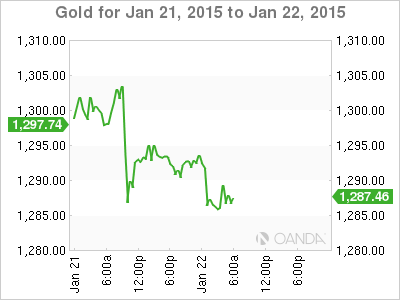

Gold is steady on Thursday, with a spot price of $1287.64 per ounce in the European session. The metal is in a holding pattern as the markets await a likely QE announcement from the ECB later in the day. There is also concern about the Greek elections on Sunday, as the Syriza party, which has promised to tear up Greece’s bailout agreement, leads in the polls. In the US, today’s highlight is Unemployment Claims, with the indicator expected to dip to 301 thousand.

Gold has taken a breather from its impressive run as it trades close to the $1300 level. Gold has been a winner from the recent volatility in the currency markets, as investors have looked to gold as a safe haven in recent weeks. The metal has posted strong gains since the SNB announcement last Thursday, when the SNB suddenly abandoned its cap that set EUR/CHF at 1.20, sending shock waves across global markets. This resulted in the euro recording sharp losses against the Swiss franc and the US dollar.

As the markets nervously eye the ECB policy meeting on Thursday, is this the calm before the storm? On Wednesday, French President Francois Hollande stated flat out that the ECB will announce a quantitative easing package at the ECB meeting. However, now that a QE is likely priced in, the question remains what will be the size of the program? The markets are anticipating QE of between EUR 500-600 billion, but some market players are saying that the ECB could go as high as EUR 800 billion. Will the euro take a hit on Thursday? The likelihood is yes, unless the ECB surprises with a “QE lite”, such as EUR 300 billion, which would be well below expectations.

XAU/USD 1291.75 H: 1303.38 L: 1290.15

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.