![]()

Where will price turn, where will price move to?

The question above is the most important question to the trader and investor in any market. You can be the top fundamental analyst in the world and know your data inside and out but it all comes down to where price will turn and where price will go. To answer this question requires a simple focus on one thing and one thing only, buy and sell orders (demand and supply). Most people focus on the market turning and timing portion first and foremost but that is only half the focus. The focus of today’s piece is to help you predict where price will move to and we will do that by looking at a trading opportunity offered in the Mastermind Community last week.

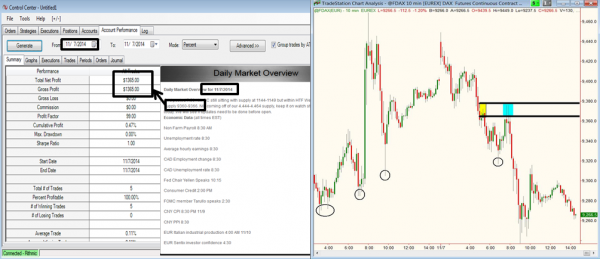

DAX Futures 11/7/14 Daily Market Overview Income Trade – Profit: $1,365.00

The key is to know how to identify where banks are buying and selling. Specifically, what the picture of demand (unfilled buy orders) and supply (unfilled sell orders) looks like on a price chart. The trading opportunity was found by using the Daily Market Overview in the Mastermind Community. The trade was to sell short the DAX at a fresh supply zone as noted on the Daily Market Overview and the yellow box on the chart. Once price falls away from that yellow shaded area, the price pattern and odds enhancers tell us banks are selling the DAX in that area and that now all their orders are filled. In short, we have a fresh supply zone. Whether we take the trade or not depends on one more important factor, where is demand. Once supply is established, we need to know where banks are buying, where significant demand is. The circled areas on the chart are pivot points which is where conventional technical analysis “support” is. Meaning, most people expect price to stop falling and turn higher at those pivot lows (circled areas). At Online Trading Academy, our rules and logic tell us those pivot lows are not demand and we expect price to fall right through those levels. The picture on the chart in those area’s does not represent unfilled buy orders and remember what I said above, this is all about the buy and sell orders, nothing else. There is a reason you don’t see many people making any money from conventional technical analysis trading books.

So, the simple reason I sold short was because there was fresh supply and no significant demand below. In other words, we had a ceiling and the floor was much lower. All this can be clearly seen in the charts if you know what you are looking for and have a razor sharp focus on orders. The blue area is the entry point for the trade, selling short to a buyer who was buying after a rally in price and at a price level where supply clearly exceeded demand. This short term income trade worked out for a $1,365.00 profit during the morning trading session. Whether you are trading for short term income or long term wealth, whether you are buying or selling, nothing in this piece changes. By focusing on where the significant buy and sell orders are in the market, you will answer the two most important questions.

Where are prices going to turn? Price will turn at fresh supply and demand levels.

Where are prices going to move to? Price will move through levels where there is a lack of supply and demand.

Price in any and all markets simply moves to and from supply and demand levels. Understand this simple concept and unlock a life time of low risk, high reward, and high probability trading opportunity. For more on this concept, read some of my prior articles or join us at a trading workshop.

Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD remains below 1.1850 after US data

EUR/USD struggles to gain traction and trades in a narrow range below 1.1850 on Wednesday. The US Dollar stays resilient against its rivals following the better-than-expected Durable Goods Orders and housing data, limiting the pair's upside ahead of FOMC Minutes.

GBP/USD stays in narrow channel above 1.3550 ahead of FOMC Minutes

GBP/USD holds its ground following Tuesday's slide and moves sideways above 1.3550 midweek. Although the data from the UK confirmed that inflation cooled in January, the positive shift seen in market mood helps the pair keep its footing as investors wait for the Fed to publish the minnutes of the January policy meeting.

Gold regains some shine, retargets $5,000 ahead of FOMC Minutes

Gold gathers fresh upside traction on Wednesday, leaving part of the weakness seen at the beginning of the week and refocusing its attention to the key $5,000 mark per troy ounce, all ahead of the release of the FOMC Minutes and despite the modest uptick in the US Dollar.

Pi Network rally defies market pressure ahead of its first anniversary

Pi Network is trading above $0.1900 at press time on Wednesday, extending the weekly gains by nearly 8% so far. The steady recovery is supported by a short-term pause in mainnet migration, which reduces pressure on the PI token supply for Centralized Exchanges. The technical outlook focuses on the $0.1919 resistance as bullish momentum increases.

Mixed UK inflation data no gamechanger for the Bank of England

Food inflation plunged in January, but service sector price pressure is proving stickier. We continue to expect Bank of England rate cuts in March and June. The latest UK inflation read is a mixed bag for the Bank of England, but we doubt it drastically changes the odds of a March rate cut.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.