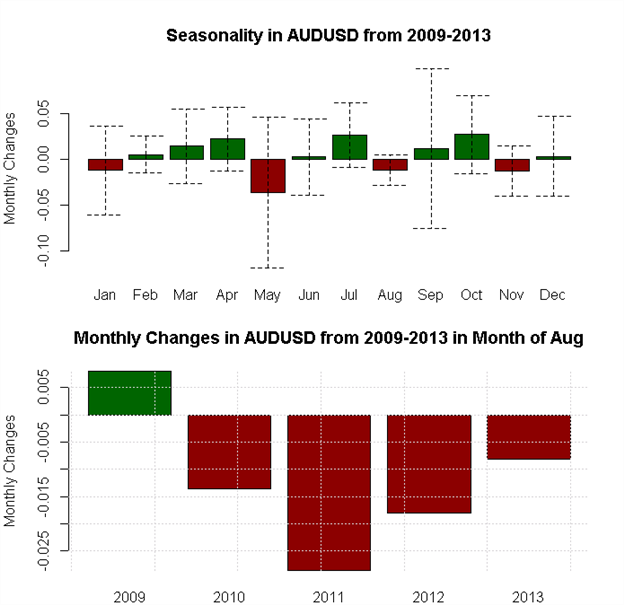

Forex Seasonality in the Australian Dollar

Seasonality favors a weaker Australian Dollar in August. AU DUSD has sold off each of the past four Augusts, despite volatility historically being at a low point for the year. Recent weakness seen in AUDUSD at the end of July (historically a strong month for AUDUSD) primes the market for more losses in August (first seasonally bearish month since May, last one until November).

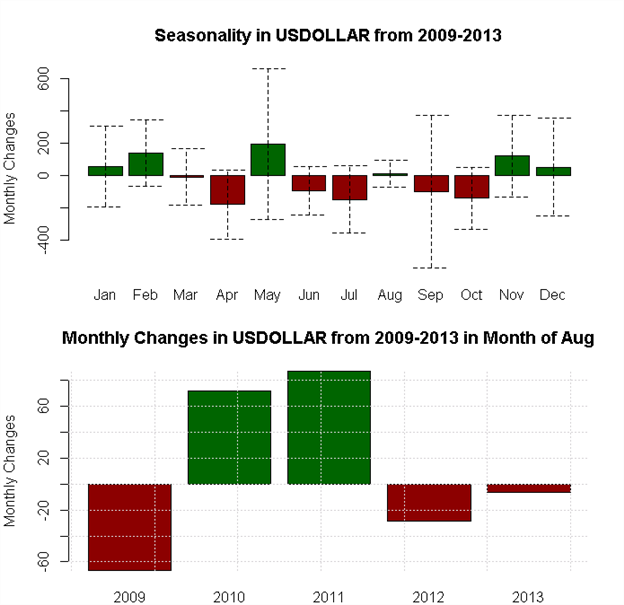

Forex Seasonality in the USDOLLAR

As an amalgamation of the Australian Dollar, British Pound, Euro, and Japanese Yen, the USDOLLAR Index serves as a proxy for the US Dollar more broadly. Historically, the US Dollar tends to hold flat in August (barely negative each of the past two years, outsized gains in 2010 and 2011, outsized loss in 2009).

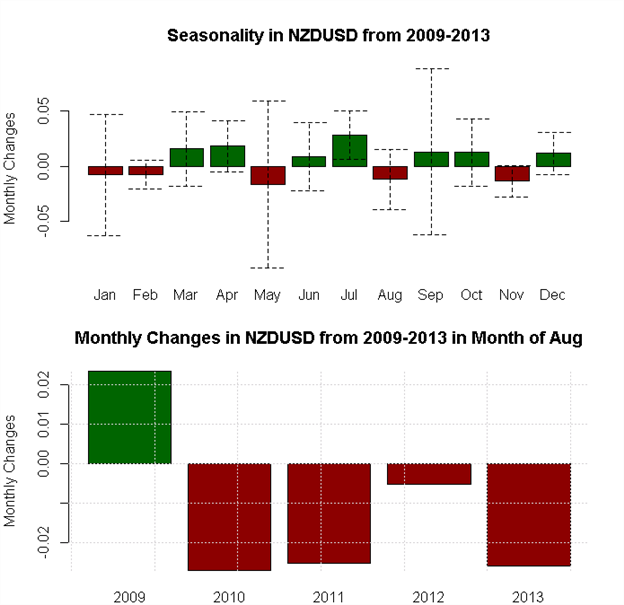

Forex Seasonality in the New Zealand Dollar

Seasonality favors a weaker New Zealand Dollar in August. NZDUSD has sold off each of the past four Augusts. Recent weakness seen in NZDUSD at the end of July (historically a strong month for NSUSD) primes the market for more losses in August (first seasonally bearish month since May, last one until November).

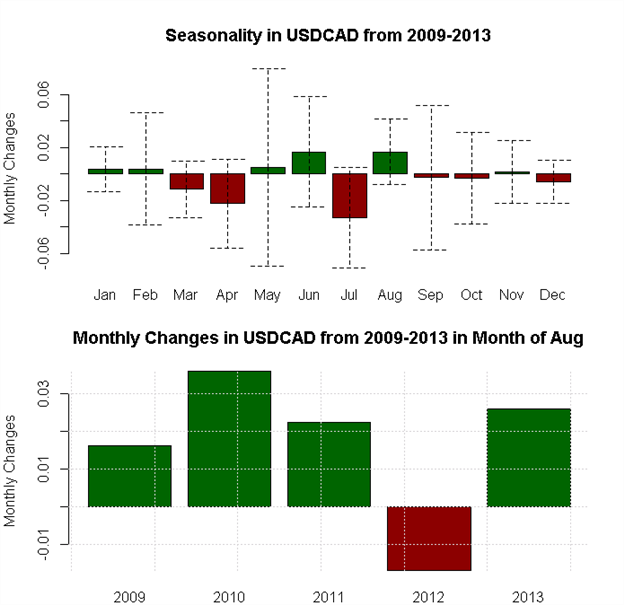

Forex Seasonality in the Canadian Dollar

Seasonality tends to favor a weaker Canadian Dollar (stronger USDCAD) in August. Gains in USDCAD have been common in August, with four of the past five years producing gains. The seasonal outlook is bullish.

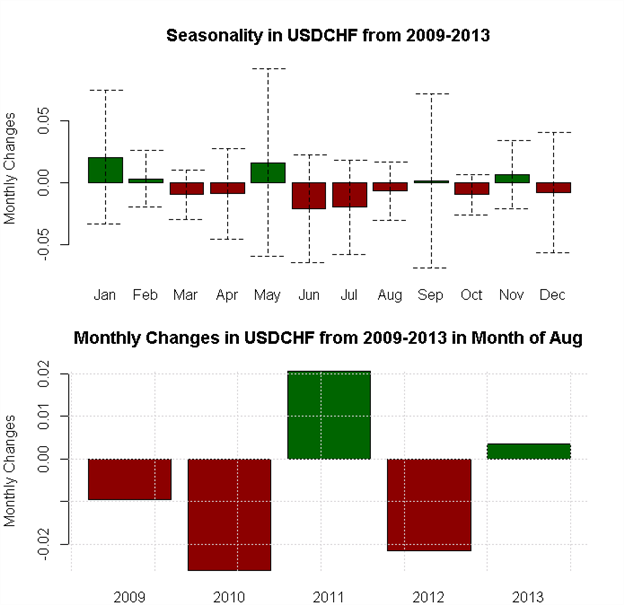

Forex Seasonality in the Swiss Franc

Seasonality favors a weaker USDCHF in August. Results have flipped between gains and losses each of the past four years, leaving the average decidely neutral. The seasonal outlook is bearish USDCHF, even as one of the lowest volatiltiy months of the year sets in.

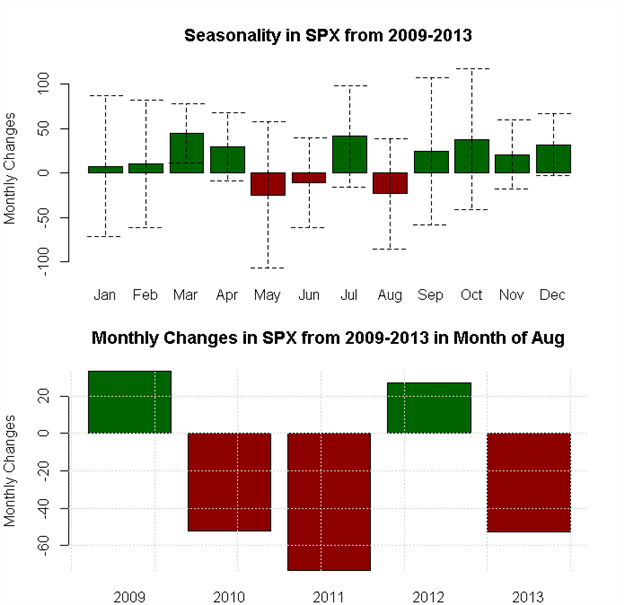

Seasonality in the US S&P 500 Index

The S&P has shown a tendency to pull back in August and show increased volatiltiy. The seasonal outlook is bearish, as the market enters August having lost ground in four of the past five years.

Seasonality in Gold (XAUUSD)

Gold has shown a stronger tendency to advance in August. Notably, the only loss occurred in 2009. Seasonal outlook is bullish as precious metals enter the second half of their best two-month stretch of the year.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.