Gold trades on the back foot as a firmer US Dollar weighs

- Gold trades lower as bullish momentum fades below the $4,500 psychological mark.

- A firmer US Dollar and modest profit-taking weigh on Bullion despite a supportive macro backdrop.

- Geopolitical tensions and upcoming US labour data keep traders cautious.

Gold (XAU/USD) remains under pressure on Thursday, with prices extending their pullback for a second consecutive day as bullish momentum fades following a rejection near the $4,500 psychological barrier. At the time of writing, XAU/USD trades near $4,425, down nearly 0.60%.

The loss of upside traction has encouraged modest profit-taking, while a steady US Dollar (USD), supported by firm US data, is adding further pressure and keeping Bullion capped despite a broadly supportive macro backdrop.

Geopolitical tensions continue to dominate market sentiment. Investors are closely monitoring developments surrounding the ongoing United States (US)-Venezuela turmoil, as well as fresh rhetoric from US President Donald Trump about Greenland.

Meanwhile, continued expectations of further monetary policy easing by the Federal Reserve (Fed) should help cushion further losses and keep dip-buying interest alive near key support levels.

Market movers: Rising geopolitical risks and US data keep markets cautious

- Data released by the US Department of Labor showed Initial Jobless Claims rose modestly to 208,000 in the week ended January 3, slightly below market expectations of 210,000 but above the previous week’s revised reading of 200,000. The four-week moving average of Initial Jobless Claims fell to 211,750 from 219,000. Continuing Jobless Claims rose to 1.914 million from 1.858 million.

- Adding to the headwinds, analysts note that precious metals may face a short-term price correction linked to the annual January rebalancing of the Bloomberg Commodity Index (BCOM). The reweighting is expected to take place between January 8-9 and January 15.

- In an interview with The New York Times on Thursday, US President Donald Trump said “only time will tell” how long direct US oversight of Venezuela might last, adding that he expects it to be “much longer” than a few months. Trump reiterated plans to rebuild Venezuela in a “very profitable way,” including using and selling the country’s Oil to push down global prices and generate revenue for both Venezuela and the US.

- On Wednesday, White House Press Secretary Karoline Leavitt said Oil from Venezuela is expected to arrive in the US very soon, adding that Washington has already begun marketing the crude and proceeds from sales are set to settle in US banks under US government oversight. Meanwhile, US Energy Secretary Chris Wright told an energy conference that the US plans to oversee Venezuelan Oil sales “indefinitely,” saying controlling the flow of Oil and revenue gives Washington significant leverage.

- Adding to the geopolitical backdrop, US authorities on Wednesday seized a Russian-flagged oil tanker in the North Atlantic that was allegedly linked to Venezuelan crude exports, according to US officials. Meanwhile, reports say a bipartisan US sanctions bill backed by President Donald Trump could give the administration the authority to impose tariffs of up to 500% on countries that continue to buy Russian Oil.

- The White House confirmed that President Donald Trump is actively discussing a potential purchase of Greenland, citing its strategic value, and said the use of the military “is always an option.” The remarks have drawn sharp diplomatic pushback from Denmark and NATO allies.

- US economic releases on Wednesday painted a mixed picture of the economy. The ISM Services Purchasing Managers Index (PMI) for December climbed to a 14-month high of 54.4, beating expectations of 52.3. The ADP Employment Change report showed private payrolls rose by 41K in December, below expectations of 47K, but reversing the previous month’s decline of 29K. JOLTS data showed job openings fell to 7.146 million in November from 7.449 million, undershooting expectations of 7.6 million.

Technical analysis: Bulls lose grip as prices slip below $4,450

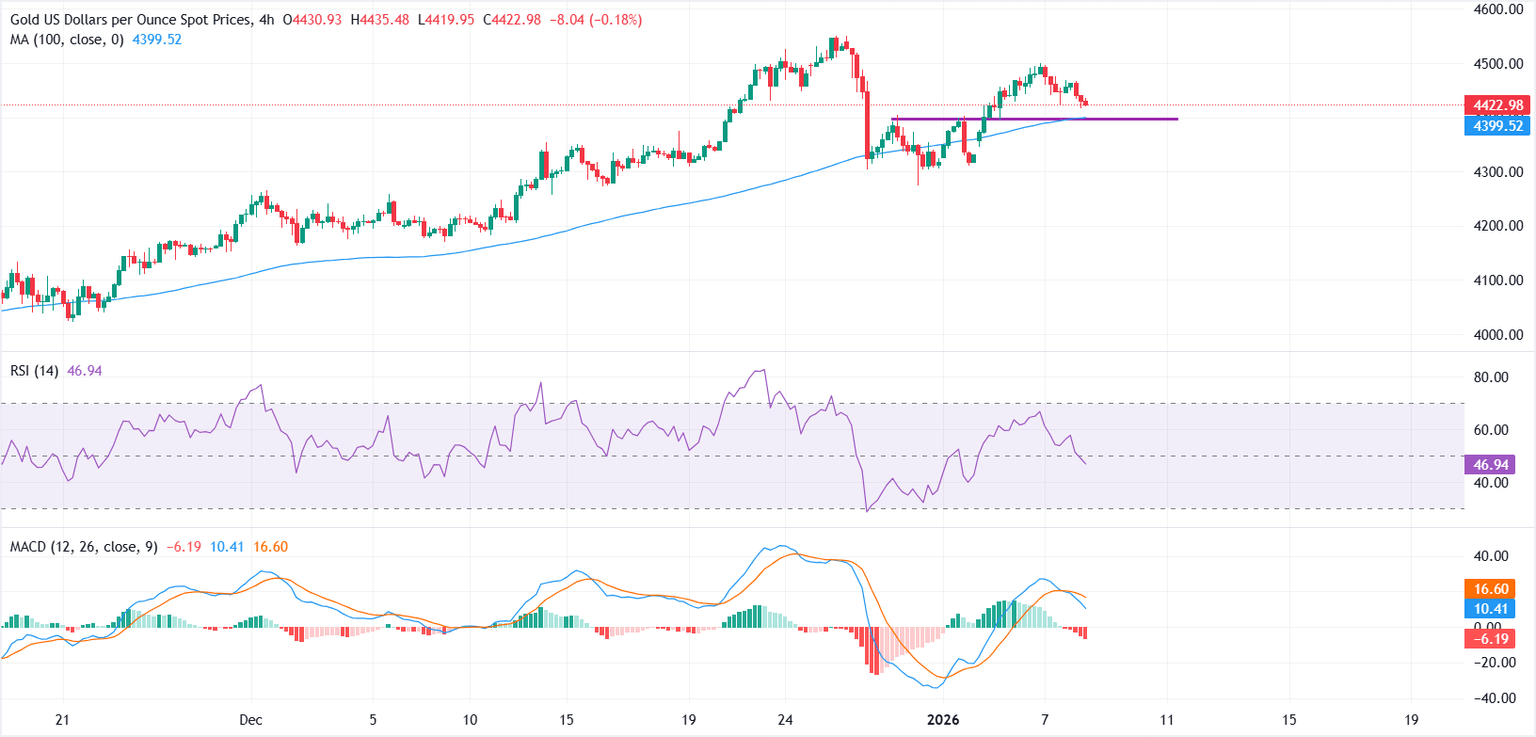

Gold’s near-term technical outlook has turned slightly bearish after prices failed to sustain a move above the $4,500 psychological level and extended losses below $4,450, a zone that now acts as immediate resistance.

Momentum indicators are reinforcing the softer tone. The Relative Strength Index (RSI) on both the hourly and daily charts is pointing lower after recently approaching overbought territory, suggesting bullish momentum is fading and buyers are stepping to the sidelines.

On the 4-hour chart, the 100-period Simple Moving Average (SMA), near the $4,400 area, stands out as the first line of defence for bulls. A clear break below this level would likely increase selling pressure and expose the next support near $4,300, where buyers emerged earlier this week.

(This story was corrected on January 8 at 14:40 GMT to say that the previous week’s revised Initial Jobless Claims reading was 200,000, not 199,000.)

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.