![]()

How many times have you heard someone say, “Trading is an art, not a science.”? I have heard that for years and years and I have to say, it is probably the most ridiculous statement I have heard when it comes to trading and, as we all know, there are some pretty ridiculous statements in the trading world. There is absolutely nothing artistic about trading at all. This is, 100%, a numbers game… How much willing demand and supply there is at each price level is what determines price turns and movement. It’s the buy orders vs. the sell orders and, again, it all comes down to the numbers on both sides of that equation and nothing else. To think Picasso or Van Gough should be brought into this discussion is rather amusing if you think about it. To illustrate the point, let me share a very recent trade we setup for our students in the Extended Learning Track (XLT, our live Forex trading room).

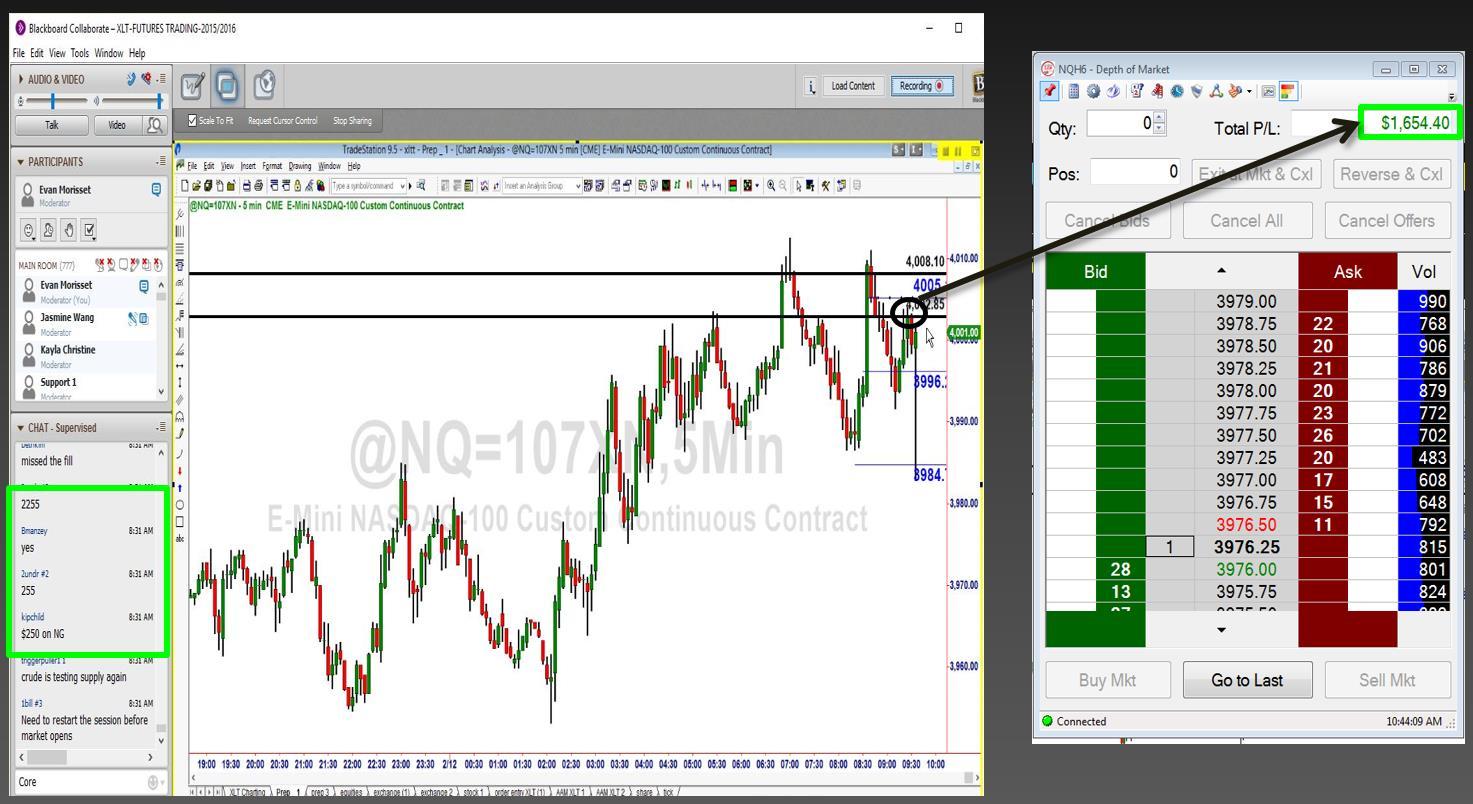

Live Trading Session – Feb. 12, 2016

During this session we were going over a shorting opportunity in the NASDAQ. Notice the supply level with the black lines around it. According to our supply and demand strategy that I write about so often, that area shaded was a key supply level. Meaning, institutions/banks had large orders to sell at that level, there was a significant supply and demand imbalance at that level. We know this because price could not remain at that level and declined in strong fashion after a very short period of time (Odds Enhancer #1). Think about it, if supply and demand were in balance at that level, price would have remained at that level, but it couldn’t because supply and demand were very much “out of balance”. I mentioned price spent very little time at that level and this is a key point. OTA Odds Enhancer #2: The less time price spends at a level, the more out of balance supply and demand is at the level. Trading books tell us when looking for key support and resistance levels to look for areas on the chart where there was lots of trading activity, many candles on the screen, above average volume and so on… If you think the simple logic through, I think you will find the opposite to be true. At price levels in any market where supply and demand are most out of balance you are going to get very few transactions (trades), not many trades. Therefore, that picture on a chart is going to be few candles on the screen, not many like all the trading books say and this was the case in our trading opportunity above.

As you can see on the chart to the right, a bit later price rallied up to the supply level offering us an opportunity to sell short with a significant profit zone below. As the chart shows, there was little demand below meaning price should have a very easy time falling. Lastly, when price reaches supply we always want to know who we are selling to. We need to make sure we are selling to a novice retail trader, someone who is clearly willing to pay retail prices. The way we answer this questions is this: Is the buyer we are selling to buying after a rally in price and into a price level where supply exceeds demand. These are the two footprints of a novice market speculator. If the answers are yes and the risk to reward meets the minimum criteria we are looking for, we take the trade like a robot.

The mathematical equation we mapped out in advance played out as we thought and our profit target was achieved. If you think art had anything to do with this, I have an original very rare one of a kind painting that was painted by Big Foot in the Rocky Mountains 200 years ago. It’s worth $100,000 but I will give it to you for $10,000, so hurry. You see, when I was on the institution side of the trading business it was very clear from day one that price moves 100% because of an ongoing supply and demand equation in each and every market. Trading opportunities exist when this simple and straight forward equation is out of balance. At the CME where I began my career, they didn’t have Monets or Picassos on the wall, they had bids and offers. If I wanted to see art, I would walk down Monroe Street to Michigan Avenue and go to the Art Institute. Goldman Sachs doesn’t start out each trading day with a company meeting to discuss artistic opportunities in the market; every single decision is based on inventory, order flow and risk/reward. The only place art and trading come together is in the world of conventional technical analysis. Meaning, conventional chart patterns which people refer to as the “art,” like Head and Shoulders, Cup and Handle and all the others that will serve you much better with a frame around them on your wall than they will trying to use them to make money. While I may get some unfriendly emails from this article, I take it as my responsibility to be very honest with people as your hard earned money is on the line with each and every trade.

Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD holds losses below 1.1850 ahead of FOMC Minutes

EUR/USD stays on the back foot below 1.1850 in the European session on Wednesday, pressured by renewed US Dollar demand and reports that ECB President Lagarde will step down before the end of her term. Traders now look forward to the Minutes of the Fed's January monetary policy meeting for fresh signals on future rate cuts.

GBP/USD defends 1.3550 after UK inflation data

GBP/USD is holding above 1.3550 in Wednesday's European morning, little changed following the UK Consumer Price Index (CPI) data release. The UK inflation eased as expected in January, reaffirming bets for a March BoE interest rate cut, especially after Tuesday's weak employment report.

Gold retains bullish bias amid Fed rate cut bets, ahead of Fed Minutes

Gold sticks to modest intraday gains through the early European session, reversing a major part of the previous day's heavy losses of more than 2%, to the $4,843-4,842 region or a nearly two-week low. That said, the fundamental backdrop warrants caution for bulls ahead of the FOMC Minutes, which will look for more cues about the US Federal Reserve's rate-cut path.

Pi Network rally defies market pressure ahead of its first anniversary

Pi Network is trading above $0.1900 at press time on Wednesday, extending the weekly gains by nearly 8% so far. The steady recovery is supported by a short-term pause in mainnet migration, which reduces pressure on the PI token supply for Centralized Exchanges. The technical outlook focuses on the $0.1919 resistance as bullish momentum increases.

Mixed UK inflation data no gamechanger for the Bank of England

Food inflation plunged in January, but service sector price pressure is proving stickier. We continue to expect Bank of England rate cuts in March and June. The latest UK inflation read is a mixed bag for the Bank of England, but we doubt it drastically changes the odds of a March rate cut.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.