![]()

From birth, we are conditioned to trade incorrectly. We naturally run from things we are fearful of, and are drawn to things that make us feel good. If you take this action in trading you are headed for trouble which, in the trading world, means losses. For example, if your invitation to buy into a market comes only after an uptrend is well underway, all the indicators are pointed up and the news is good on that market; where do you think price is in that market? Yep, it’s likely very high. To buy here completely goes against how you make money buying and selling anything and is very high risk. Never forget, when you buy many people have to buy after you and at higher prices or there is no chance you will profit in your trade. To obtain an entry that allows you to buy before others and at price levels where the risk is low, most of the time (if not all the time) you are buying at the end of a downtrend, when most indicators are pointing down and when the news is bad. This action is completely against our mental make – up. As I said before, we are conditioned from birth to trade incorrectly. That action or belief system is often reinforced during the many years of traditional finance/economics in high school and college education. For example, most college courses on markets teach to us to do plenty of research on a stock before buying into that market. The general rule is to make sure the company has good earnings, good management, is a leader in its industry and has a stock price that is in an uptrend. Again I ask you, where do you think the price of the stock is when all this criteria is true? Almost always, the stock price is very high when this criteria is true which ensures that if you buy now, you are simply paying everyone else who bought before you at lower prices.

In my opinion, there are two things that you must have if you are to succeed at trading or investing. First, you must have a solid understanding of how the market really works and a rule based strategy based on the objective laws of supply and demand. Due to very little regulation in the trading/investing education industry, most people learn to trade completely wrong from people who are good at marketing but not so good at trading. This ensures that perhaps as much as 80% of people who attempt to trade will fail as they never learn how a market or trading really works and, instead, are poisoned with trading education and information that has them buying high and selling low. This path is fraught with lagging indicators and oscillators and conventional technical analysis information that leads to high risk, low reward trading and investing. Second, you must have the discipline to follow your rule based strategy. So, of the roughly 20% of hopeful traders who actually obtain proper trading education, the lack of discipline factor likely eliminates 80% of them, which adds up to a select few that ever make it. Before you stop reading this piece and throw it into your fireplace because it is so negative, sit tight and read on, help is on the way…

Along with driving the education at Online Trading Academy, I am one of the instructors for the Extended Learning Track (XLT) which is an educational live online trading room at Online Trading Academy. I have been trading Stocks, Futures, Forex, and Options for many years and, being around new traders at Online Trading Academy, I see so many people come into the program not having the two most important pieces of the trading puzzle mentioned above. Let’s go over a trade from last week from our Supply/Demand Grid in hopes that you will get closer to having a solid understanding of how proper trading and markets work; and then I will show you how we handle the discipline issues that can be so challenging for new traders in the program.

Income Trade Apr. 28, 2015. S&P Futures. Profit: $2975.00

Before the opening of the market I simply marked off the Supply zone where banks were selling. Once the market got going, I was happy to sell to someone who wanted to buy after a rally in price and at my predetermined supply level as that is the low risk / high reward / high probability time to sell. Understand that the laws of supply and demand ensure that the buyer who buys after a rally in price and at price levels where supply exceeds demand will most often lose, so we use our rule based strategy to make sure we are there to take the other side of that trade and sell to the ill-informed buyer who is buying at retail levels where banks are selling (supply). Next, as price declined, I bought back the position for profit near demand. Who did I buy from? I bought from the trader who is making the same two mistakes every consistently losing buyer and seller of anything makes. First, they are selling after a big decline in price, mistake number one. Second, they are selling at a price level where the chart is suggesting demand exceeds supply. Why would someone buy from me at the entry price level? They would buy because they are conditioned to buy when the news is good, where a solid uptrend is underway, and simply because the basic human brain is wired to buy when everyone else is buying, at or near supply (retail prices).

The Answer

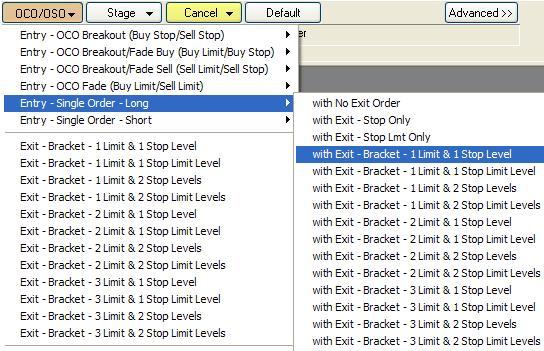

If you think I or members of the Academy are able to take these trades because we have somehow de-humanized our brains and have some super powers that only successful traders have, think again. We think and feel much of the same things everyone else thinks and feels. The key is that I realized years ago that my human brain is flawed when it comes to proper trading and has the potential to be my own worst enemy, so I make sure I do my objective rule based analysis based on the laws of supply and demand and then take full advantage of today’s fantastic order execution capabilities to make sure emotion never even has a chance to come into my trading world. Below, I have taken a picture of what type of order I would use when buying. By selecting the “OCO” (order cancels order) order below, I am able to enter an order to buy at demand, enter a protective sell stop order to limit the risk because you (and I) will have losses from time to time, and also enter a sell limit order to take profits all at the same time. Once I set up that order and execute it, I am hands off for that entire trade from start to completion. This accomplishes two things for me and people in the Academy. First, it takes care of the emotions and second, it means we don’t have to sit in front of the computer screen all day; life is way too short to do that in my opinion. I call this “set it and forget it” trading.

Today, just about any type of order you can think of is available. I encourage you to begin to take advantage of the opportunity to set and forget your short term income and long term wealth opportunities.

As always, never forget that those who know what they are doing in the markets simply get paid from those who don’t, so make sure you have the two issues discussed in this piece figured out before you put your hard earned money at risk.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

AUD/USD shrugs off losses, retargets 0.7100

AUD/USD partially fades Wednesday’s pullback, managing to regain balance, leave behind the earlier drop to the 0.7020 zone, and trade with modest gains ahead of the opening bell in Asia. Moving forward, the preliminary PMIs will be the salient event in Oz on Friday.

EUR/USD remains offered below 1.1800, looks at US data

EUR/USD is still trading on the defensive in the latter part of Thursday’s session, while the US Dollar maintains its bid bias as investors now gear up for Friday’s key release of the PCE data, advanced Q4 GDP prints and flash PMIs.

Gold surrenders some gains, back below $5,000

Gold is giving away part of its earlier gains on Thursday, receding to the sub-$5,000 region per troy ounce. The precious metal is finding support from renewed geopolitical tensions in the Middle East and declining US Treasury yields across the curve in a context of further advance in the Greenback.

XRP edges lower as SG-FORGE integrates EUR stablecoin on XRP Ledger

Ripple’s (XRP) outlook remains weak, as headwinds spark declines toward the $1.40 psychological support at the time of writing on Thursday.

Hawkish Fed minutes and a market finding its footing

It was green across the board for US Stock market indexes at the close on Wednesday, with most S&P 500 names ending higher, adding 38 points (0.6%) to 6,881 overall. At the GICS sector level, energy led gains, followed by technology and consumer discretionary, while utilities and real estate posted the largest losses.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.