Today's Highlights

Eurozone data dominates

Global economy is cause for concern

FX Market Overview

Thursday's slim data diary gives way to a barrage of data from the EU and that will be followed by some interesting morsels from America. We have already had a swathe of economic growth figures from Germany and France to name just two but the morning will also bring Portugal's figures along with those from Italy and Greece and from the Eurozone as a whole. Zero growth is the most likely scenario for the Eurozone but some analysts are predicting contraction and that would be a bad thing for the euro. Euro buyers may want to get their automated orders in before 10.00am to ensure they capture the best of the volatility. We will also get Eurozone inflation figures which could also yield a 0.0% result. Not the most scintillating data I know but it does give some idea of the dire state of the Eurozone economy.

This afternoon brings US retail sales data as well as import and export prices and the University of Michigan consumer sentiment index. Whilst consumer sentiment and retail sales figures are forecast to be a tad on the positive side, that may not be enough to strengthen the already strong US Dollar.

According to a poll published by Bloomberg, 89% of respondents see deflation risk in Europe and 38% believe the global economy is worsening; twice as many as the last time they were asked in July. But the negative mood in the markets isn't just derived from Europe's woes, Chinese data points to a slowdown, falling commodity prices likewise and the geopolitical tensions caused by ISIS and a number of Middle Eastern problems are troubling global markets. EU officials are likely to get a bit of buffeting from other world leaders when they attend the G20 meeting this weekend. Europe's poor performance affects everyone.

And speaking of the weekend, if you are popping over to EuroDisney, just watch out for tigers. I'm not talking about Tigger here, there is apparently a real tiger on the loose and the Parisian police are on its trail. But there are good parts to this story because the wonderful thing about Tiggers is Tiggers are wonderful things. Their tops are made out of rubber and their bottoms are made out of springs but they are merciless killers and they will eat people.

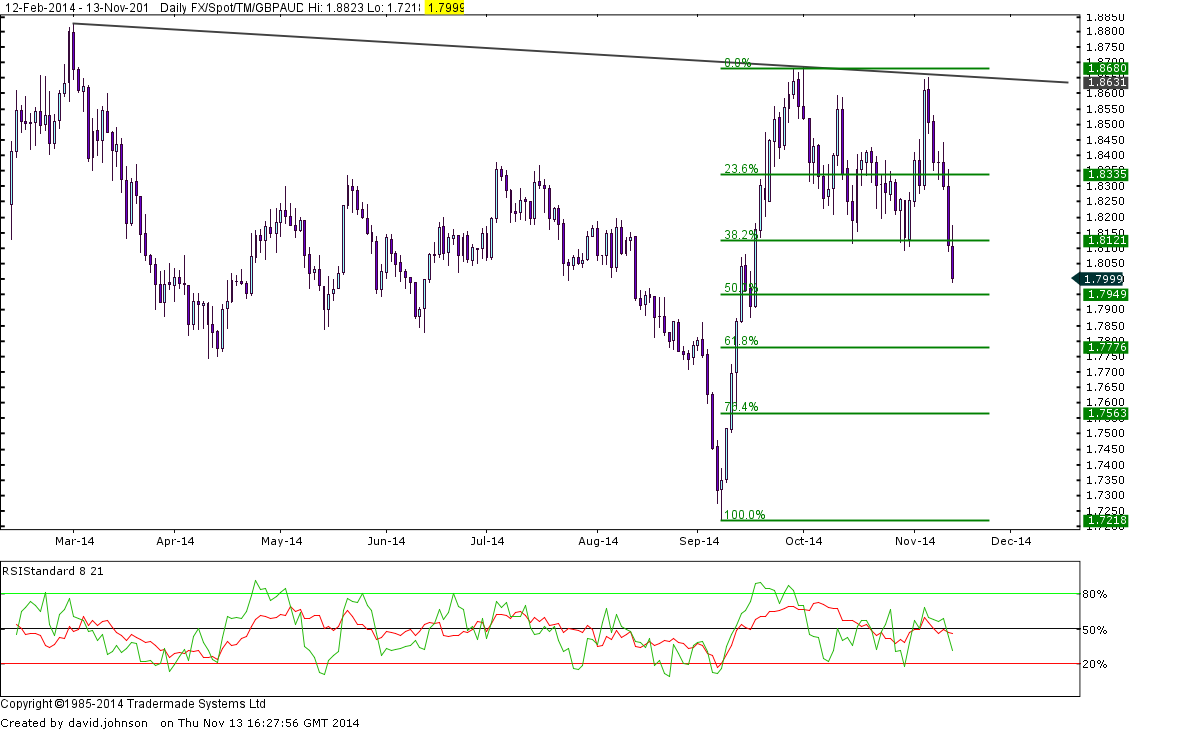

Currency - GBP/Australian Dollar

As it has become clearer that interest rates in the UK, EU, US and Japan are likely to stay at or around 0.0% for an extended period, the lure of the higher base rates in Australia and New Zealand has become more apparent. So, in spite of slower growth in Australia's major export market, the Australian Dollar is still gaining ground against most other currencies. Against the Pound, the AUD is heading for the next Fibonacci retracement level at A$1.7950 or thereabouts and I would be very surprised if we didn't see it hit that level. What happens next is the big question but, as that is an unknown unknown, it is worth Aussie Dollar sellers getting rid of some of their requirement at that level and placing a stop loss order to protect against a bounce in the value of the Pound at that point. Similarly, Sterling sellers may want to cover their risk in case the Pound capitulates and this pair pushes down towards the next target of A$1.7770.

Currency - GBP/Canadian Dollar

The Sterling – Canadian Dollar exchange rate is falling as the CAD copies its US counterpart and strengthens whilst Sterling reacts to the Bank of England's negative tone. The BOE pushed back the likely date of the first interest rate hike to October 2015 and that caused a significant sell off in the value of the Pound. Technically, the Pound has found support at C$1.78 where two trend channels intersect. You can see the blue and red channels in the chart above. In the short term, the Pound is looking oversold so Canadian Dollar selling is a sensible idea at this juncture. However. If the market does drop to C$1.77 or below, a more substantial fall to C$1.74 may well be on the cards. Prepare yourself for that possibility.

Currency - GBP/Euro

Sterling's strength in other currency pairs is not so evident against the beleaguered Euro. The Pound may have slipped from its recent highs but, at around €1.26, it is still within 2 cents of the strongest levels seen in the last 6 years. The medium term channel has a base level at around €1.24 and the longer term resistance line caps this pair at €1.28. It would be wise to use that range as your template for euro and Sterling buying levels. Any break of either end of this range would be significant as it would mark the breakout from a 6 year downtrend or an 18 month upward channel.

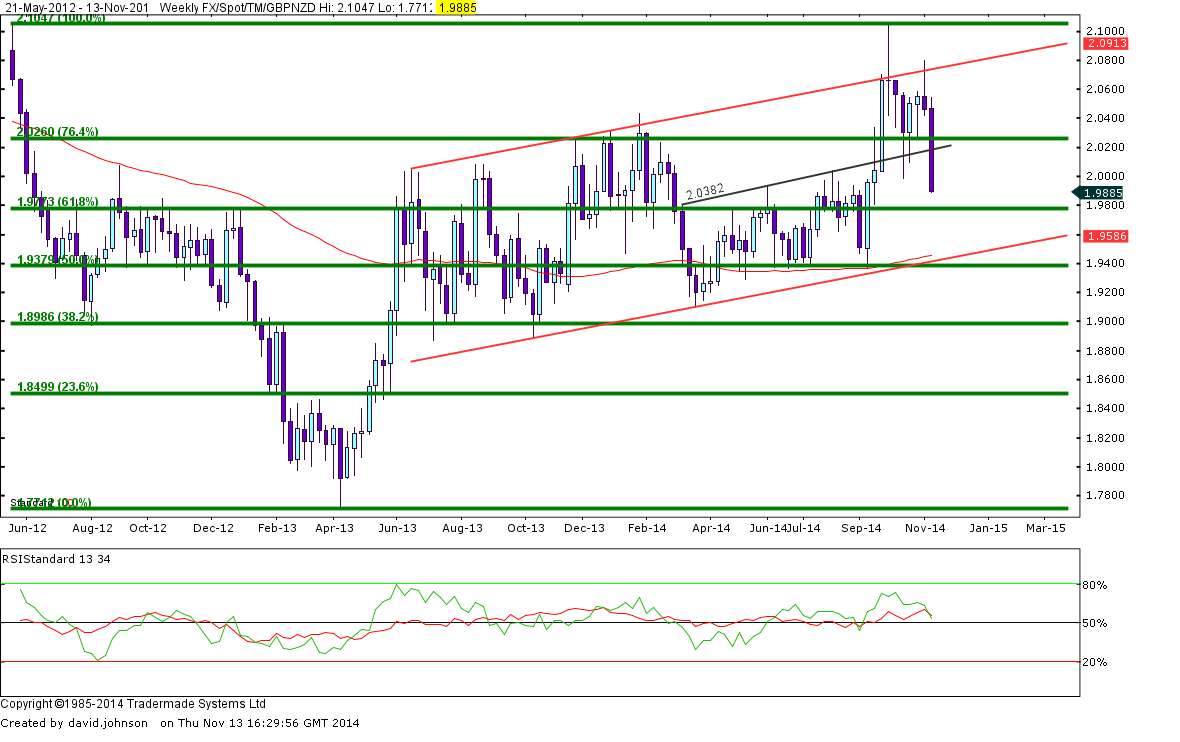

Currency - GBP/New Zealand Dollar

As mentioned in the Australian dollar section above, the attractiveness of New Zealand's 3.5% base rate cannot be underestimated at a time when it is impossible to get a worthwhile yield on almost any other currency. Investors, who can borrow at virtually 0.0% elsewhere, can make a guaranteed return by investing in NZ Dollars as long as they can hedge the exchange rate risk. The Reserve Bank of New Zealand is talking about a considerable delay before any further hikes but that will probably loosely coincide with hikes elsewhere; maintaining the NZ yield advantage. So we ought to plan for further NZ Dollar strength in the days ahead. A drop in the GBP-NZD rate to the bottom of the current channel NZ$1.95 is highly likely unless the Pound can find enough buyers around the NMZ$1.98level. That is a Fibonacci retracement line and it has seen buying and selling interest before.

Currency - GBP/US Dollar

The US Federal Reserve has hinted very heavily that they are considering earlier interest rate hikes than had previously been believed. That gave the US Dollar a solid boost last week and that pressure has continued into this week. Hence the Sterling – US Dollar exchange rate (Cable to its friends) has continued to follow the path it started etching out in July. That downward channel has taken us from $1.72 to the current $1.57; a 61.8% retracement level and a significant Sterling buying opportunity. Anyone who has been lucky enough to hold on from selling their US Dollar over the last 5 months is 9% better off and the trend may well continue to take this pair lower unless there is sufficient GBP buying interest here. If we do get a bounce, the psychologically significant $1.60 level will provide resistance.

Quote

Middle age is when you're sitting at home on a Saturday night and the telephone rings and you hope it isn't for you.

Ogden Nash

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.