The actual exchange rate is decided by the market makers who operate as foreign exchange dealers. A dealer accommodates people who want to change one currency into another, usually for the purpose of trade or investment, dealers charge buyers a higher price than they pay sellers making themselves a profit by providing this service.

To understand what drives FOREX prices we need to understand the foreign exchange dealer function, how do they decide prices and what makes them increase or decrease price.

Jack Treynor in his 1987 article "The Economics of the Dealer Function" provided the definitive view of the way money market dealers operate, he gave us the Treynor model which gives a thorough insight into the motivation and actions of dealers.

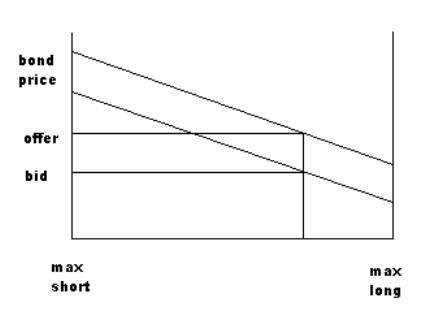

The model shown on the left shows the price of a security on the vertical axis and the exposure of the dealer on the horizontal.

Given a set position for the dealer, in the case highlighted the dealer is currently long the security. The mid point on the horizontal axis would be his flat position. The dealers bid and offer prices are shown, the spread being clear as the difference between these two.

Every time a dealer changes his net position his mean price (average of bid and offer) will change. If a customer who wants to buy a substantial amount of the security the dealer has to decide what price to offer the security at. The trade will alter the net position of the dealer, this new position will change the future price of the security, hence it must affect the current price, indeed the dealers current price must reflect what the price is expected to be in the future if it does not people will be able to make profit simply by trading with the dealer and he will consequently loose money.

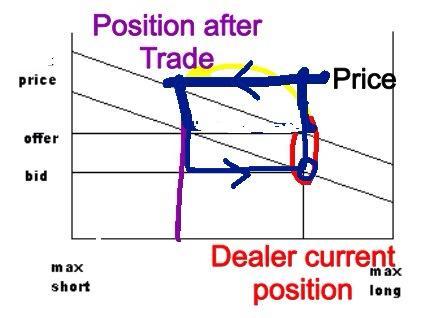

As an example of this suppose a trader wishes to buy a substantial number of GBP from the dealer to pay for goods bought in the UK from an exporter. If the current dealer position in GBP is shown in red,(according to the diagram he is net long the GBP) after taking the deal, selling GBP to the customer, he will have less GBP, he may be short GBP, his new position is shown in purple.

To ensure the customer cannot make a profit by undoing the deal he must offer the price that would take effect after the deal. Which is higher than the offer price before the deal. The blue box shows what would happen if the customer sold the GBP back immediately, the dealer would make the spread on both trades and the customer would loose money.

As the size of a dealers position grows they take on more and more price risk, they are not in the business of speculation, they are merely providing a service and taking a profit for doing so. If the orders arrive in a symmetrical fashion, equal buy and sell orders, the dealer will be happy his current position will be flat and he will continue to make the spread.

Often an investor will come to the market who has a view on the asset that is not yet reflected in the price, a series of such investors would result in the dealer holding a large position and getting sand bagged along with the other investors who did not have the new insight. Investors decide if their insight is sufficient to cancel the cost of trading, if not they should not trade.

If the dealer reaches his maximum position he will turn to the dealer of last resort, the central bank, to lay off his position.

The balanced dealer

In the above discussion which is a simplified view of the dealer function but sufficient for people to get a good understanding of what happens, the dealer will be constantly exposed to price risk for the underlying security. If that were the case they would be speculative dealers making profit from the movement in currency not from providing a service.The majority of FX dealers do not expose themselves to price risk, they are not speculative dealers. To mitigate the risk the dealer will hedge each position by opening a forward exchange contract. If the value of the security drops it is offset by changes in the forward contract. The price risk has not disappeared it has been transferred to someone else by the forward contract. The forward will often be held by a speculative dealer with a naked long or short position however they may move some of the risk on with more forwards.

The dealer has replaced price risk with liquidity risk as he must now be able to role over the forward contracts as required. Hence the need for liquid markets!

Having discussed the economics of the dealer function which is the main driver of foreign exchange rates we can see that the price that the dealer quotes depends on two distinct things

The volume of buying and selling of a particular currency

The price of the forward contract needed to provide matched book.

1. Estimating the physical demand for a currency

We can get a good estimate of this by looking at two things, the trade balance and the volume of government securities being bought by foreigners. There are other reasons to change currency but these are the two major sources of currency exchange. If a currency has a negative trade balance (importing more than it exports) this will put downward pressure on the exchange rate as people are selling the local currency to buy the currency of the exporting country to pay for goods and services.High yield on government debt will attract foreign buyers who will have to buy the local currency before they purchase the government bond, this effect is very noticeable at the moment with the euro and some of the more peripheral country bonds offering high yield. Figures of foreign ownership of debt are published by each central bank as is their timetable for issuing new

2.Estimating the forward price

We must consider two numbers here, the expected price and the forward price, many people believe these two things should be the same(that is the UIP uncovered interest rate parity). If the two numbers were the same it would be impossible for the speculative dealer to make a profit and the balanced book dealer would not be able to hedge his position. The speculative dealer makes money when the forward price is less than the expected spot price, which is proven empirically to be true.The forward and the expected spot rate are linked closely to interest rate expectations and hence monetary policy.

Having discussed the dealer function in this way and concentrated on the matched book dealer we have a much better understanding of how changes in the prices of FOREX can be explained.

Editors’ Picks

US Dollar declines as Trump tariff uncertainty grows

The US Dollar stays under bearish pressure to start the new week as investors assess the headlines surrounding the US trade regime. After the Supreme Court ruled against US President Trump's tariffs, Trump hiked global tariff rates to 15%.

Gold climbs above $5,100 on broad USD weakness

Gold sticks to its bullish bias near the monthly above $5,100 on Monday. Renewed trade-war fears, along with rising geopolitical tensions in the Middle East, turn out to be key factors that underpin the safe-haven precious metal and validate the constructive outlook.

EUR/USD holds above 1.1800 after German sentiment data

EUR/USD stays in positive territory above 1.1800 on Monday after the data from Germany highlighted a modest improvement in business sentiment in February. Meanwhile, the US Dollar stays under pressure amid growing unceratinty surrounding the US trade regime, allowing the pair to hold its ground.

Cardano braces for impact as US tariff storm brews

Cardano is down 4% at press time on Monday, entering its third consecutive day of decline. Bearish bias in Cardano’s derivatives market positional buildup aligns with rising pressure on the broader cryptocurrencymarket amid US President Donald Trump's reassessment of global tariffs and domestic conflict with the US Supreme Court.

Supreme Court nixes tariffs, Trump teases 15% global tariff

On February 20th, the Supreme Court ruled that Trump’s global tariffs under IEEPA authority were unconstitutional, effectively nullifying the framework. However, the relief was short-lived. Within hours, Trump floated a 15% blanket tariff under an alternative legal authority.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.