UP NEXT:

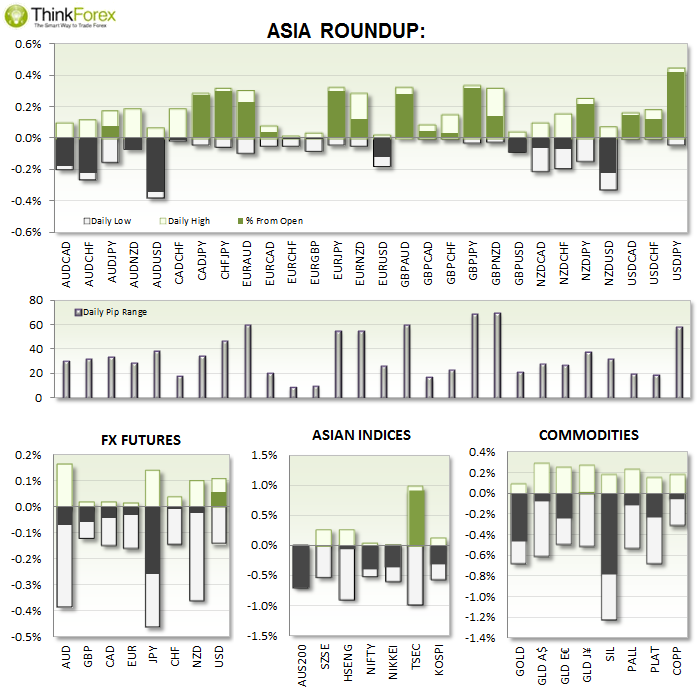

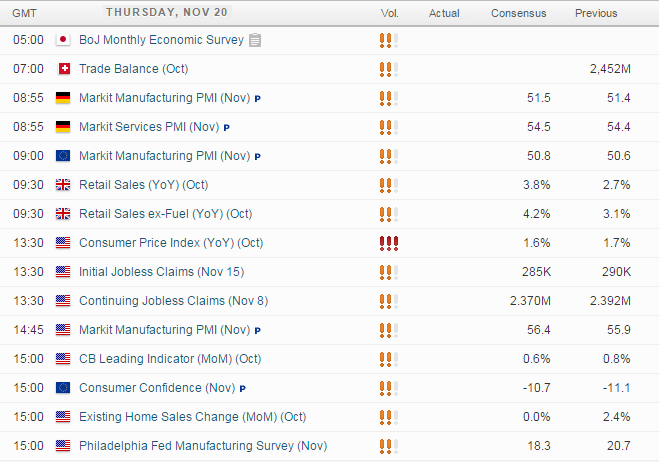

Busy night of news with releases from Europe, US and UK.

The BoE surprised the markets by being less dovish to see Cable rebound from the multi-month low. Strong retail sales may see an extension of this move.

EURUSD has drifted to resistance and we have several key data points from the Eurozone. Any weakness here should see it firmly back below 1.60

Then over to the US for employment, inflation and manufacturing data. Plenty here to get most markets moving if we miss expectations enough, in any direction.

TECHNICAL ANALYSIS:

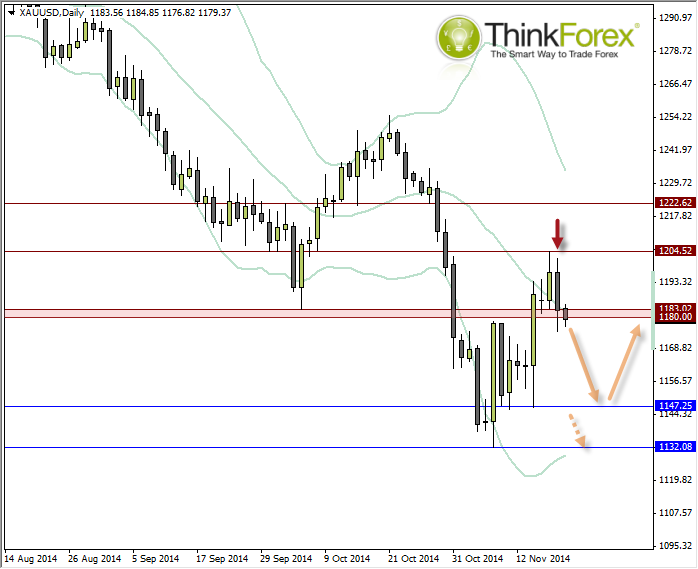

GOLD: Watching $1180

Whilst I suspect that Gold has formed a swing high at $1204, at time of writing I do not like how price meanders around $1108-83 and would prefer to see it below this resistance level.

That said at some stage we do need to take a punt, so we could consider shorting into any retracement within yesterday's range to assume a swing highs has been seen.

Any break above this level would favour $1108-83 becoming support and for price continue its way to the upper Bollinger Band.

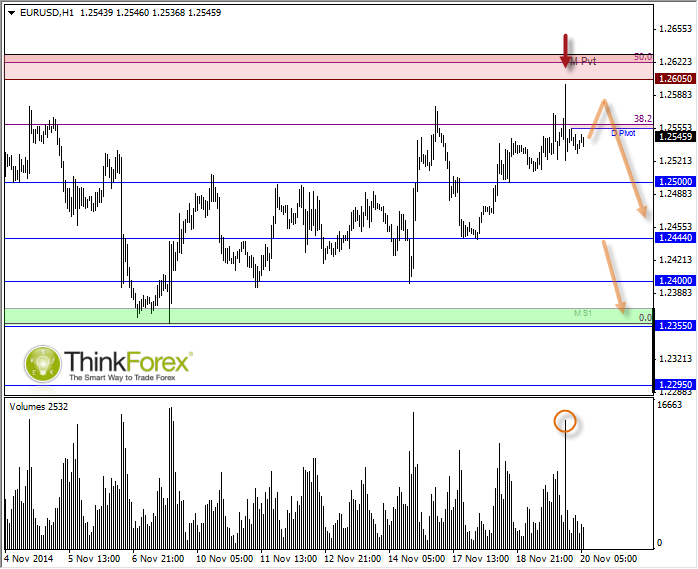

EURUSD: May have seen end of the correction

For a view of D1 and further details on this trade please see yesterday's post: EURUSD drifts towards 1.60 resistance

Price has tested the 1.605 resistance zone with a spike on higher volume. This suggests there has been a 'change in hands' at these levels and raises the potential for a top to have formed.

Keep in mind that spikes in isolation do not pinpoint with accuracy a top, as it is common to see several spikes around the same area. In fact I am hoping for another attempt to break higher so I can fade into it with a tighter stop / or move my stop further buying 1.605 to (hopefully) see EURUSD return to the bearish trend.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.