If the Ms. Yellen and her fellow policy makers do happen to pull the rate trigger later this afternoon (2pm EST), it will be the first U.S rate hike in just under a decade. It’s not what the Fed does; a hike of 25bps or less, but what they say that investors should focus on. Capital markets need to be reassured that future rate increases will “only be very gradual” in nature, in fact baby steps back towards rate normalization. The call is so close with various surveys seeing a near-even split among economists, while fixed-income dealers are pricing in roughly a +23% chance of a rate liftoff.

The “yes” hike camp have pointed to a U.S economy with near full employment (+5.1%), and if you included the recent growth in the money supply argument, coupled with domestic economic growth signs across the board, certainly justifies a domestic rate hike call.

Despite U.S headline inflation remaining relatively subdued, it continues to give investors a misleading impression. The global low price syndrome is an energy and commodity based issue – energy prices declined -2% last month stateside. Yesterday, the U.S CPI headline for August turned negative (-0.1% m/m) for the first time in nine-months, while the core-CPI (+1.8% y/y) exhibited tepid growth. As CPI is not the Fed’s preferred measure of inflation, the decline in the core headline could figure into today’s meeting as just another sign that U.S policy makers are some ways away from meeting its price goals. Therefore a token hike is unlikely to do much harm to the U.S economy. If there is one, it should be accompanied with a “dovish” statement.

The Fed needs to keep its credibility intact, especially with Ms. Yellen being so vocal on a hike in 2015. If U.S policy makers leave it too late, there is a danger of having to play catch up, and this could only cause more problems, especially to consumer spending and business confidence at a later date.

Nevertheless, the Fed is in a tough spot, they have their domestic reasons to hike, but being “the” global leader; it’s not just the impact on their own economy that they have to worry about. With the dollar’s dominant reserve currency status, today’s decision will have a massive impact for the global economy as a whole, and Ms. Yellen and company cannot ignore that. So, either way, what they communicate is of the utmost importance.

In the “no” camp there are a plethora of reasons not to hike today. Aside from the subdued inflation argument (highlighted above), the mighty dollar remains underpinned by elevated yields. In time, a stronger dollar will have a negative impact on the U.S economy. A couple of Fed speakers (Dudley and Williams) have stated that the U.S economy is showing an “amber light, not green.” Despite backing herself into a corner on a hike for this year, there still is time in October and December for the Fed to carry out Yellen’s wishes. Now that global economies haven taken on so much U.S debt, especially emerging markets (EM), any Fed tightening will cause further financial disruption to these weaker economies. Does the Fed really want to insight further financial instability at this point?

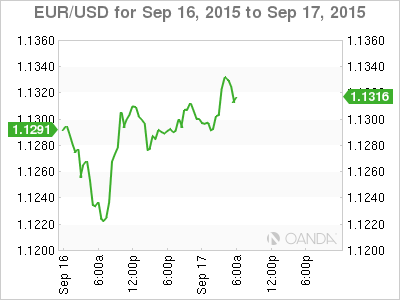

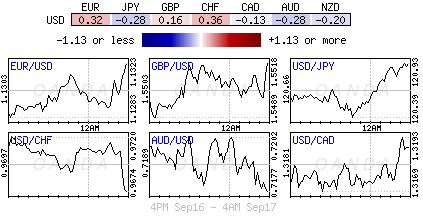

**No matter what transpires later this afternoon, price movements across the various asset classes are expected to be extremely volatile, especially as more dealers return back to the market after having pared their exposure pre-Fed announcement.**

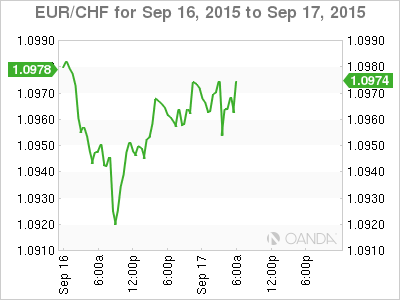

The Swiss National Bank (SNB) did what was expected of them earlier this morning. They left their deposit rates unchanged at -0.75% while keeping its targeted three-month Libor band intact (-1.25% to -0.25%). Despite fundamentals, it would have been difficult for any central bank to preempt the Fed. Not much of a surprise, the SNB noted that the CHF remains over valued and poses a “challenging situation for many companies.” The SNB again went out of their way to stress that they will remain “active” in the forex markets.

Overnight, the Bank of Japan (BoJ) Governor Kuroda said he is ready to act, but he did not provide a clue about whether they will ease monetary policy further in the near term. Earlier this week the BoJ kept monetary policy unchanged, but toned down there assessment of the domestic economy as slowing emerging economies are undermining their efforts. Most economists do not see the BoJ being able to achieve its +2% inflation target by the intended timeframe of H1 of 2016, and are certainly more vocal over the waning effect of Abenomics. Do not be surprised to see PM Abe and the BoJ step up stimulus efforts next month.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.