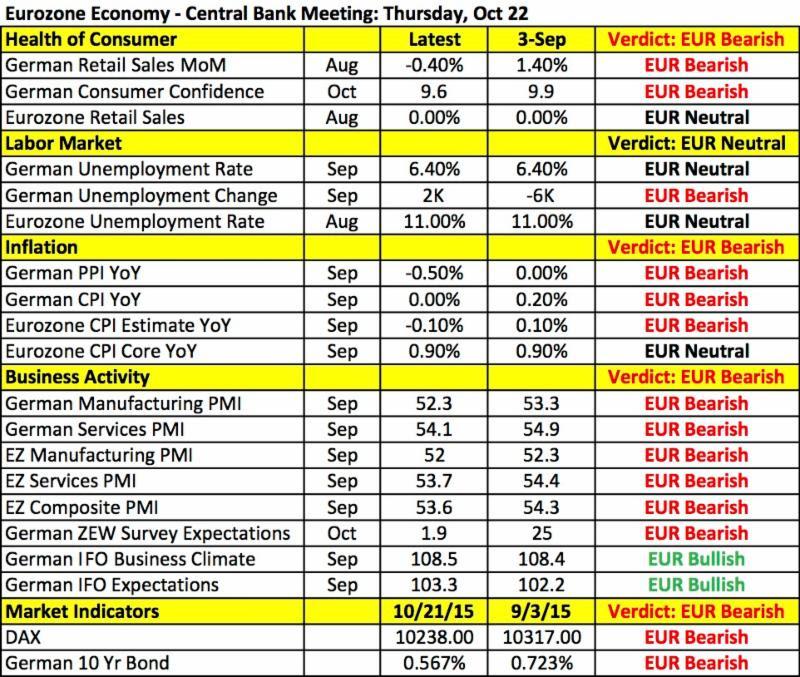

However investors are not positioned for additional QE based on the EUR/USD's recent price action. A lot of this sentiment has to do with the recent comments from Draghi who seemed to be in no rush to increase stimulus. Earlier this month he said the effects of QE surpassed their expectations. Although the recent source of Europe's troubles is Germany, Bundesbank President Weidmann believes more stimulus would not enhance growth and said he is not particularly worried about the global outlook. As such with two of the most important policymakers in the Eurozone reluctant to support more easing, investors are hesistant to take on large short EUR/USD positions ahead of the ECB meeting.

Yet if ECB President Draghi is dovish or eases, EUR/USD could fall quickly towards 1.12. In fact if they were to go further, there are 4 ways that the ECB could crush EUR/USD this week. The most damaging scenario for the euro would be if the central bank cuts interest rates. However considering that interest rates are already -20bp, the chance of the ECB driving rates even lower is low but the benefit is that it would broaden the type of assets the central bank could buy and require less logistical hurdles than more QE. The second option for the ECB would be to increase the size of their QE program. If they choose to do so without extending the end date, it would represent a more aggressive frontloaded operation that would also be extremely bearish for the euro. The third option would be to expand the types of bonds they can purchase to bank and corporate bonds and the final most talked about possibility is a simple extension of the soft deadline for the current program beyond September 2016.

Of course with everyone talking about the inevitability of more QE from the ECB, the greatest disappointment would be optimistic comments from Mario Draghi. The chance may be low but not impossible given his comments earlier this month.

Today's strong gains in USD/CAD give investors a taste of what they can expect for EUR/USD. The Bank of Canada left monetary policy unchanged but their decision to cut their 2016 and 2017 GDP forecasts weighed heavily on the currency. While Central Bank Governor Poloz tried to sound a bit more optimistic by saying there are "clear signs Canada growth is picking up," actions speak louder than words because the changes to their official economic forecasts left a greater the impression on the market. The BoC sees the recent decline in oil prices shaving 75bp from GDP. Unfortunately a further decline in oil prices also added pressure on the currency. Canadian retail sales are scheduled for release tomorrow and based on the drop in wholesale sales, we could be looking at another soft report that could take USD/CAD to 1.32.

Sterling is also in play tomorrow with UK retail sales scheduled for release. This is the most important piece of U.K. data this week. Although GBP/USD traded lower today, the recent increase in wage growth and rise in the BRC retail sales monitor points to the greater possibility of a stronger release that could lead GBP/USD to retest 1.55. BoE Governor Carney spoke today about the upcoming EU Referendum. He said there is no impact on the economy so far from the EU-Exit talk and the country benefitted from being apart of the EU while avoiding the drawbacks.

The U.S. dollar traded higher against all of the major currencies but with U.S. rates falling, the move is more a function of strength in commodity currencies. No news has been good news for the greenback but that changes tomorrow with jobless claims and existing home sales scheduled for release. Last week's claims report was the lowest in 4 decades and a rebound is expected.

Meanwhile the Australian and New Zealand dollars fell sharply against the greenback - their moves were driven entirely by the decline in commodity prices.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.