![]()

…One of everybody’s favorite John Candy movies of all time. When I was a teenager, I had a very small part in another one of his movies and got to meet him. He was a big funny guy just like I expected. As funny as the movie is, there is a real story in it that all traders and investors need to be aware of. I go through periods where I travel quite a bit through air, cars, and occasionally the Tube in London and elsewhere. Air travel can be tricky and draining because of airports and weather you and I have no control over. Being an Executive Platinum member, knowing all the short cuts, and tricks with lines and special seating, the experience can still be long and draining at times. Overall, I do enjoy air travel. Sitting back with no access to a phone is quite relaxing. Driving to your destination is another story. Long airport lines are replaced by stand still traffic, road raged drivers, and icy roads if you live in Chicago like I do. You are also now the pilot so there is much more responsibility than flying. However, heated seats and a good sound system make driving a pleasure these days. Train travel is something I have not experienced much but when I do, it is typically a packed tube in London or the subway in Manhattan. Wherever you’re going, whether your destination is Florida or the North Pole, a plane, train, or automobile can get you there just fine.

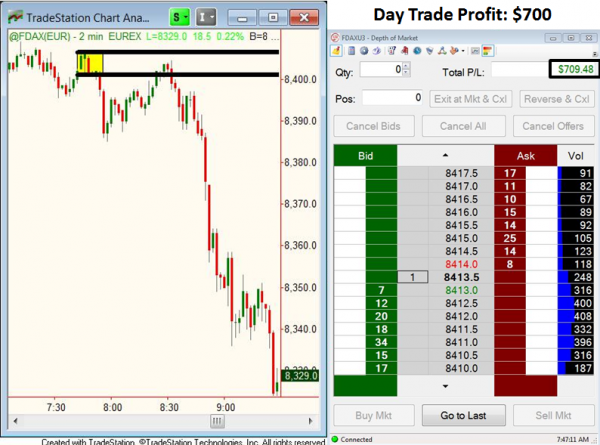

Just like travel, there are many ways to reach your desired destination in trading. The chart below shows a recent short term income trade. This small time frame supply level was well placed on the curve. Our “odds enhancers” exercise suggested this was a high probability opportunity as well.

When price rallied up to our supply level for a short entry, that told us these were very novice buyers buying after a rally in price and into a price level where the chart told us supply exceeded demand. Price proceeded to fall to our target and the trade was complete. All the information we needed to identify and take advantage of this low risk and high reward opportunity is clearly seen with price and price alone. Ultimately, all that matters is knowing where the significant buyers and sellers are in a market and price does a fine job of showing us that.

DAX – Short Term Income Trade: 7/24/13

Some traders however are either not comfortable using only price action analysis or they desire more confirmation to take a trade. For this, people tend to use indicators and oscillators as the confirmation crutch. Let’s take a look at the same trading opportunity only this time, lets add Bollinger Bands.

At the time of entry for our short position, we see that price actually touches the upper Bollinger Band suggesting an overbought condition for this trade. Price touching the upper band and reaching an objective supply level with a large profit zone below, this suggests higher odds.

Adding Bollinger Bands to this trading opportunity makes the trade more attractive and also points out a key ingredient when using Bollinger Bands. Don’t just sell short because price is touching an upper or lower band. Take action because price is touching an upper or lower band AND price has reached a supply or demand level. In the Options XLT for example, our options expert Eric Ochotnicki calls this setup an “All Star” setup.

Lets again look at the same shorting opportunity and add the Commodity Channel Index (CCI).

This is an overbought (+100 or greater)/oversold (-100 or greater) oscillator. Notice at the time of our short entry, CCI was giving an overbought reading, suggesting this was a high odds opportunity to sell short. Notice the overbought CCI reading I circled. This is in line with our short entry which makes CCI look attractive as a decision making tool. However, keep in mind that price does not turn lower because CCI is overbought, it turns lower because it has reached a price level where supply exceeds demand. As for using it for confirmation, it’s a decent secondary decision making tool. If CCI was our primary decision making tool here for entry and exit, we would have entered the trade early and maybe stopped out for a loss and we also would have taken profits way too early.

Last but not least, let’s add Slow Stochastics to our successful short term trade. Stochastics are a very popular overbought/oversold oscillator. The typical buy and sell signal are a moving average (red and blue lines) cross in overbought and oversold territory. Did the Stochastics sell signal line up with our price action sell signal, yes. Did the Stochastics buy signal line up with our price action profit target demand level, yes. Did we need Stochastics for this trading opportunity, no.

The most important point here is that while indicators and oscillators can assist in ones “comfort” level, these can’t be used as primary decision making tools. These tools don’t know anything about supply and demand and don’t consider it. It’s not that they are broken or don’t work. They are mathematically generated lines on your chart. The math is always correct. Whether that math leads to profits or losses in your trading account is the question most novice traders never ask and it happens to be the only question that matters. As John Candy showed us, there are many ways to reach our destination. Trading is only slightly different. While you can use indicators and oscillators as confirmation tools, if you are NOT filtering these buy and sell signals through real demand and supply levels, you are traveling east and west, trying to reach that North Pole, good luck with that. If you must use indicators and oscillators, go ahead and use them. Again, just make sure you filter those signals they spit out through proper supply and demand analysis. If I just repeated myself three times, it’s only because it’s so important and we at Online Trading Academy care about you and your financial well being.

Hope this was helpful. Have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD seems fragile below 1.1700 as Middle East war boosts energy prices

The EUR/USD pair trades flat at around 1.1680 during the Asian trading session on Tuesday, but broadly seems vulnerable, being close to its five-week low. The major currency pair is under pressure as surging oil prices due to the United States-Israel war with Iran have increased the risks of higher inflation for the Old Continent.

Gold weakens below $5,300 as sustained USD buying counter Middle East tensions

Gold attracts some intraday selling and falls around $100 from the daily top, around the $5,380 area. The US Dollar climbs to a fresh high since January 20 and turns out to be a key factor exerting downward pressure on the commodity. However, concerns about a broader regional conflict in the Middle East continue to weigh on investors' sentiment and underpin demand for the traditional safe-haven bullion.

GBP/USD hovers around 1.3400 with bearish pressure intact

GBP/USD edges higher after three days of losses, trading around 1.3400 during the Asian hours on Tuesday. The technical analysis of the daily chart indicates an ongoing bearish bias, as the pair trades within a descending channel pattern.

Stellar risks deeper losses as derivatives metrics turn negative

Stellar is trading red below $0.16 at the time of writing on Tuesday, after a slight recovery the previous day. Weakening derivatives data caps the recovery, while an unfavorable technical outlook projects a deeper correction for the XLM token in the upcoming days.

The market is not panicking it is repricing the probability distribution of Oil and time

At the end of the day, markets do not trade morality or geopolitics. They trade transmission channels. And the only channel that truly matters in this maelstrom runs through the price of energy and the time value of money.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.