![]()

One of the first things I tell new Online Trading Academy students when they ask for advice is to really open your eyes and pay attention. What I am suggesting is that they (you) pay attention to the reality of what is happening around you. Being aware of the simple things in life that most people ignore is one of the most important components to desirable outcomes and achievements.

If you think what I am suggesting is a waste of time and just another article on trading psychology, think again. Think of one or two of the biggest mistakes you have made in your life. It could be in trading, a failed relationship or marriage, a bad choice that caused you your job, losing part of your nest egg to a bad investment, and so on. I bet the ultimate reason you made this mistake is because you were not paying attention to a reality that was right in front of your eyes. Do you look back on that mistake these days and say, “How could I have done that?” “How did I not see that coming?” It all seems so obvious after the fact. It all comes down to simply paying attention to what is happening all around you, being aware.

We talk about this in our live online trading and investing sessions. We focus more than anything else on paying attention to the reality of what the PRICE ACTION is telling us. Not thinking too deep, but more importantly, paying close attention to the simple supply and demand information the market is always conveying to us. What is important for you to understand is that this important market information is only given to those who listen.

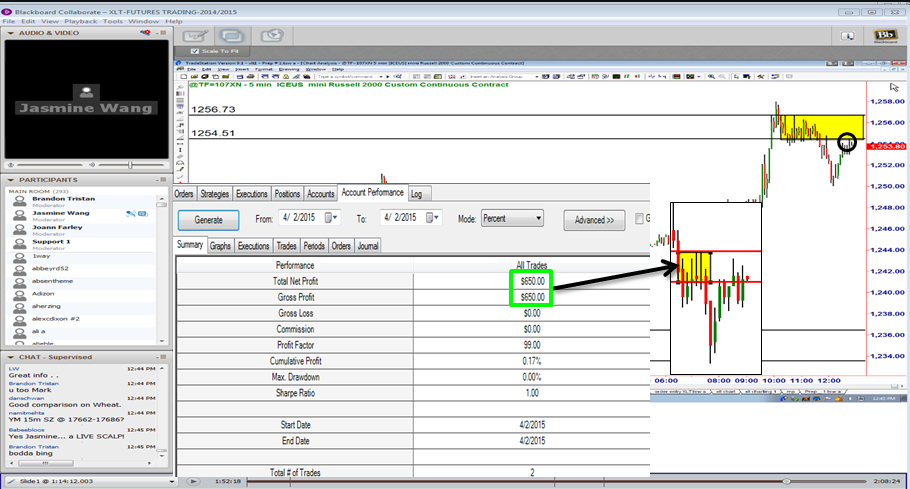

Live Online Trading Session Trade, April 2nd 2015. Income Trade Profit: $650

This picture is a screen shot of the XLT, our online live trading room, on April 2nd. We were looking at the S&P and Russell Futures and discussing this market during the session. What we do in the first part of the trading and analysis session is go through the markets we trade and show students how we find and setup low risk, high reward and high probability trading opportunities. The two lines on the chart above are drawn around a cluster of trading which we call supply in this case. During that period of trading price was not moving much, supply and demand appeared to be in balance. All of a sudden price declined from that level in strong fashion, as you can see above. What the market was telling those who were willing to listen at that time was simply that supply greatly exceeded demand at the origin of that decline in price which is why we drew two lines around the cluster of trading. This is where the bank and financial institution sell orders were. In the XLT, we call this a “supply zone” or “sell zone.” This set up a quality trading opportunity in the near future, for those who were paying attention.

Once the market got going that day and after we planned out the low risk, high reward and high probability shorting opportunity in the XLT, price eventually rallied back to that level where we had our predetermined supply zone. This is where we look to sell. What makes this a high probability shorting opportunity is best understood when you focus on who is on the other side of your trade, the buyer in this case. The buyers who bought when price revisited our supply zone were making two key mistakes. First, they bought after a rally in price and second, they bought at a price level where supply exceeded demand; the chart already told us that. These two actions tell us that these are novice traders who take action when the odds are stacked against them. By taking the other side of that low odds trade, we are taking the high odds trade. The trade went on to reach the target for low risk gain.

Being able to consistently identify turning points in markets is the key to low risk and high reward trading and investing. This begins with being able to objectively quantify demand and supply in any market. To get to that point you must have to be able to do something most people can’t, and that is paying attention to the reality of how proper trading and investing really works.

Instead of reading all the trading books and learning to buy and sell in markets when everyone else buys and sells (no edge)…

Instead of acting on the advice of others who likely get paid from that advice, not from trading…

Pay attention to what is happening in front of your eyes. Pay attention to what is happening around you.

Hope this was helpful. Have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD trims losses, flirts with the 1.1850 zone

EUR/USD is back on the back foot on Wednesday, slipping below the 1.1850 area as the US Dollar picks up some modest traction. The move comes as traders position ahead of a busy run of US data and the release of the FOMC Minutes. Adding to the pullback are reports that the ECB’s Lagarde may step down before completing her term.

GBP/USD flirts with daily highs near 1.3580

GBP/USD manages to set aside two consecutive daily declines and trades with slight gains in the 1.3580 zone on Wednesday. Cable’s uptick comes despite acceptable gains in the Greenback and easing UK inflation figures, which seem to have reinforced the case for a BoE rate cut in March.

Gold regains some shine, retargets $5,000 ahead of FOMC Minutes

Gold gathers fresh upside traction on Wednesday, leaving part of the weakness seen at the beginning of the week and refocusing its attention to the key $5,000 mark per troy ounce, all ahead of the release of the FOMC Minutes and despite the modest uptick in the US Dollar.

Pi Network rally defies market pressure ahead of its first anniversary

Pi Network is trading above $0.1900 at press time on Wednesday, extending the weekly gains by nearly 8% so far. The steady recovery is supported by a short-term pause in mainnet migration, which reduces pressure on the PI token supply for Centralized Exchanges. The technical outlook focuses on the $0.1919 resistance as bullish momentum increases.

Mixed UK inflation data no gamechanger for the Bank of England

Food inflation plunged in January, but service sector price pressure is proving stickier. We continue to expect Bank of England rate cuts in March and June. The latest UK inflation read is a mixed bag for the Bank of England, but we doubt it drastically changes the odds of a March rate cut.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.