The trading was relatively light in the American session as US market celebrated Thanksgiving. However, we still saw some movements as Dollar strengthened on the first day this week while commodities slumped.

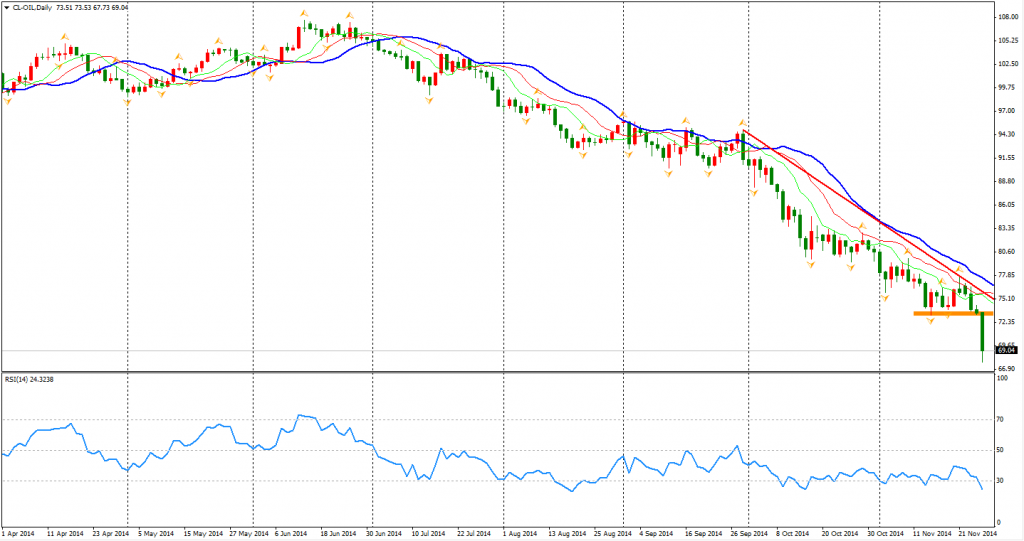

The news about OPEC deciding not to cut the oil production sent WTI to $70 per barrel below level. The price war started as Saudi Arabia want to use lower price to drive out the US shale gas manufacturers. However, since the oil price has already fallen to $69, the space for further decline was already limited. Technical buys may support the price.

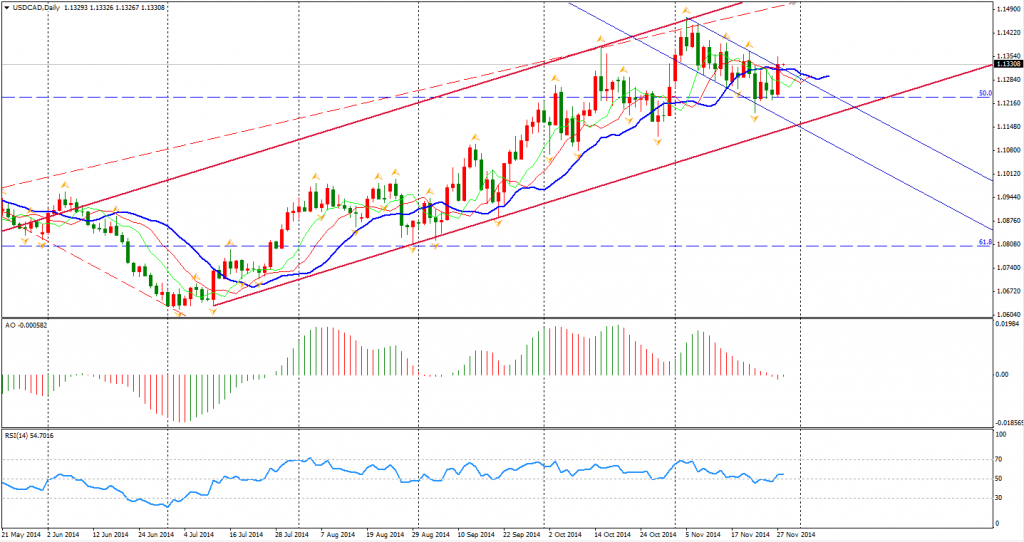

As the bearishness of oil continues, Canadian Dollar also fell yesterday. We may see USDCAD rise back to 1.14 level again.

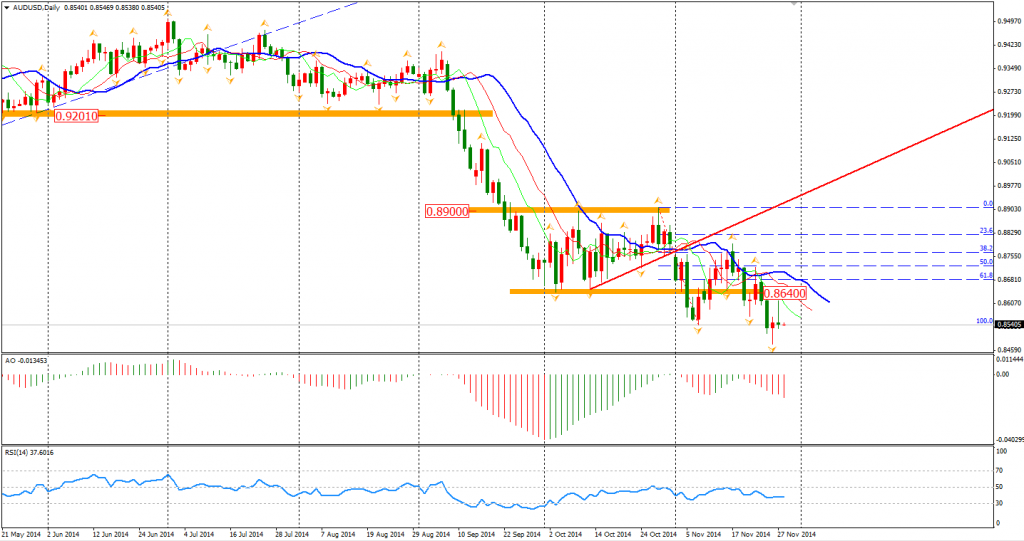

Australian Dollar rebounded back to the 0.86 level during Asian trading hours but erased the whole gain back to 0.8540 after the day, leaving a doji on the daily chart. The outlook of Aussie Dollar remains bearish. The market seems to have no intention to change the current bearishness.

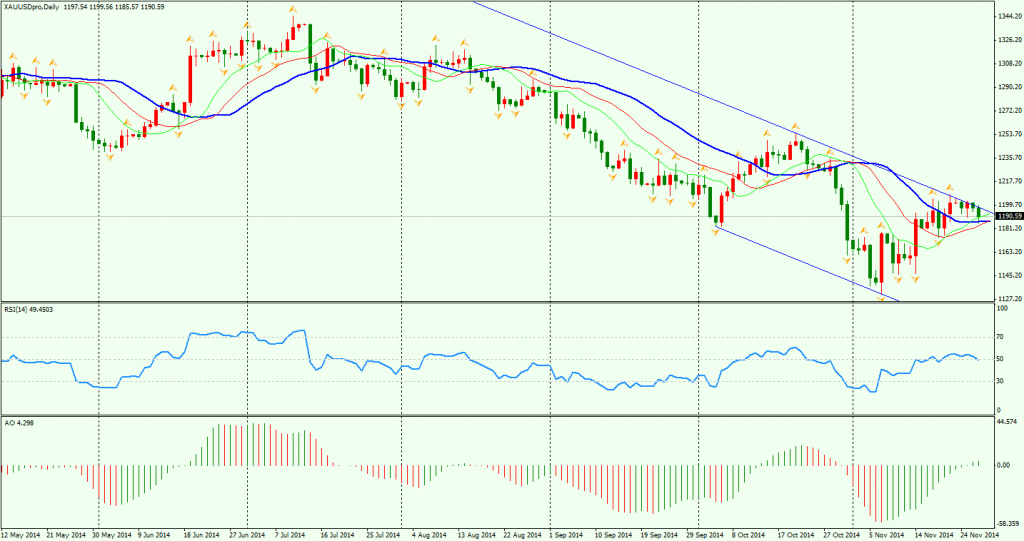

Gold once fell to $1186 per ounce during the Asian session but shortly recovered. However, as we discussed yesterday, the price was suppressed by the downward channel. The support levels below are the low of last Friday $1186.7 and $1180.

Most Asian stock markets remained rising. The rose of Shanghai Composite continues. The index surged 1% to 2630, refreshed 3-year high for 4 days in a row. ASX 200 also advanced 0.1% to 5400. In the European stock markets, the UK FTSE was down 0.09%, the German DAX rose 0.6% and the French CAC Index gained 0.2%.

On the data front, New Zealand ANZ Business Confidence will be released at 11:00 AEDST. Euro area Unemployment rate and CPI Flash Estimate are the main data in European session. Also, Canada GDP will be released at midnight.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.