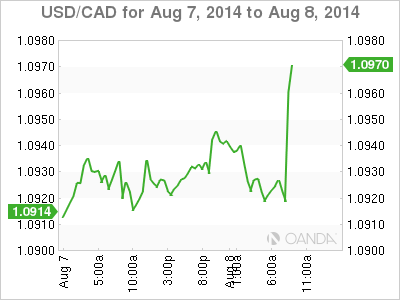

The Canadian dollar has posted slight losses on Friday, as USD/CAD trades in the mid-1.09 range late in the session. In economic news, Canadian Employment Change posted a gain of just 0.2 thousand, well short of expectations. The unemployment rate edged lower, to 7.0%. In the US, there are no major releases on today's schedule.

Canada wrapped up the week with disappointing employment numbers, as Employment Change came in almost flat, at just 0.2 thousand. This surprised the markets, which had expected a strong gain of 25.4 thousand. The indicator tends to show sharp swings, which often results in estimates that are well off the mark. There was better news from the unemployment rate, which dipped to 7.0%, down from 7.1%. This matched the forecast.

South of the border, US Unemployment Claims improved, dipping below the 300 thousand level last week. The key indicator dropped to 289 thousand, beating the estimate of 305 thousand. The four-week claims average, which is less volatile than the weekly count, dipped to 293,500, its lowest level since February 2006. The stronger numbers point to increased hiring in response to stronger demand, which in turn has contributed to gains in income and stronger consumer spending. An improving job market is critical for economic growth, and the dollar has gained broad strength as key US data points upwards.

Canadian numbers were sharp on Thursday, led by Building Permits which posted a strong gain of 13.5% last month. This figure was close to the previous release of 13.8%, and crushed the forecast of -1.8%. Building Permits is an important gauge of the strength of the construction sector, and the markets will be hoping that Housing Starts, which will be released on Monday, follows suit with a strong showing. There was excellent news from Canadian Ivey PMI, which climbed to 54.1 points, matching the forecast. This was up sharply from 46.9 points a month earlier. The PMI pushed above the 50 line, which marks expansion, for the first time since April.

USD/CAD 1.0966 H: 1.0967 L: 1.0910

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.