Review: Correction time

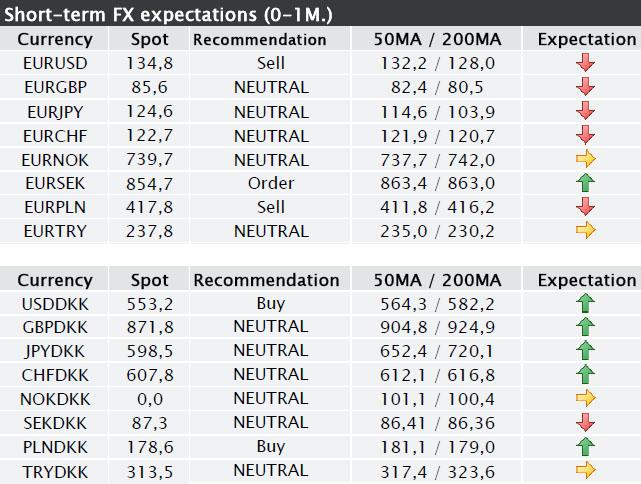

EUR: Several EUR cross rates gave a sell signal yesterday. The divergences we have seen between EUR and the various asset classes are now about to be eliminated again. Hence there is every indication that a reasonable correction is taking place in the financial market.

Why? In respect of Spain, there are concerns whether the Spanish Prime Minister has taken bribes or not. In respect of Italy, there are concerns about the outcome of the election. Also, it is being questioned to which extent the Italian banking sector has been consolidated/how strong it is in actual fact.Safe havens: The typical safe havens were in demand. EURUSD fell by more than 1% and EURJPY by more than 1.5%. Even EURCHF fell by more than 1%.

The US: Fisher of the Fed stated that the Fed should tone down the monthly QE in step with the improvement of the economy. The views of the Fed members who want to slow down QE have over the past month or so been given more space in the media. This goes to prove the disagreement that has arisen among the Fed members. As stated yesterday, we still expect that QE will continue at least throughout the first six months of the year.

The US: The US Department of Justice is planning to sue the rating agency S&P over the credit rating that S&P gave in connection with the subprime loans back in 2007-2008.

Market sentiment:

As things are becoming increasingly clear, there is no doubt that this week will see a correction. We anticipate that the correction will last at least until Thursday afternoon after the ECB’s interest-rate meeting.

It is still very important to keep an eye on the development of the major equity indices (DAX, MSCI World, SP500, HSI) because if they begin to fall by more than 1% a day over two or three days, it is increasingly likely that the correction will be considerable. Pay attention to the development of the yields on Spanish and Italian government bonds.

Today’s events:

11:00 EUR: retail sales.

16:00 USD: ISM service The economic trend indicators surprised to the upside and are now above the long-term average. Growth is only relatively moderate, and therefore we anticipate a minor decline in ISM to a level that will match growth.

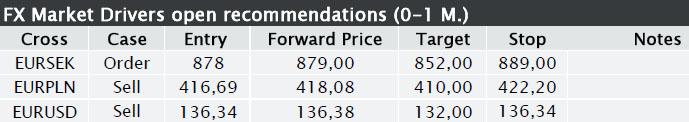

EURUSD (SELL):

We recommend that investors sell EURUSD with take-profit at 132.00 and stop-loss at 136.34. We recommend that investors move stop-loss to 135.52 if EURUSD trades below 133.88 again.

As an alternative to selling EURUSD, investors might want to sell EURGBP or EURTRY instead. See Monday’s and today’s EURUSD chart to see the close correlation.

For the short term, the potential offered among the three cross rates is practically the same. The big difference will arise if the FX market trades in a narrow, sideways range, which we consider most unlikely.

The highest gain is to be had in EURTRY, but this is also where you see the highest intraday volatility (= risk).

If we look at the underlying technical factors, EURUSD is in a needed correction phase.

If global equities and commodities continue to fall (over the next couple of days), such movements will most likely force EURUSD over the firm cliff of euro euphoria that has arisen and result in a considerable decline of EURUSD.

We expect that this correction phase will bring EURUSD down to the level of 131.50-132.50.

Resistance and support:

Downside: 135.50 & 134.00. Then 131.88.

Upside: 137.30. Then 138.33.

EURUSD and EURGBP

EURPLN (SELL): We recommend investors to SELL EURPLN and move S/L up to 422.20.

We generally recommend that investors trade in the range of 402.96-422.12.

Trade has taken place in this range since July. It would be a very good idea to place a double stop because a breakout above 422.12 will result in increasing pressure to buy.

We clearly expect that EURPLN has peaked this time around, which is also illustrated by the technical indicators:

- RSI has fallen to a level below 60 again and that happened without the RSI setting a new top (see the dotted line).

- MACD has turned around and given a clear SELL signal (see the red circle).

We find it is very likely that EURPLN will fall below 412 this week.

Resistance and support:

Downside: 415,05. Then 407.00.

Upside: 419,75-421,75. Then the area at about 434.00.

EURPLN

EURSEK (NEUTRAL):

The next major level of support is at 850. If the market breaks out at a level below 849.50, the way is paved towards the next major level of support at 840.

Chart: MSCI world

The analysis is based on information which Jyske Bank finds reliable, but Jyske Bank does not assume any responsibility for the correctness of the material nor for transactions made on the basis of the information or the estimates of the analysis. The estimates and recommendations of the analysis may be changed without notice. The analysis is for the personal use of Jyske Bank's customers and may not be copied.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.