Analysis for December 15th, 2014

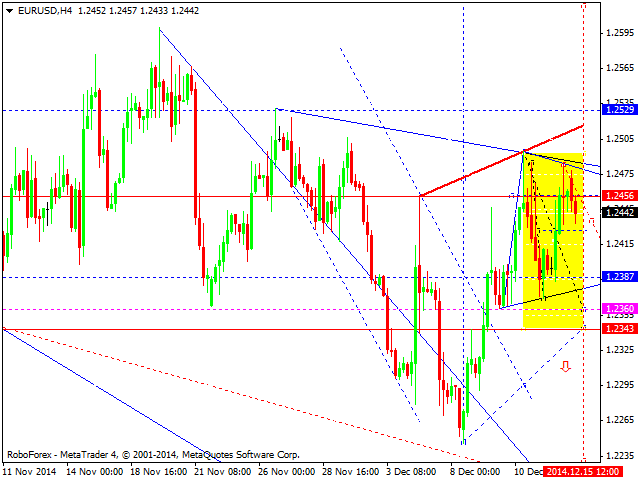

EURUSD, “Euro vs US Dollar”

The market was opened with a gap up today. Eurodollar is trying to continue its ascending movement, but hasn’t been able to stay above level of 1.2456. This descending movement may be considered as a wave towards level of 1.2360; while moving downwards, the pair may form triangle consolidation pattern. We think, today the price may continue forming this pattern. If later the price breaks it downwards, the current correction may continue; if upwards – Euro may form the third ascending wave.

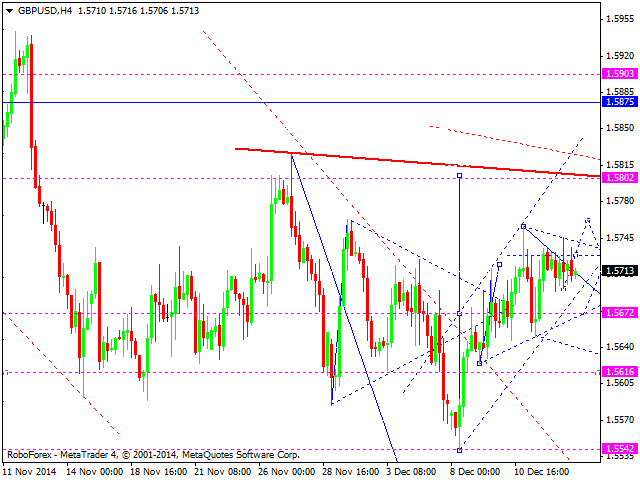

GBPUSD, “Great Britain Pound vs US Dollar”

Pound hasn’t been able to break level of 1.5730 and stay above it for a couple of weeks already. It means that we can’t be sure if the pair is going to reach level of 1.5800. This uncertainty may result in a new descending movement and new lows. We think, today the price may continue consolidating at the current levels and try to start a new ascending movement.

USDCHF, “US Dollar vs Swiss Franc”

The market was opened with a gap down today. Franc is trying to continue its descending movement, but hasn’t been able to stay below level of 0.9638. The pair is expected to form a higher correction towards level of 0.9723. We think, today the price may form triangle consolidation pattern. If later the price breaks it upwards, the pair may form a correction; if downwards – continue falling and forming a descending wave.

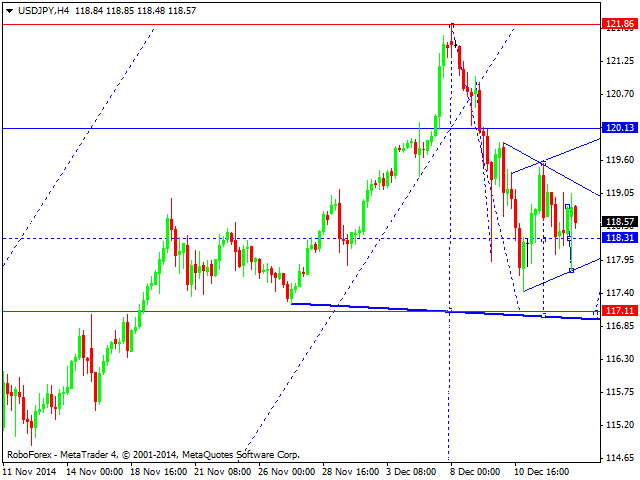

USDJPY, “US Dollar vs Japanese Yen”

Yen is still forming triangle consolidation pattern. We think, today the price may break it downwards and continue falling towards the target at level of 117.10. However, the pair may break it upwards and reach level of 120.00 (as a correction). After reaching it, the price may fall again towards the above-mentioned target. This descending structure may be extended, thus forming the first wave of the downtrend.

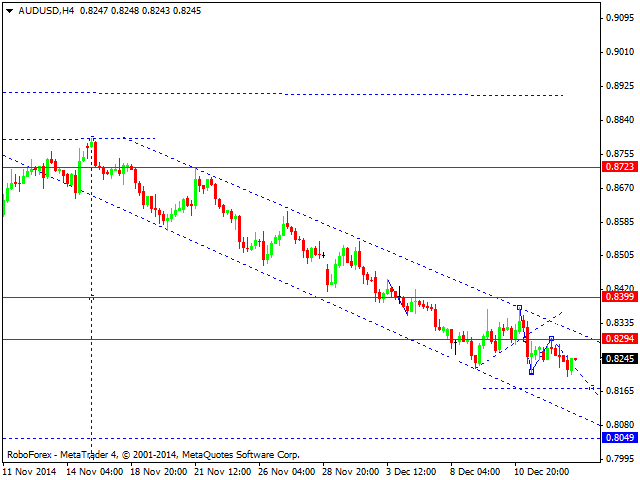

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar is still falling inside a descending channel with the target at 0.8500. Any attempt of the price to return to level of 0.8294 may be considered as an opportunity to increase short positions.

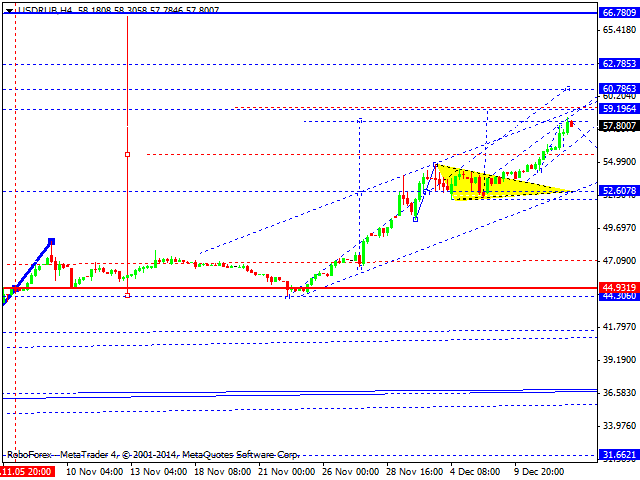

USDRUB, “US Dollar vs Russian Ruble”

Ruble wasn’t able to rebound to start a new correction and continued moving upwards. We think, today the price may reach level of 59.19 and then return to level of 54.80. This structure may be considered as an upside continuation pattern towards level of 66.70.

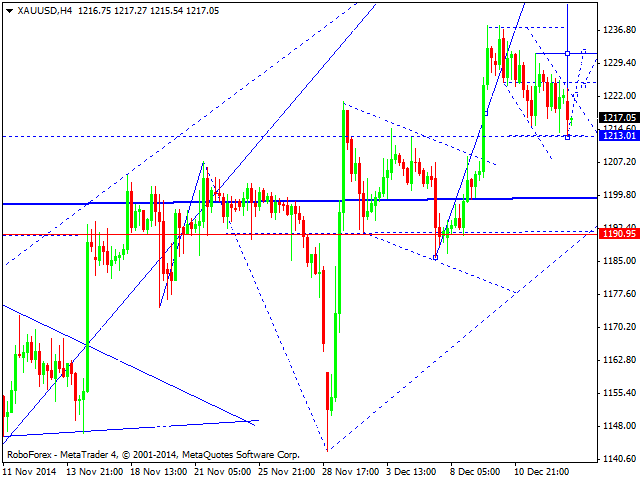

XAUUSD, “Gold vs US Dollar”

Gold has reached the target of its correction and right now is moving upwards. We think, today the price may form an ascending wave to reach level of 1250 and then start a new correction towards level of 1190.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.