Even though the China Q3 beat market expectations, the 7.3% annual expansion is still a six-year low and lower than the official target of 7.5%. The fixed-asset investment rate increased by 16.1% for the first month from the previous year – the lowest since 2001. On the flip side, it provides some with comfort knowing that the external demand has quickened and the services sector has expanded in Q3. Beijing repeatedly stresses economic reform over short term stimulus as the priority for the government. Hence, China’s demand for commodities may stay weak in the near future.

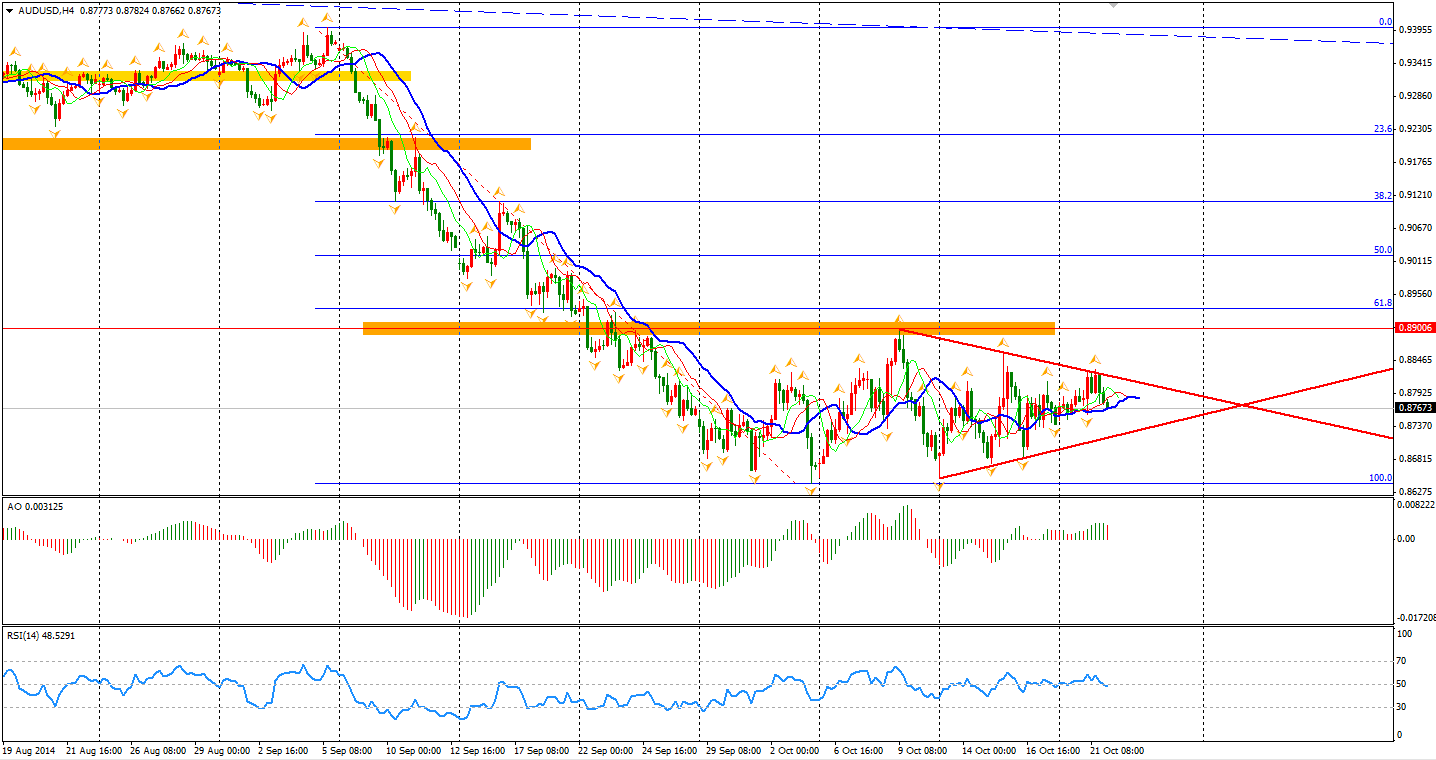

This is certainly not good news for Australia of which China is its largest trade partner. The Aussie Dollar is still in consolidation between 0.8650 and 0.89. In the 4-hour chart, a demand pattern is quite clear now, which we may see a breakout soon.

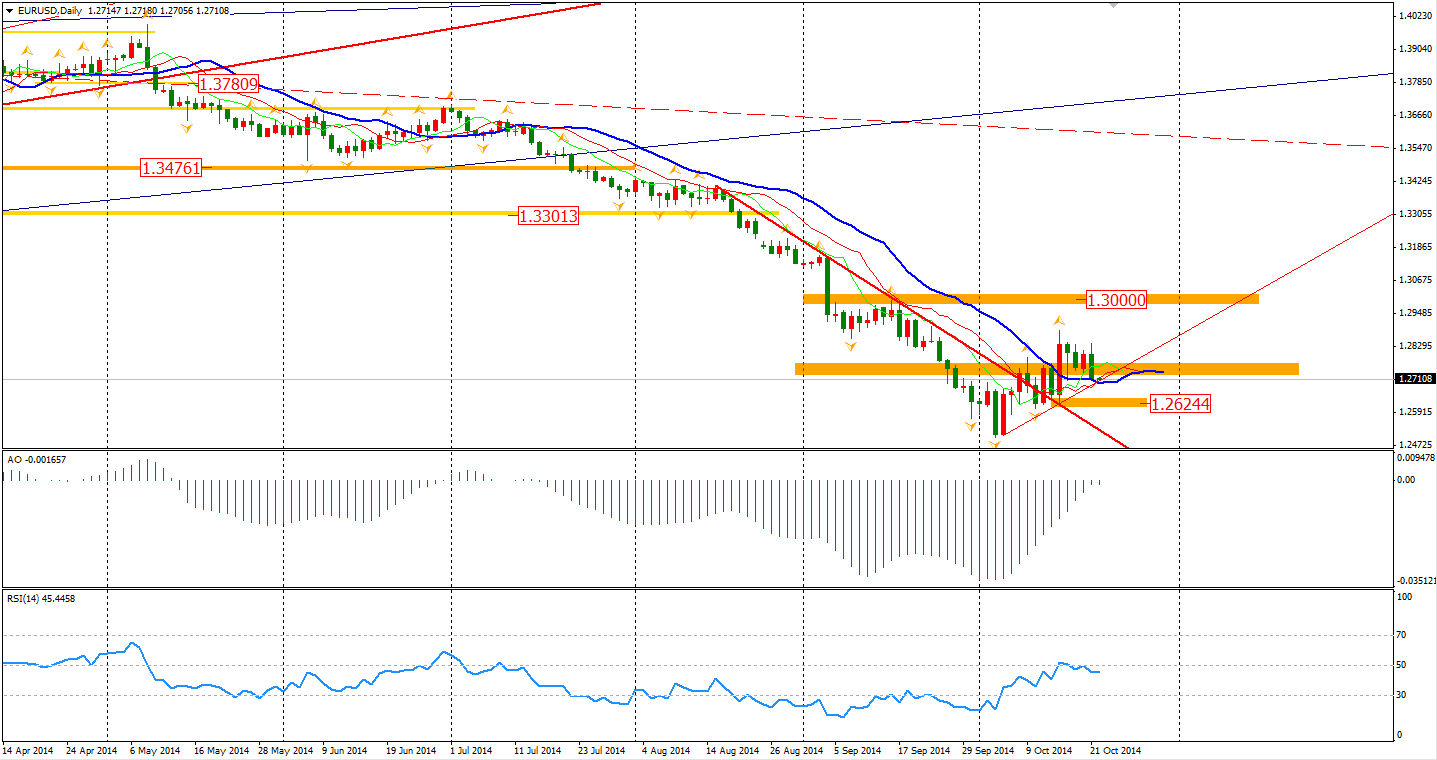

The Euro also fell against the Dollar yesterday, breaking the 1.2740 support and fell to 1.27 again. The breakout is not a good sign for the bulls and may imply that this round of rebound is over. The next support will be last Wednesday’s low of 1.2624, of which, if broken may confirm that the bearishness has come back.

The Asian stock markets fell across the board on Tuesday on the China GDP data. The Shanghai Composite lost 0.72% to 2339. ASX 200 gained 0.11% to 5325. The Nikkei Stock Average fell 2.03% as an adjustment of Monday’s surge. In European stock markets, the UK FTSE was up 1.68%, the German DAX gained 1.94% and the French CAC Index surged 2.25%. The US market bounced strongly, led by technology stocks. The Dow once gained 1.31% to 16614, while the Nasdaq Composite Index edge up 2.4% to 4419. The S&P 500 surged 1.46% to 1941.

For the data front, Australian CPI will be released at 11:30 AEST, followed by Chinese GDP and its disaggregated data. UK MPC minutes will be published at 19:30 AEST and US CPI and Canada Retail Sales are at midnight.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.