Over the last few weeks worth of articles I’ve taken a fresh approach to some of the classical forms of analysis. We have looked at some practical uses of tools such as moving averages and trend lines, in ways that can help us as objective traders using price action first and foremost, as a reason for entering the market. I said it then and I’ll say it now, always use price as your primary reason for taking a trade and only then is it okay to use another technical tool to help confirm that the opportunity is a good one. However, I have found over my years of teaching that when I introduce students to our core strategy, they rarely ever want to use any of the other tools on top of it. This is because price gives them the clearest picture of the market and allows them to set their stop losses, targets and entries without emotion and with controlled discipline.

It is for this reason that in the Online Trading Academy classroom, we focus on the core strategy above all else. We look objectively at the price chart to recognise opportunities where imbalances are present between supply and demand. When these imbalances are present, we call this a supply or demand level. These levels give us our entries and our risk management parameters of the trades available. When teaching students about the supply or demand zones in the first instance, we show them how to define the entry above all else and what picture we specifically look for on the chart. By looking to the charts to find where the greatest imbalances are between the institutional buyers and sellers, we can then get a very good idea of where we want to enter the market when price returns to that area.

As is often the case though with traders and those who are learning new techniques in the market, they get very caught up in finding an entry, but rarely think about the all important exit as well. Think about this for a second: what is the point of getting into a trade if you have no idea how to get out of it for profit as well? The stop loss, well that kind of takes care of itself but the profit target can sometimes be the most challenging aspect of all, which is ironic considering that we are trading to make money in the first place and we often forget how important it is to have that profit objective.

So in answer to that question of “where do I put my profit target?” the simple answer as always is back in the price chart itself. The beauty of using supply and demand levels to find our trades, is that they also help us in finding out the targets and stop losses as well. Let’s take a look at an example:

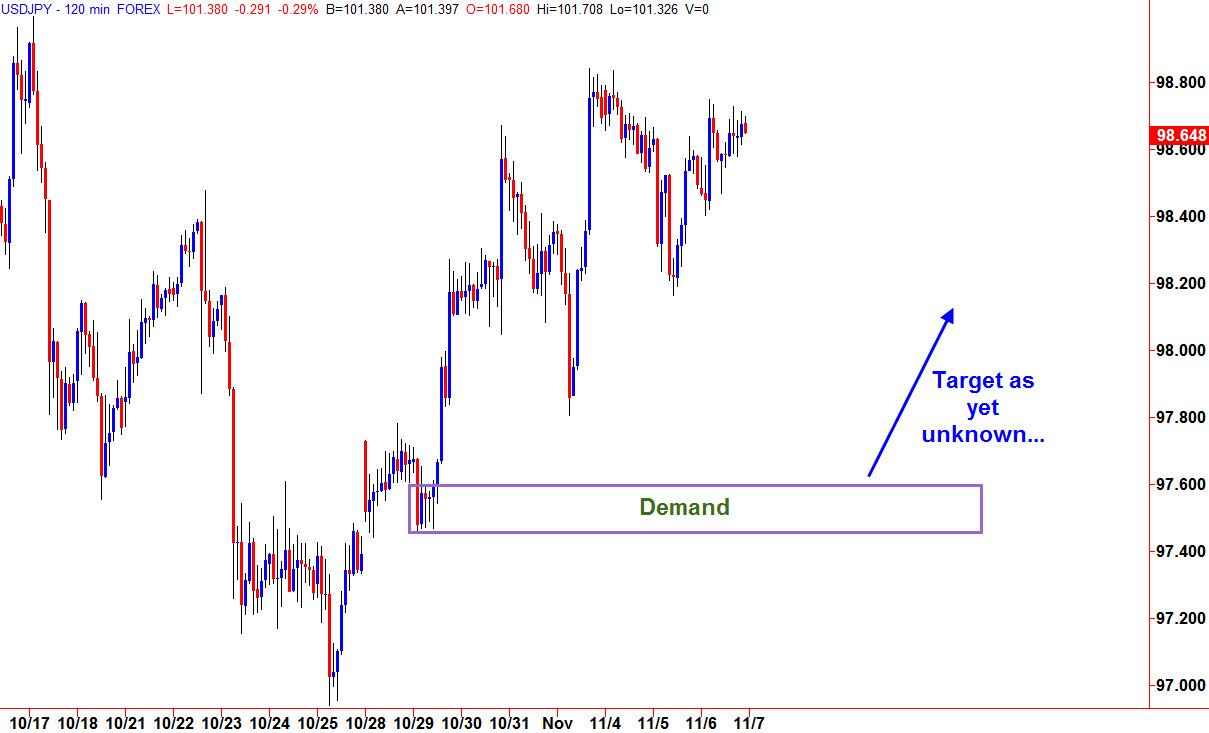

This is a common swing trading set up on a two hour time frame of the USD JPY currency pair. Anything from a one hour chart up to a four hour chart is ideal for set and forget swing trading in the world of FX. You can see in this example that we have highlighted a lower area of demand in the price region of around 97.50. This area is attractive to us because clearly there was a large imbalance between the willing buyers and the willing sellers which resulted in a strong move away in price to the upside. Clearly somebody with larger pockets than mine was trying to buy a lot of dollars at this particular price. That means I want to be first in the queue to buy some if the price comes back to that area in the future. We would like to take an entry at the top section of the demand zone and use the lower section as a guide for placing our stop loss below, in case we are wrong on this buying opportunity. At this point in time I know where I want to buy and I know where I want to be out if I’m wrong. The only question left unanswered is what will be my profit target? Give it some more time and we can find out. Let’s take a look at the next chart:

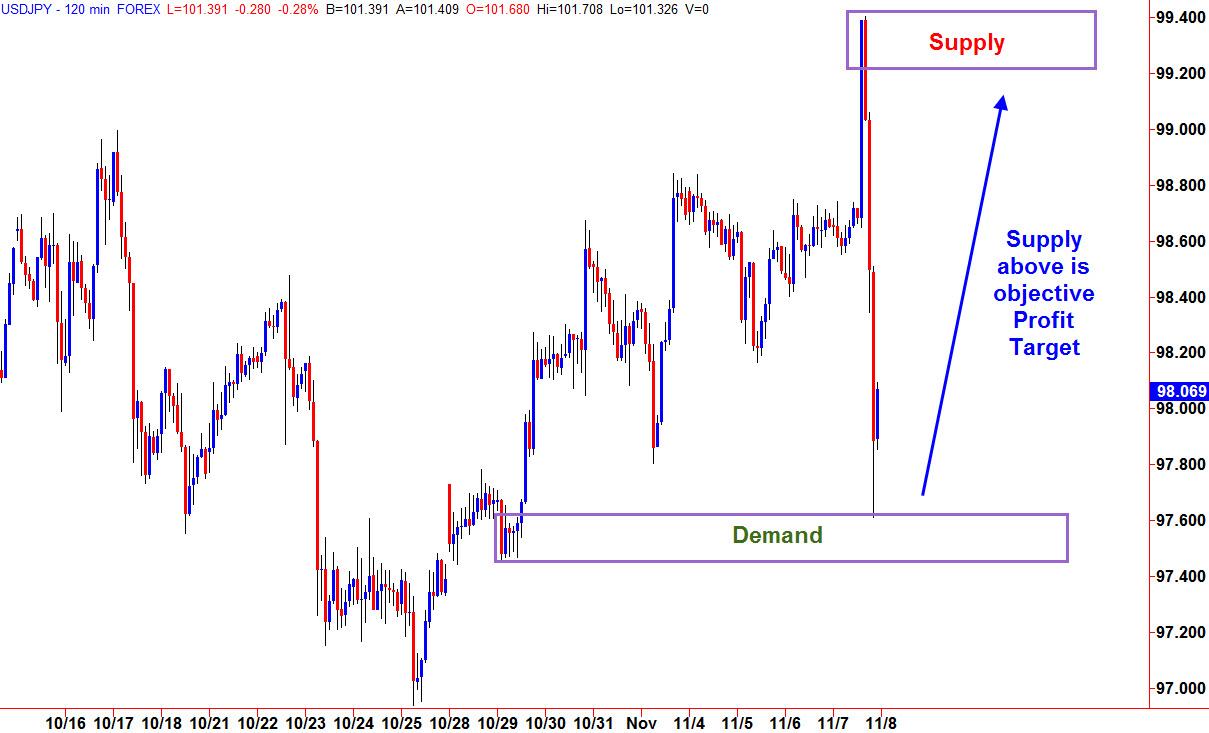

One of the practices which a swing trader needs to get used to, is having patience. It can often be difficult to wait for a trade to come to you but as we can see in this chart, this buying opportunity was triggered the very next day and we didn’t need to be there at the moment it triggered either, because this can all be set up on our trading platform in advance. Now the question is where are we going to get out for profit? Well, let the chart tell you. Notice how we had a very impulsive and strong move to the down side from an area of supply around 99.30? When this drop happened, there were no more other pockets of willing sellers along the way, suggesting to us that the price should not have too much difficulty getting all the way back up to at least 99.00, assuming the area of demand holds. This trade now offers a very attractive reward to risk ratio profile.

To some this may look like an ambitious profit target, however to our students this is a concept known as the path of least resistance. Some people refer to price having memory and this is that dynamic in play. If the price chart is not telling me that there are any obstacles along the way to stop the market moving in my direction, then I will simply trust this objectively and trade the market how I find it. At this moment in time there were no winning sellers until much higher about 99.00, which is an attractive profit target and exit for the trade. Of course there is no guarantee that the market will get there but if you’re working on solid risk to reward ratios during your trade setups, not every single trade has to reach its final target. I always say the winners will take care of themselves, as will the losers but only if you use a protective stop order. Let’s see how things panned out:

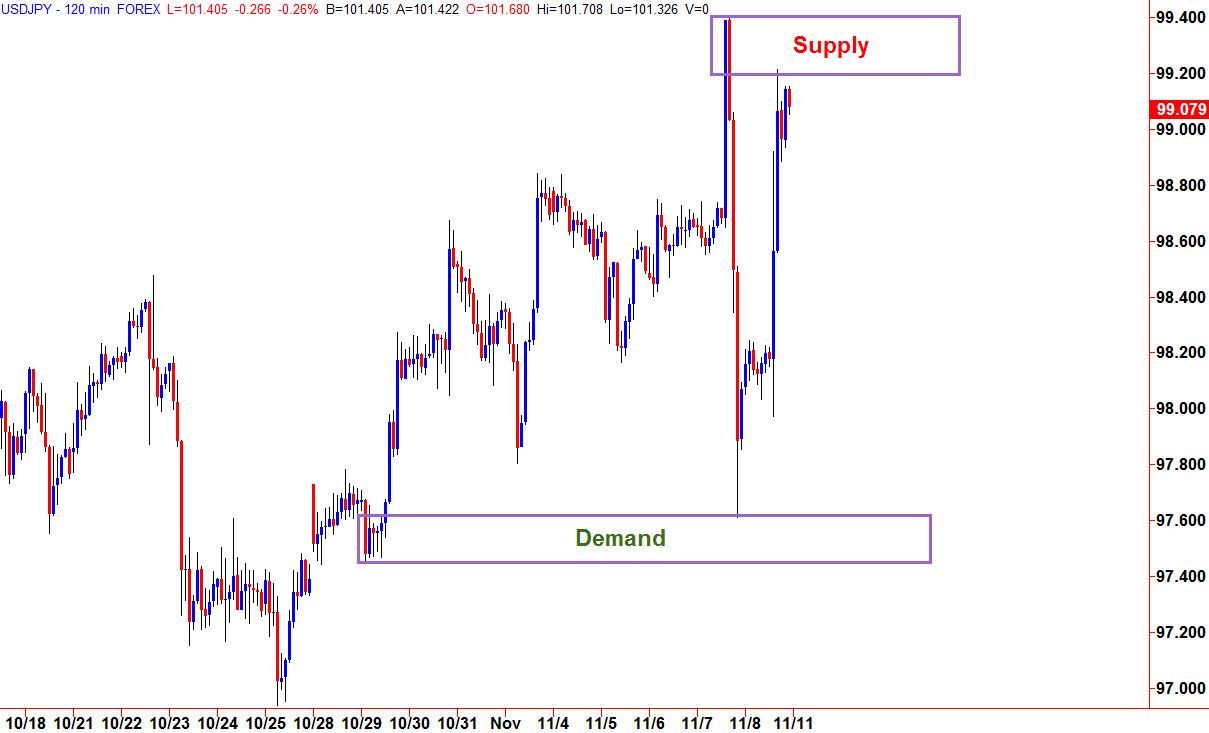

In this final chart snapshot, we can see that in as quickly as price fell towards our entry, it pretty much rallied all the way back up to where it came from in the same length of time. As I said before, our core strategy not only tells us when to get in and get out for a loss but it also tells us when to get out for profit but only if we learn to trust the levels which we are analyzing. The more that we learn to step away from the charts and allow the market to do its thing, without us actually being there to watch it, the more likely we are to have success at trading. I can put my own hand up and say that I’ve been the greatest enemy in my trading career over the years by fiddling and taking profits to soon, as opposed to trusting the levels which the market is showing me. Build your plan, do your analysis and let the market tell you what to do. That’s the key ingredient to consistency. I hope you found this useful.

The information provided is for informational purposes only. It does not constitute any form of advice or recommendation to buy or sell any securities or adopt any investment strategy mentioned. It is intended only to provide observations and views of the author(s) or hosts at the time of writing or presenting, both of which are subject to change at any time without prior notice. The information provided does not have regard to specific investment objectives, financial situation, or specific needs of any specific person who may read it. Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. Please see our website for more information: https://bustamanteco.com/privacy-policy/

Editors’ Picks

NZD/USD: All eyes on RBNZ guidance and new Governor Breman's debut

NZD/USD opened Tuesday at 0.60344, reached a high of 0.60520 and a low of 0.60044, and closed at 0.60480, down 0.22%. The pair is holding well above the 50-day Exponential Moving Average at 0.59041 and the 200-day EMA at 0.58545, with both averages rising and spaced roughly 50 pips apart, confirming the underlying bullish trend that began from the January low of 0.57110.

AUD/USD extends the bounce, focus back to 0.7100

AUD/USD adds to Monday’s optimism and approaches the key 0.7100 barrier ahead of the opening bell in Asia. The pair’s positive performance comes as investors keep assessing the hawkish tilt from the RBA Minutes and despite humble gains in the Greenback. Next in Oz will be the Westpac Leading Index and the Wage Price Index.

Gold remains offered below $5,000

Gold stays on the defensive on Tuesday, receding to the sub-$5,000 region per troy ounce on the back of the persistent move higher in the Greenback. The precious metal’s decline is also underpinned by the modest uptick in US Treasury yields across the spectrum.

RBNZ set to pause interest-rate easing cycle as new Governor Breman faces firm inflation

The Reserve Bank of New Zealand remains on track to maintain the Official Cash Rate at 2.25% after concluding its first monetary policy meeting of this year on Wednesday.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.