Analysis for July 25th, 2014

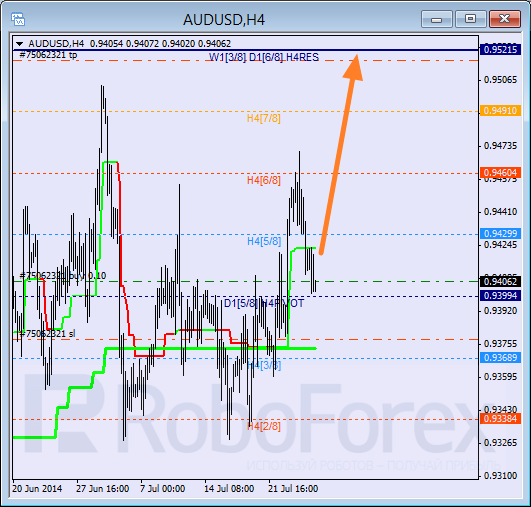

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar broke H4 Super Trend downwards during correction. If price is able to break it upwards again and stay above, market will start new ascending movement towards the 8/8 level, where I placed take profit on my buy order.

As we can see at H1 chart, pair may rebound from trend line. I’m planning to increase my long position as soon as Super Trends form “bullish cross”. Most likely, in the beginning of the next week market will enter “overbought zone” and then continue moving towards the +2/8 level.

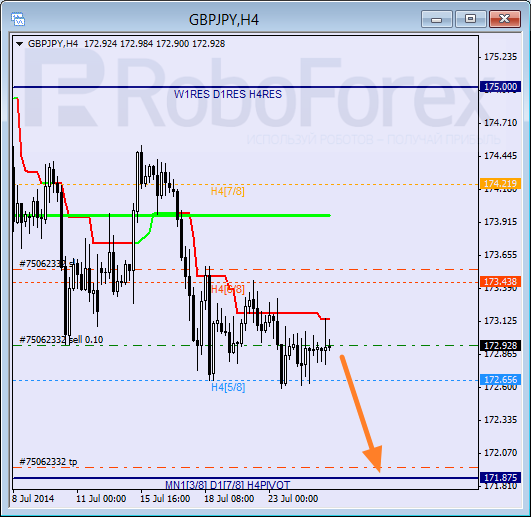

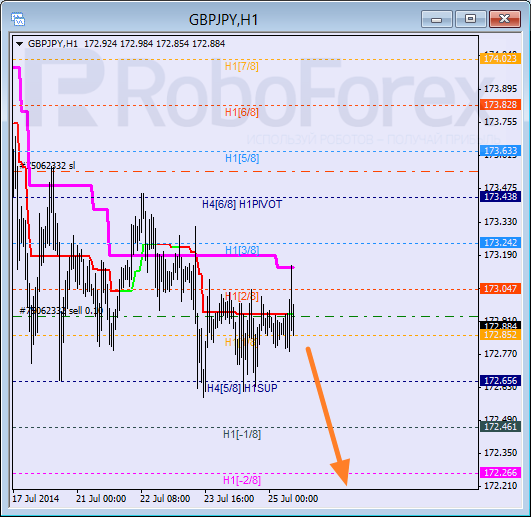

GBP JPY, “Great Britain Pound vs Japanese Yen”

Pair rebounded from H4 Super trend and I decided to open sell order. Stop loss is placed above the 6/8 level. In the near term, price is expected to reach the 4/8 level and rebound from it.

As we can see at H1 chart, market made several unsuccessful attempts to enter “oversold zone”. However, price rebounded from the 2/8 level, which means that it may start falling down again. If later pair breaks the -2/8 level, lines at the chart will be redrawn.

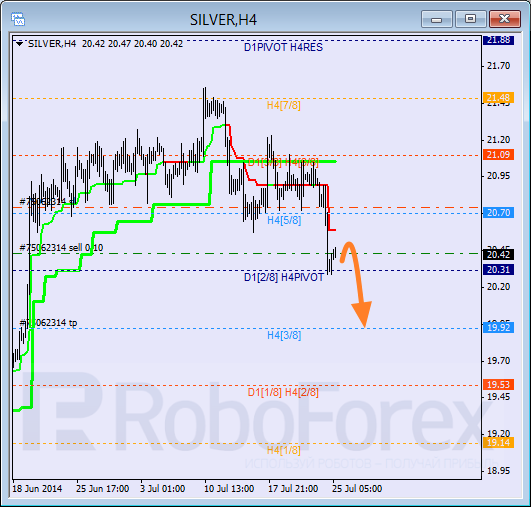

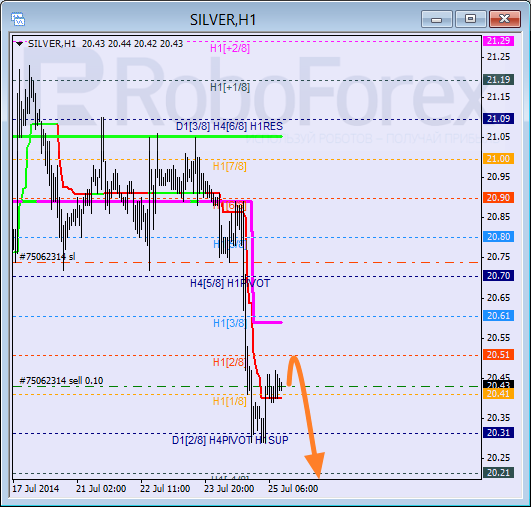

XAG USD, “Silver vs US Dollar”

Silver successfully reached the 4/8 level and take profit on my sell order worked. During correction, I opened new sell order with stop loss placed above Super Trend. In the near term, instrument is expected to continue falling down and reach the 3/8 level, at least.

More detailed structure of current correction is shown on H1 chart. Possibly, price may test the 2/8 level in the nearest future. If price rebounds from it, instrument will start falling down again and break the 0/8 level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.