ASIA ROUNDUP:

It was certainly a game of two halves for AUD today following contrasting data to see a spike to 0.945 before a prompt reversal (and some more...)

Japan May core machine orders fall sharply; Down -14.3% y/y and -19.5% m/m, which was expected to be +0.9%.

AUD inflation expectations was down slightly to 3.8% from 4% last month. However markets were awaiting the employment figures which came in mixed.

AUD June Employment +15.9k (+12k expected) however FT employment was down 3.8k, whilst PT Employment was up +19.7k; Unemployment was also up to 6%, its highest in 3-months. AUDUSD spiked to 0.945 but quickly reversed as the markets absorbed the numbers.

Chinese Trade Balance fell short today to see AUDUSD wide off the day's gains and continue down below 0.940.

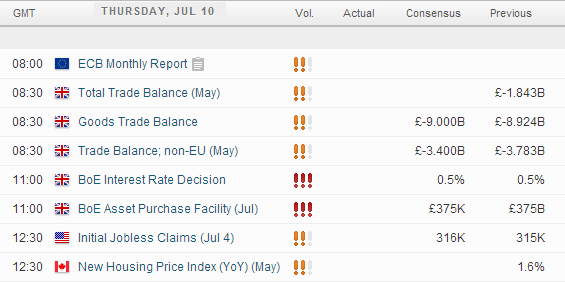

UP NEXT:

BoE Bank rate is widely expected to remain fixed at 0.5% and with another unanimous vote; what would be particularly bullish for GBP is if we saw some voting members become more hawkish, or a more specific timing clue for interest rate rises occur during the following rate statement. Conversely, if the statement comes across as surprisingly dovish then we can expect some bearish movements on GBP pairs as longs unwind their position. However before you become too bearish just remember that overall the trends remain up so, so GBP pairs favour 'buy the dip' strategies.

US Initial Jobless claims are expected to remain steady. Overall job data has been very positive for the US, so any weakness here should come as more of a surprise. However any significantly good employment could help AUDUSD remain around 0.945, EURUSD below 1.3650 and Cable below 1.718 high.

CAD New House Price Index is forecast to rise by 0.1% and considered a leading indicator of the housing industry. With USDCAD seemingly building a base above 1.062, any weakness here could help provide further support for USDCAD.

TECHNICAL ANALYSIS:

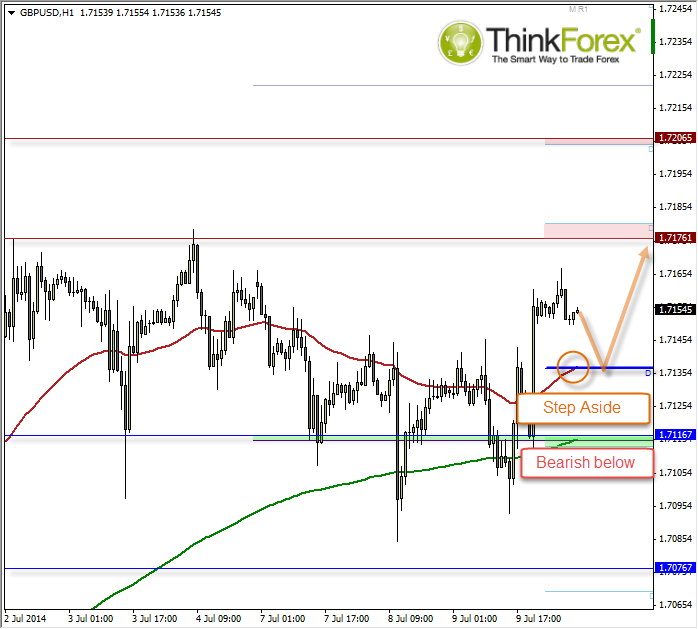

GBPUSD: Holds steady ahead of BoE rate statement

The setups itself is fairly straight forward; however it would require certain conditions being met before attempting it. First of all we need to see a basing pattern around the daily pivot, but due to BoE statement and US employment data tonight we could just witness a horrid spike around key levels which don’t provide traditional entry signals.

So ideally we will see GBPUSD drift towards the daily pivot and form this base before take-off.

In the event we do see a rate rise then expects some fireworks and for Cable to break to new highs.

If we break below the daily pivot we enter what I call 'no man’s land' as this is within a congestions area and sandwiched between key levels. Only a break below 1.711 would get my interest for bearish setups.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.