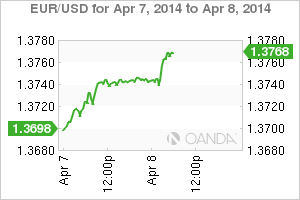

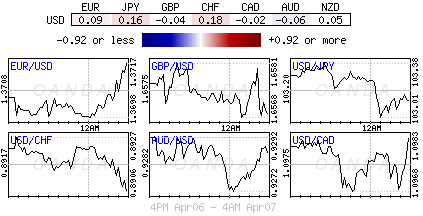

It was bound to happen, especially when it would not go down. Forex speculators short the 18-member single currency on ECB hype are now paying the penalty of Draghi and company's "on-hold" decision last week. The EUR has strongly rebounded from its 100-DMA just below the psychological $1.3700 print post ECB rate announcement last Thursday. Aiding the currency in its flight are the Euro-zone bond yields edging higher after regional policymakers again stressed that that any move to print money (QE) to raise ultra-low inflation was still a long way off. A solid move this morning above $1.3755 should provide more ammo for the techies and their bullish signal, potentially opening up the topside to a new handle ($1.3820 and above).

With global equity bourses opening up mixed today, following sharp declines yesterday as peripheral indices lag, has the USD trading softer against a bunch of currencies (major, commodity-related and emerging markets). Various EM pairs have already managed to print fresh 2014 highs during the Euro session (ZAR and TRY). The market should be expecting additional stop-losses to follow the single-currency pair, especially as the EUR pushes above its 200-HMA (€1.3751). Tighter UST/Bund spread is leading the short squeeze higher. The 2-year spread was +30bps before the ECB announcement, now its trading shy of +22bps. Dip buyers are expected to raise their bids, chasing this market a tad, towards the 55-DMA at €1.3730. Resistance must be now near last week's highs, just north of €1.3808 to €1.3820.

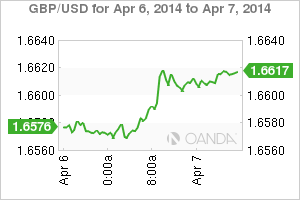

Even the pound this morning is managing to undermine the dollar, supported most certainly by some stellar economic releases during this morning's Euro session. The UK industrial sector is showing no ill effects from the bad weather experienced last February in the British Isles. Cable (£1.6712) has managed to garner a half-cent boost from February's stronger Industrial (+0.9%) and Manufacturing (+1.0%) production prints. This is certainly a boost for the "hawks" that are calling for a Bank of England rate hike (+0.5%) in the latter half of this year or in Q1 2015.

This morning's three-week high print is knocking on the next resistance level (£1.6720). Expect EUR/GBP, dropping to a new one-month low (0.8239) to be a potential catalyst to drag the pound higher. Some techies are looking for a market run back north of 0.8300 as they are not yet wholly convinced of the bearish momentum. For the GBP bulls, this move seems real enough, especially with the daily activity trading volume in EUR/GBP up +98% versus the one-month average since the UK's economic releases this morning. Long market stops are now accumulating south of 0.8214. If nothing else, a market squeeze is on!

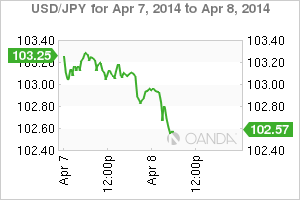

They came, saw and did what was expected of them - the Bank of Japan maintained their monetary policy setting (increase of ¥60-70t annual pace) and kept their economic assessment unchanged for an eighth consecutive month last night, but notes "fluctuations due to consumption tax hike."

Basically, Japanese policy makers seek more clarity on the extent of headwind from the higher sales tax (+5% to +8%) implemented this week before deciding on further policy adjustment.

In the accompanying statement, Governor Kuroda and company did manage to tweak some of the copy, noting there were some variations concerning the overall recovery as well as private consumption and housing investment, and also added "some cautiousness" around the outlook for business sentiment.

Yen's initial reaction was to trade a touch softer as trader's interpreted elevated cautiousness over the outlook potentially paving the way to more easing in a fortnight when BOJ happens to release their semi-annual report on economic and price trends. However, the fall in global equity markets (Nikkei -1.4%) suggest a risk-off environment, with USD/JPY now the victim (¥102.52 fresh April low). Spot needs to hold above the ¥102.40 to maintain the current technical bullish outlook.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.