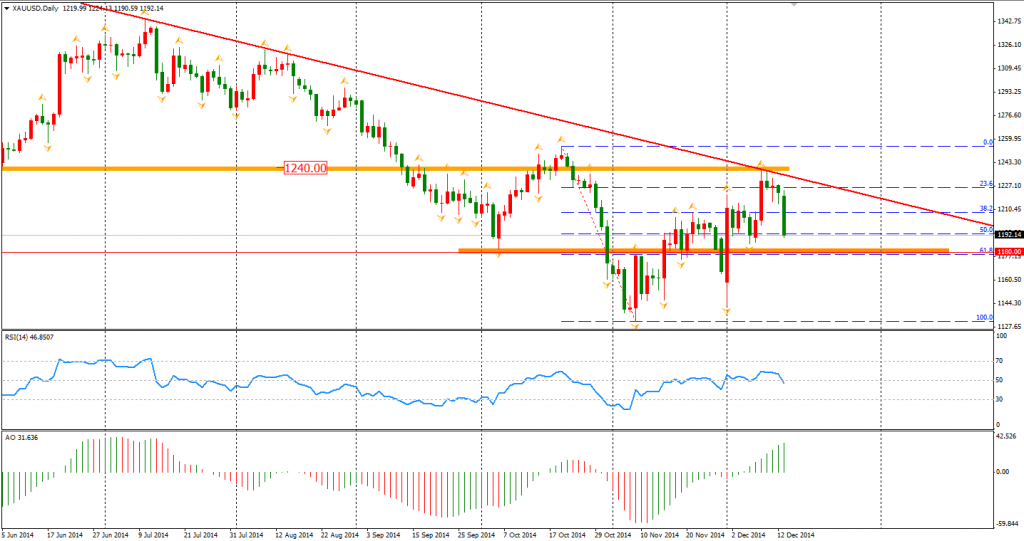

The fears of potential collapse of emerging markets like Russia, continues to spread encouraging last night’s selloff of commodities. The recent fall of oil prices caused the Ruble to plummet last night by 13% to 66 per Dollar. Even with the data showing US industrial output as better than expected – the dampening could not be relieved. The WTI slumped again by over 3% to $55.3 per barrel. The Brent North Sea crude settled at $US61.06 a barrel in London, down 79 cents from Friday’s closing level reaching a new 5 year low. The price of gold fell below the $1200 mark to $1193.50. As I have previously mentioned, $1240 is the critical resistance and the bearishness of the gold price will remain as long as the trendline is not broken. A bearish reversal has formed and the $1180 level below is the next bears’ target.

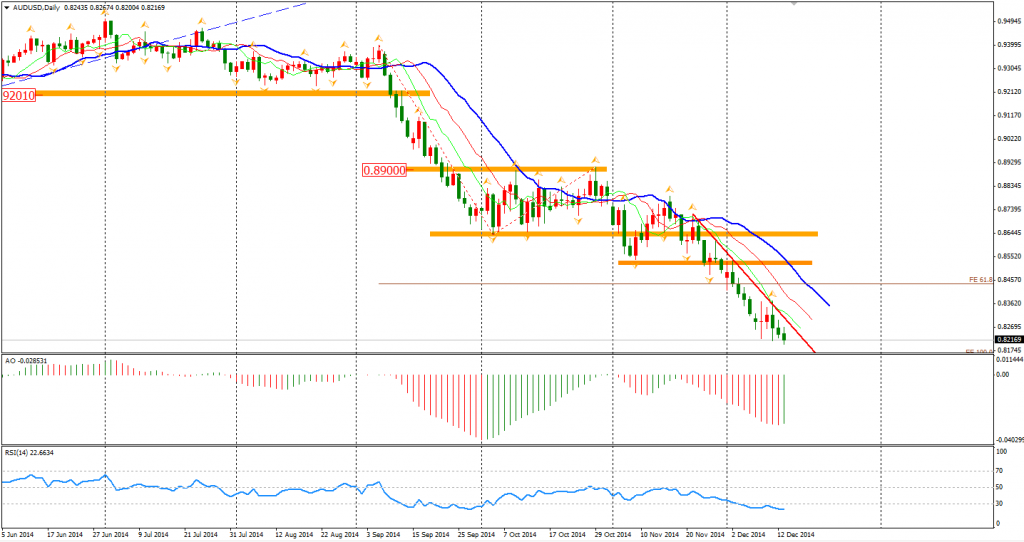

The Aussie Dollar again refreshed recent lows down to 0.8200 – largely attached to pessimistic views on commodity demands. The Aussie may have also been affected by the hostage situation which occurred in Sydney’s CBD yesterday and overnight. Major financial institutions and businesses were evacuated from the vicinity with many not returning to work today.

The Chinese data released last week is of major concern. Weak data including electricity output, industrial production and fixed asset investment showed that the Chinese economy has slowed again for November. As such, the Australian Treasurer has predicted that the price of iron ore may fall to $60 per tonne, and so the bearish trend of Aussie Dollar will most likely continue.

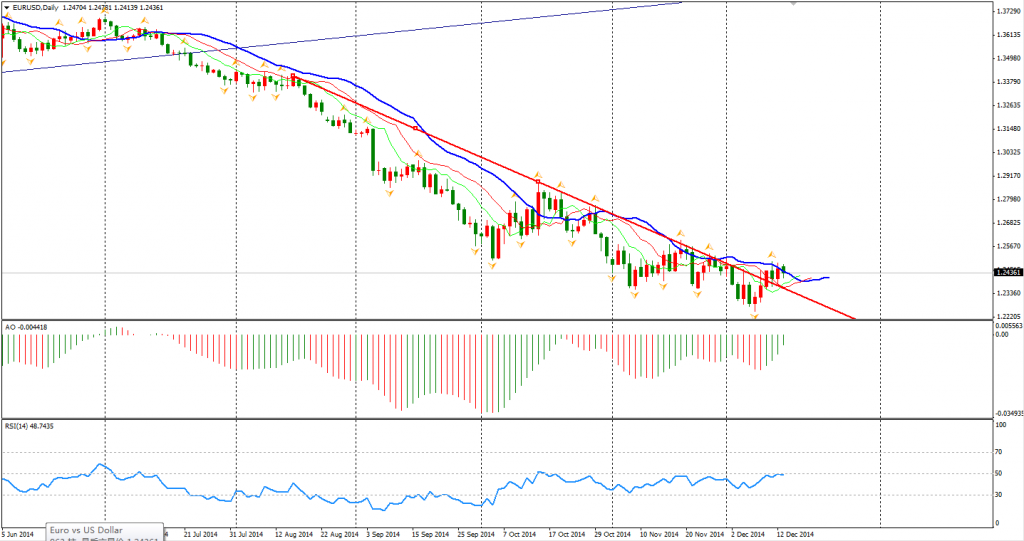

Euro’s rally temporally stopped at the 1.25 mark, but the short term bullish trend remains. The recent strength of the Euro comes from the profit-taking of bears. According to the position report of CFTC, the net short position of the Euro has dramatically dropped by 14%. The trend may keep going for the next couple days before the FOMC meeting.

Looking back to the Asian stock markets, the Shanghai Composite gained 0.52% to 2953. ASX 200 lost 0.64% to 5186. The Nikkei Stock Average was down 1.57%. In European markets, the UK FTSE lost 1.87%, the German DAX and the French CAC Index plummeted 2.7% and 2.5%, respectively. US market keeps falling on concerns of global economic slowdown. The S&P 500 closed 0.62% lower to 1989. The Dow dropped 0.58% to 17180, and the Nasdaq Composite Index lost 1.04% to 4605.

On the data front, Australia Monetary Policy Meeting Minutes will be released at 11:30 AEDST. HSBC Flash Manufacturing PMI will be at 12:45 am. Euro area PMIs and UK CPI and BOE report will be the major events in the Eur

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.