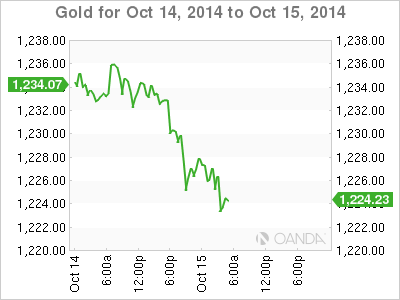

Gold has posted slight losses on Wednesday, as the spot price stands at $122.55 per ounce in the European session. After strong gains last week, gold prices have weakened slightly. On the release front, we’ll get a look at US releases after a quiet start to the week. There are three key events on the calendar – Retail Sales, Core Retail Sales and PPI.

US markets were off on Monday for a holiday, so it’s been a quiet week until now for XAU/USD. That could change later on Wednesday, as the US releases key consumer spending and inflation data. The markets are keeping low expectations, so traders should be prepared for some movement from the pair if there are some unexpected readings from Wednesday’s releases.

The US dollar has looked razor sharp against gold, as the metal has lost about 5% of its value since the start of September. However, the greenback’s rally was interrupted by last week’s FOMC minutes, which were unexpectedly dovish. In the minutes, the Fed poured some cold water on rising expectations of a rate hike, as a number of policymakers said that the Federal Reserve should take a more data-dependent approach regarding a rate hike. The Fed also voiced concern about the rising strength of the US dollar which could weigh on the recovery. On the weekend, FOMC member Stanley Fischer said that the Fed could slow tightening if global growth is weaker than expected. Strong US numbers have raised expectations about a rate hike, but clearly the Fed is taking a cautious approach regarding the timing of a rate hike. Still, with QE set to wind up by the end of the month, rising speculation about higher rates bodes well for the US dollar.

XAU/USD 1222.55 H: 1230.22 L: 1222.08

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

EUR/USD grapples with higher ground as Fed cuts weigh on Greenback

EUR/USD found the high end on Thursday, holding fast to the 1.1150 level, though most of the pair’s bullish momentum comes from a broad-market selloff in the Greenback rather than any particular bullish fix in the Euro.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.