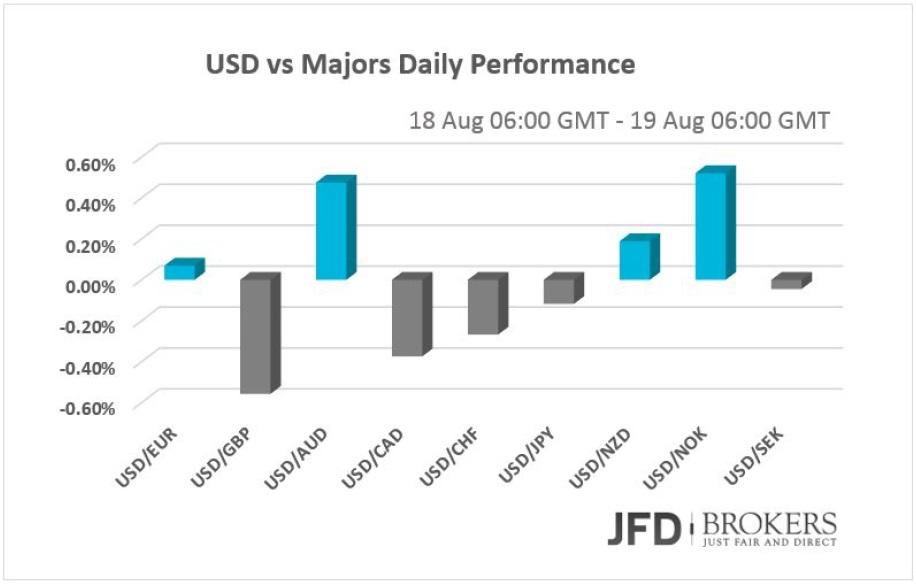

The dollar once again is mixed, falling against three of the G10 currencies; GBP, CAD and CHF while gaining against two; AUD and NOK. The British Pound lifted‐off immediately after the better than expected Inflation Rate and added 0.47% to the weekly gains. The single currency has fallen for a fifth consecutive day against the greenback despite the absence of market‐affecting news for the currency. The Fed Reserve will release its minutes for this month’s policy meeting, where it may provide any hints about interest rates. Japanese yen and Swedish Krona were virtually unchanged versus the dollar. Gold remained flat near $1,120 while silver slipped 3.32%. U.S. stocks finish lower with Nasdaq leading the way with 0.64% drop.

EUR/USD No clear direction

The dollar edged higher Tuesday, extending its gains from earlier in the session and snapping a fivesession losing streak against the euro after a spate of strong U.S. economic data. U.S. Housing Starts rose 0.2% in July to an annual rate of 1.206 million in July from the revised June estimate of 1.204 million. This is the highest annual rate since October 2007. The EUR/USD pair fell below the key support level of 1.1050, however, the euro recovered somewhat in early‐Wednesday, but was still below the 50‐SMA on the 4‐hour chat. Moving to the daily chart, the pair is trading between the 50 and the 200‐SMA. During the past three months, the EUR/USD has been stuck in a brutal trading range, oscillating between 1.0800 and 1.1500. No clear direction on this timeframe, so medium‐term traders can enjoy their holidays while the short‐term traders should watch the 1.1000 level, as a break below this should open the door for a further retracement towards 1.0950, which coincides with the descending trend line, which started back in mid‐July.

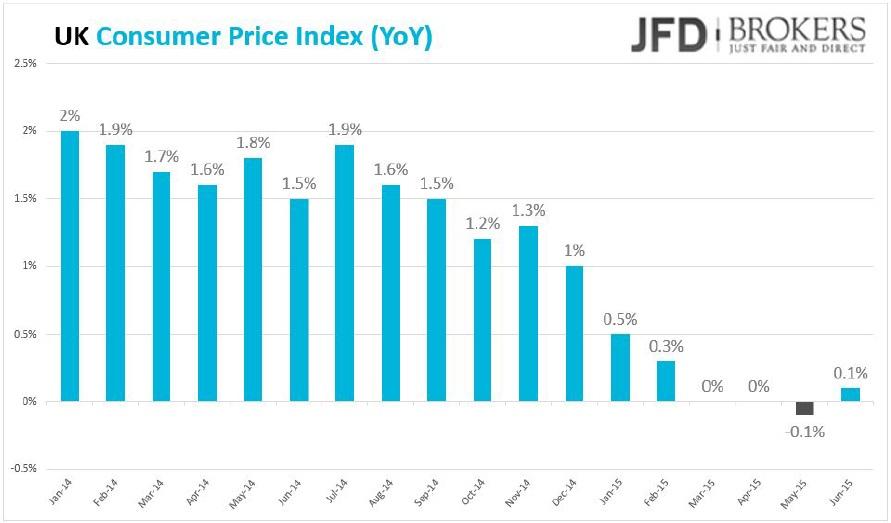

Pound surges after CPI

The British Pound lifted‐off immediately after the better than expected Inflation Rate. The Inflation rate showed an increase in July, on a yearly basis, beating expectations of remaining flat. The Core Inflation rate, a core measure of price growth, reached a five‐month high at 1.2% while the four months before the prices rose slightly below 0.9% on average. Even the month over month Inflation rate that was expected to be in deflation came out above forecasts boosting pound’s gains. Beyond that, the numbers are still low and cannot force the Bank of England to hurry up with the interest rate hike.

The GBP/USD pair surged above the significant level of 1.5580, which coincides with the 200‐SMA on the 1‐hour chart as well as above the 1.5650 barrier. Currently, the pair is trading slightly below the significant and psychological level of 1.5700. As mentioned in yesterday’s analysis, a 4‐hour close above 1.5700 will confirm the break which should prompt the next move towards the next psychological level of 1.5800. At the moment the pair failed to do so, however, intraday traders should watch that closely. Going forward, the 50‐SMA and 200‐SMA, both are providing a significant support to the price near the 1.5580 level while both of the momentum indicators are turning bullish. All in all, I remain strong bullish on the pound.

AUD/USD finds support at 0.7310

The Australian dollar is trading slightly lower against the US dollar, weighed down by falls in Asian and base metals prices. The 50‐SMA as well as the 200‐SMA on both the 1‐hour and 4‐hour charts are providing a significant resistance to the bulls slightly above the 0.7350 barrier. During yesterday’s session, the AUD/USD pair fell below the key support level of 0.7325 and is trading negative for the day at ‐0.16% adding to yesterday’s losses of ‐0.42%. Further losses would open the path to 0.7300, where a potential formation lies, although it may be too early to think of such a decline at this stage, with the 0.7310 level holding the bulls for the moment.

Dollar Index Outlook!

During the last couple of days the DYX (The Dollar Index) has been able to climb up to 97.00 where the prices found solid resistance and today, in the early Asian session we are observing that bears have taken control of the trend. From a technical perspective, the price structure suggests that further declines are likely to take place and we expect the index to depreciate towards 96.00 as a daily close below that support will open the path towards 94.00. On the other hand, an extended rally above 98.00 would indicate that the bulls are again the dominating party.

Gold and Silver Outlook!

The precious metal had another choppy session pretty much confined to the recent range and there is no change in view. XAU/USD was flat at $1,118 an ounce on early‐Wednesday, after rising the previous week and closing positive following seven negative weeks in a row. Given how far the metal has run in the past few weeks, unambiguously positive data is needed to drive the gold higher. At the moment, the yellow metal remained struggled at the $1,118 level, which coincides with the 200‐ SMA on the 4‐hour chart. Above there, the metal also struggles to break above another key level around the $1,127, August 13 high. On the downside, the metal is finding a temporary support at the $1,112 barrier. A dip below the latter level should clear the picture since it would signal the completion of a failure swing to the downside, prompting a move back towards the psychological level of $1,100. Alternatively, if the metal bounces back up, it could move to resistance at $1,127.

On the other hand, silver fell sharply, during the US session, below the key support level of $15.15 and reached our suggested target (http://bit.ly/1EBHC2z) at $14.90. The XAG/USD fell as low as $14.73, from around $15.20 early Tuesday. The white metal remains under pressure, however, given how aggressive the rally has been over the last few hours, we could see a brief period of consolidation between $14.70 and $15.20.

WTI pauses declines

Not much movement in Brent Crude with prices trading within a tight range in the past 12 hours. Technically, the commodity remains unable to set a clear direction with the 4‐hour chart. The $48.20 level remains a key support while the $49.50 barrier is the key to watch for the upside.

Meanwhile, the WTI moved higher during yesterday’s session and is now trading above the key resistance level of 42.68. The WTI fell as low as $41.40, from around $42.70 mid‐Monday. These movements strengthen my conviction that we are likely to see further consolidation or an upward corrective wave, perhaps to test the $43.00 level.

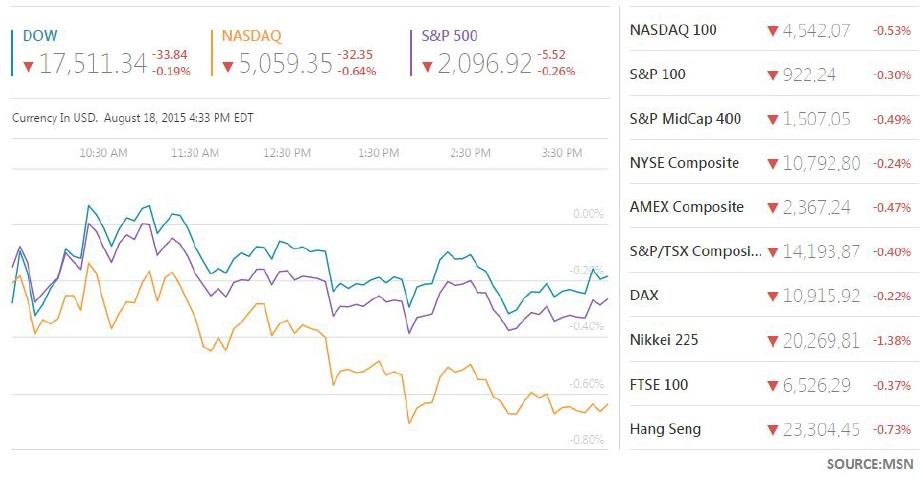

U.S. Stocks edge lower

U.S. stocks fell as after the stock market in China closed lower. The DJIA lost 33.84 points to close at 17,511.34 while the S&P500 Index fell 0.3% to 2,096.92. In the same pace, NASDAQ lost 0.64% from its value to close at 5,059.35. Technically, the Dow Jones is currently testing the 50‐SMA on the 4‐ hour chart. It seems that the selling pressure will continue and in today’s session and I would expect the index to test the next support at 17,395. It’s very remarkable that the index is forming lower higher since it reached the 18,367 – an all‐time high.

Wal‐Mart Stores Inc. (NYSE: WMT) traded down 3.37%, to a new 52‐week low, at $69.48 while Cisco (NASDAQ: CSCO) fell by more than 2% ending the day below $30. Wal‐Mart reported disappointing results and cut its outlook yesterday morning.

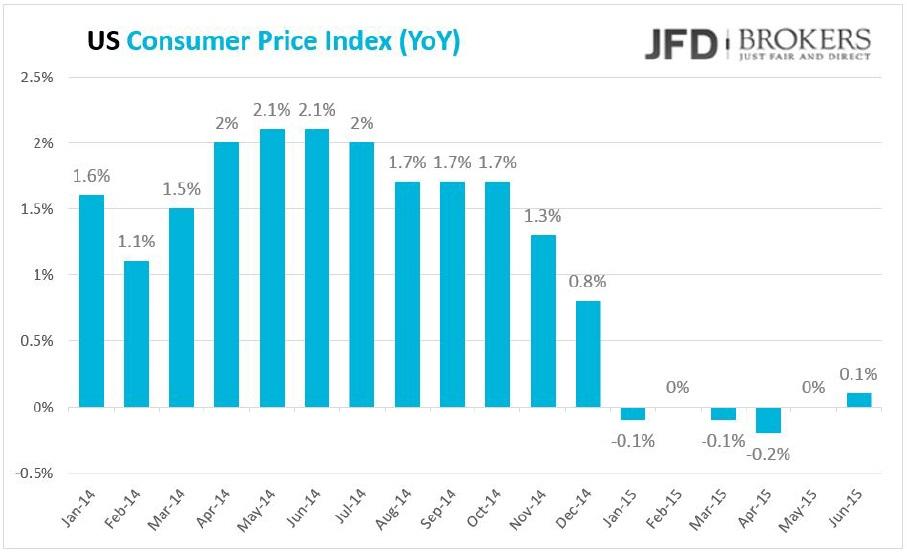

Economic Indicators

Today, the Current Account and the Construction Output in Euro area for June will be released. Going forward, in US, the day is very important and the USD currency cross pairs are anticipated to have more volatility than usual. The FOMC minutes and the CPI have leading roles for the timing for an interest rate hike. The final Inflation Rate for July will attract considerable attention. On a monthly basis, it is expected to have reduced to 0.1% in July from 0.3% before. However, on a yearly basis, the inflation rate is forecasted to have speeded up slightly by 0.2% from 0.1% the preceding month. The major event of the day is the FOMC minutes. The minutes will be scrutinized by investors to find out the discussions behind the doors for the Fed’s interest rate raise. One last NFP Report is awaited before September’s policy meeting, however, China’s currency devaluation will be strongly taken in consideration from the Fed and this could be a good reason to avoid September’s rate hike.

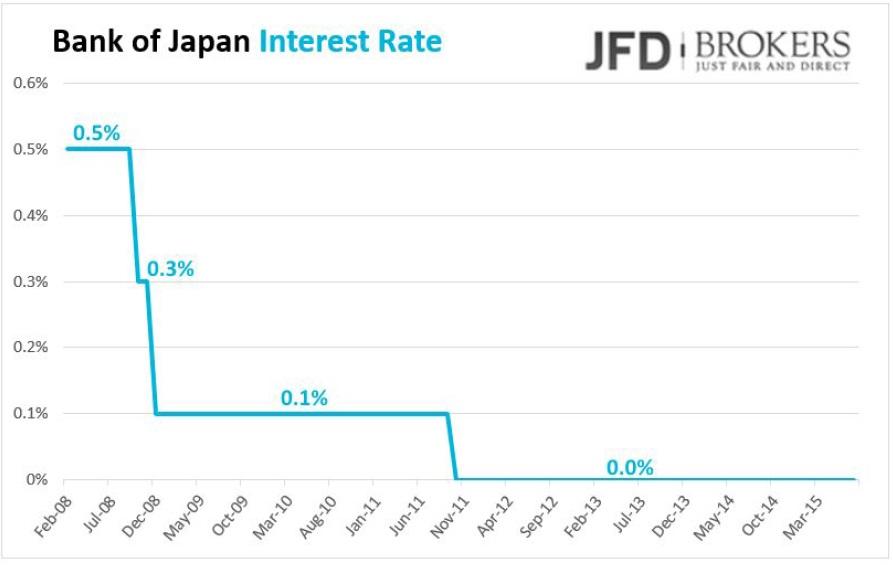

Overnight, the Bank of Japan will announce its Interest Rate decision.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.